Bitcoin is enjoying several consecutive bullish days, resulting in a break above ,000. The movement may surprise some. A few days ago, news broke that the popular cryptocurrency exchange OKEx had suspended withdrawals after reports emerged that its founder was taken away by the police. In early October, the owners of another large platform, namely BitMEX, were charged by the US CFTC with illegally operating a derivatives exchange. Similar developments typically lead to adverse consequences for the cryptocurrency market. Although Bitcoin’s price indeed dipped briefly, the asset recovered swiftly. Moreover, it actually started accelerating. On October 2nd, when the BitMEX news came out, BTC slumped to ,400. With its price set above ,200, this represents a 17%

Topics:

Jordan Lyanchev considers the following as important: AA News, Bitcoin (BTC) Price, BTCEUR, BTCGBP, btcusd, btcusdt

This could be interesting, too:

Chayanika Deka writes Yuga Labs Secures Major Win as SEC Closes Investigation Without Charges

Andrew Throuvalas writes Bitcoin Soars Back To ,000 After BlackRock CEO Says “Buy The Dip”

Chayanika Deka writes XRP, SOL, and ADA Inclusion in US Crypto Reserve Pushes Traders on Edge

Chayanika Deka writes Why Arthur Hayes Is Bullish on Bitcoin Under Trump’s Economic Strategy

Bitcoin is enjoying several consecutive bullish days, resulting in a break above $12,000. The movement may surprise some. A few days ago, news broke that the popular cryptocurrency exchange OKEx had suspended withdrawals after reports emerged that its founder was taken away by the police.

In early October, the owners of another large platform, namely BitMEX, were charged by the US CFTC with illegally operating a derivatives exchange.

Similar developments typically lead to adverse consequences for the cryptocurrency market. Although Bitcoin’s price indeed dipped briefly, the asset recovered swiftly. Moreover, it actually started accelerating.

On October 2nd, when the BitMEX news came out, BTC slumped to $10,400. With its price set above $12,200, this represents a 17% increase in less than three weeks. Since last Friday alone, when the OKEx events transpired, Bitcoin has gained about $1,000 of value.

Apart from building optimism within the community that a new 2020 high of above $12,500 is coming, BTC’s impressive performance raised questions about the nature of the funds going into Bitcoin.

New Capital Enters

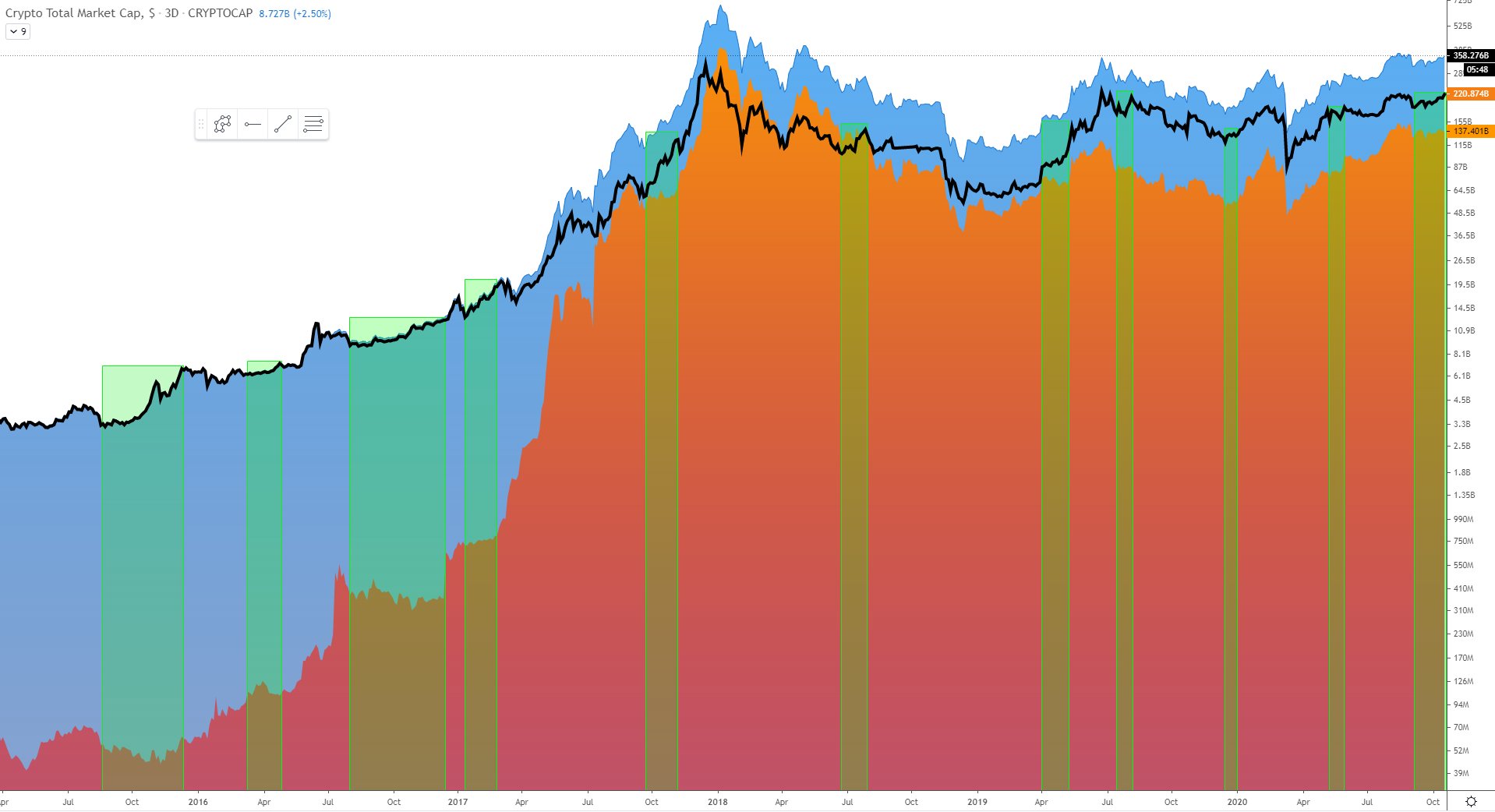

Popular cryptocurrency commentator Alex Saunders published a graphic on the matter called “Crypto Market Cycle Capital Flows.”

Saunders specified that the blue represented the entire cryptocurrency market cap, the black – BTC’s market cap, and the orange was the cumulative market cap of all alternative coins.

He outlined several periods when Bitcoin’s performance contrasted altcoins. This implies that when BTC was heading up, investors were swapping their altcoin positions for more significant exposure to Bitcoin and vice-versa.

However, the latest price increase for the primary cryptocurrency doesn’t fall under the same category. Saunders concluded that the data he collected “suggests the capital entering Bitcoin is new money rather than a rotation from Altcoins.”

Alternative Coins Stay Still

By examining the price performance of the altcoin market, one could see merit in his words. Although some alts have lost value lately, most have remained relatively stable.

On a weekly scale, Ethereum has lost less than 1%, while Ripple has dropped by about 2%, according to data from CoinMarketCap.

The altcoin market cap hovered around $148 billion a week ago and is slightly down to $147 billion now. The monthly scale even sees an increase from about $135 billion.