Recent data indicated that the HODLing mentality towards Bitcoin prevails as the number of coins that haven’t moved in two or more years has reached a three-year high.At the same time, miners are following suit as their BTC holdings have reached a two-year high.HODLing Mentality Among BTC Investors PrevailThe analytics firm Glassnode follows the behavior of Bitcoin investors by examining the BTC movements (or lack of) from their addresses. According to recent research, HODLers have increased accumulation and decreased spending since the summer of 2019 and have continued ever since.Consequently, the percent of BTC supply that hasn’t moved for at least two years has spiked from 34% in July 2019 to 44% as of writing these lines. The current level is the highest point reached in over three

Topics:

Jordan Lyanchev considers the following as important: AA News, Bitcoin-Halving, BTCEUR, BTCGBP, btcusd, btcusdt, HODL

This could be interesting, too:

Chayanika Deka writes Yuga Labs Secures Major Win as SEC Closes Investigation Without Charges

Andrew Throuvalas writes Bitcoin Soars Back To ,000 After BlackRock CEO Says “Buy The Dip”

Chayanika Deka writes XRP, SOL, and ADA Inclusion in US Crypto Reserve Pushes Traders on Edge

Chayanika Deka writes Why Arthur Hayes Is Bullish on Bitcoin Under Trump’s Economic Strategy

Recent data indicated that the HODLing mentality towards Bitcoin prevails as the number of coins that haven’t moved in two or more years has reached a three-year high.

At the same time, miners are following suit as their BTC holdings have reached a two-year high.

HODLing Mentality Among BTC Investors Prevail

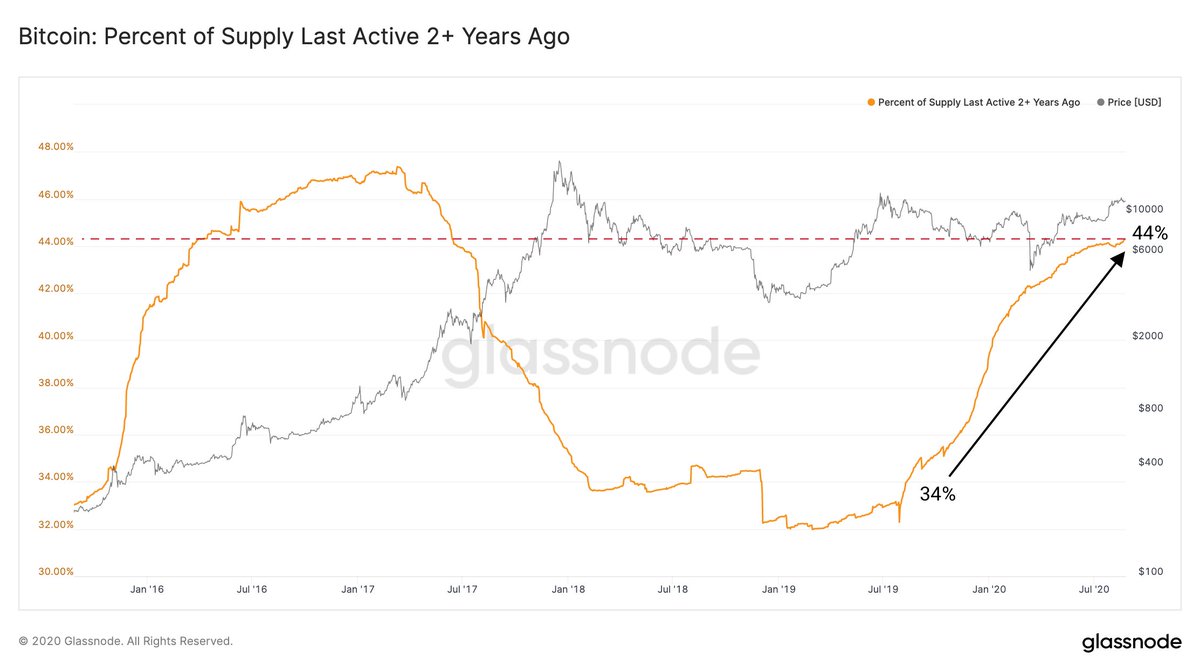

The analytics firm Glassnode follows the behavior of Bitcoin investors by examining the BTC movements (or lack of) from their addresses. According to recent research, HODLers have increased accumulation and decreased spending since the summer of 2019 and have continued ever since.

Consequently, the percent of BTC supply that hasn’t moved for at least two years has spiked from 34% in July 2019 to 44% as of writing these lines. The current level is the highest point reached in over three years.

Interestingly, this particular metric reached its all-time high of over 46% before the parabolic price increase of late 2017 and early 2018. However, as BTC was approaching its ATH of nearly $20,000, investors were disposing of their coins and the trend endured for more than a year before 2019’s reversal.

Another metric reaffirming the increased HODLing mentality from BTC investors is the so-called 1-year+ HODL wave. It displays the amount of the primary cryptocurrency that hasn’t moved on the blockchain in the past 12 (or more) months. And, the monitoring resource Cryptowatch recently brought out that it has reached a fresh all-time high of over 63%.

Miners Prefer HODLing Too

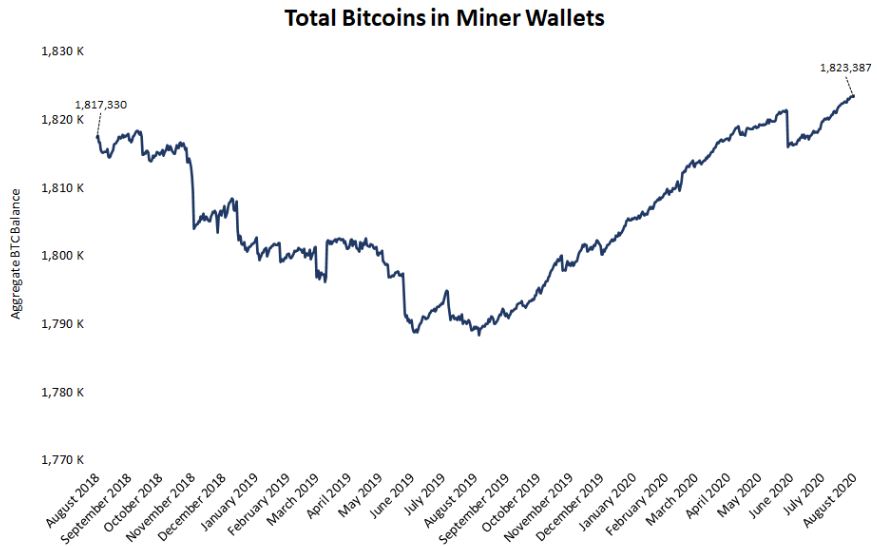

By also exploring addresses belonging to Bitcoin miners, further Glassnode data revealed that they haven’t been selling their coins either, despite BTC’s price surging since the third halving. The company’s insights noted that miners currently hold more than 1.8 million bitcoins, which is the highest point in over two years.

Similarly to BTC investors, miners have decreased the sell-offs in the summer of last year. However, the graph above showcased that they sold out sizeable portions somewhere around the halving in May.

This is perhaps even more bullish for Bitcoin as miners are typically incentivized to sell their coins to cover their electricity costs from the mining process. Even more, the asset’s price has increased by over 35% since the halving giving them more reasons to sell. Nevertheless, despite having their block rewards slashed in half to 6.25 BTC following the halving, miners prefer sticking to their coins for now.