The continuous rise of institutional interest towards the cryptocurrency industry is exemplified by Grayscale Investments’ record Q2 2020 earnings report. The large digital asset management company announced today that it had received total investments in Q2 of over 0 million – 0 million more than its previous record.Grayscale’s Best Quarter To dateThe company, primarily oriented towards institutional investors, published its Q2 2020 results earlier today. It indicates that Grayscale marked its most substantial quarterly inflows of 5.8 million, an increase of 80% from the Q1 results when the firm attracted 3.7 million.Due to the impressive results so far this year, “inflows into Grayscale products over a 6-month period crossed the billion threshold, demonstrating sustained

Topics:

Jordan Lyanchev considers the following as important: AA News, BCHBTC, bchusd, Bitcoin-Halving, btcusd, btcusdt, ETHBTC, ethusd, Grayscale, LTCBTC, ltcusd

This could be interesting, too:

Chayanika Deka writes SEC Closes Investigation Into Gemini, Winklevoss Seeks Reimbursement

Wayne Jones writes CZ Criticizes Safe Wallet’s Post-Mortem on Bybit Hack

Mandy Williams writes Bitcoin ETFs Record Over .6B in Outflows in the Past 2 Weeks

Wayne Jones writes This Trending AI Token Hits New ATH After Binance Listing

The continuous rise of institutional interest towards the cryptocurrency industry is exemplified by Grayscale Investments’ record Q2 2020 earnings report. The large digital asset management company announced today that it had received total investments in Q2 of over $900 million – $400 million more than its previous record.

Grayscale’s Best Quarter To date

The company, primarily oriented towards institutional investors, published its Q2 2020 results earlier today. It indicates that Grayscale marked its most substantial quarterly inflows of $905.8 million, an increase of 80% from the Q1 results when the firm attracted $503.7 million.

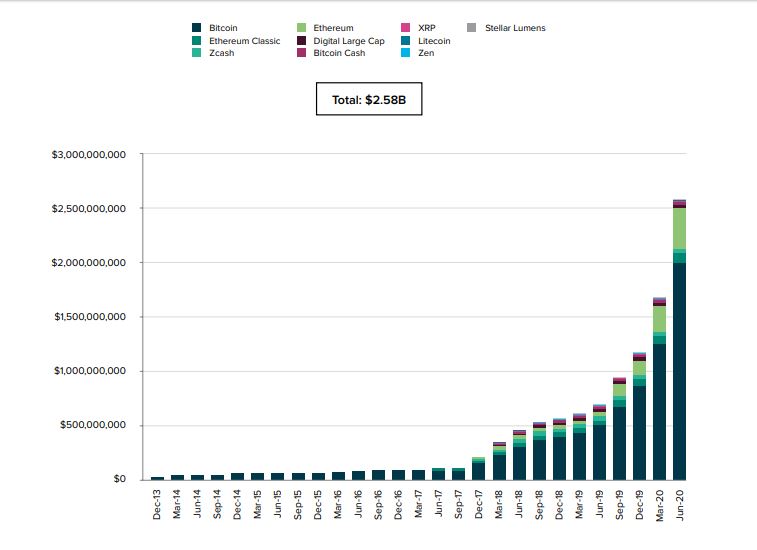

Due to the impressive results so far this year, “inflows into Grayscale products over a 6-month period crossed the $1billion threshold, demonstrating sustained demand for digital asset exposure despite a backdrop characterized by economic uncertainty.” The total amount invested in the company since its inception has grown to nearly $2.6 billion.

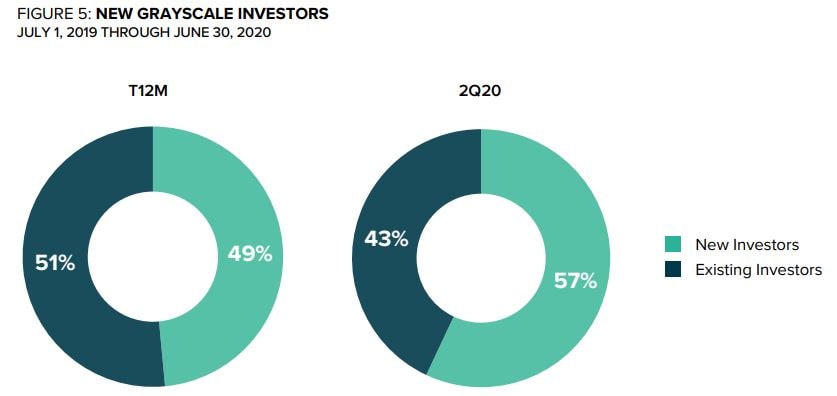

Interestingly, the company reports that it’s receiving more adoption from the investment community by highlighting that new investors represented 57% of the entire investor base in Q2 2020. This is a “significant increase over the twelve-month average.”

Additionally, most institutional customers who had previously allocated funds into Grayscale products continue to explore those options. 81% of returning investors in Q2 2020 have now invested in multiple products.

Grayscale Product Enhancement

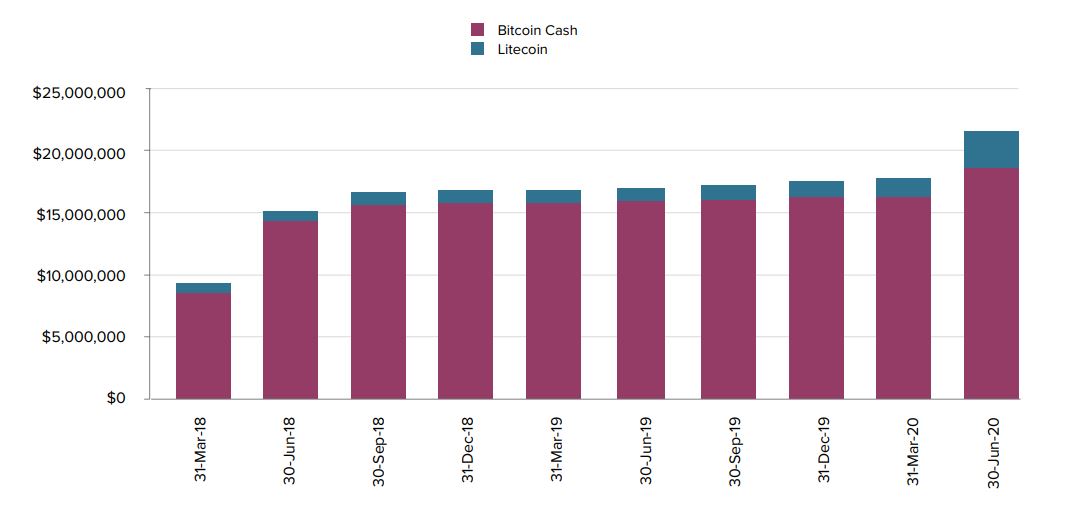

While the Bitcoin and Ethereum Trusts “represent the bulk of investment,” the company also noted an increasing demand for other digital assets. Institutional investors purchased more shares in Grayscale Ethereum Classic Trust, the Grayscale Bitcoin Cash Trust, and the Grayscale Litecoin Trust. The last two combined now exceed $20 million in inflows since inception.

Nevertheless, as seen in the first graph above, the most frequently chosen cryptocurrency offered by the company remains Bitcoin. Purchases of the primary digital asset equaled $751,1 million. The next in line – the Grayscale Ethereum Trust – saw inflows of $135.2 million.

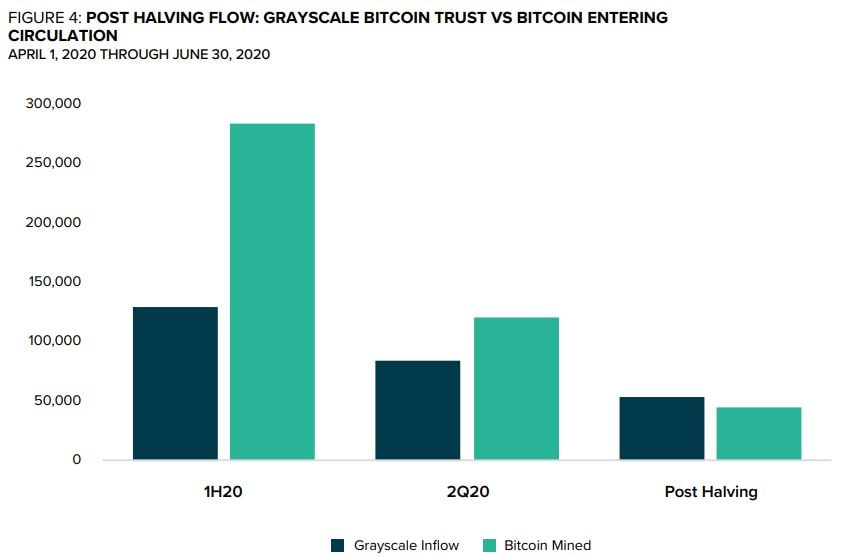

The firm also confirmed recently emerged reports that it has been accumulating more bitcoins than mined. This difference came following the 2020 halving. It had the rewards miners receive cut down to 6.25 BTC per block and ultimately decreased by half the number of freshly mined coins.

“After Bitcoin’s halving in May, 2Q20 inflows into Grayscale Bitcoin Trust surpassed the number of newly-mined Bitcoin over the same period. With so much inflow to Grayscale Bitcoin Trust relative to new-mined Bitcoin, there is a significant reduction in supply-side pressure, which may be a positive sign for Bitcoin price appreciation.” – reads the paper.