A new analysis implies an inverse correlation between the price of Bitcoin and the total supply of USDT on cryptocurrency exchanges. According to it, the declining amount of Tether sitting on exchanges could soon propel another increase in BTC’s price.Bitcoin’s Price Related To USDT On Exchanges?New data compiled by the cryptocurrency monitoring company, Santiment, relates the movement of Bitcoin’s price over the past three months to the total supply of USDT on exchanges.BTC Price/USDT On Exchanges. Source: Santiment.netStarting from February, when BTC was trading at about ,500, the amount of USDT sitting on exchanges was relatively low.In the following weeks, however, the supply of USDT grew substantially and reached a three-month high in mid-March. This coincided with the violent price

Topics:

Jordan Lyanchev considers the following as important: AA News, Bitcoin (BTC) Price, btcusd, btcusdt

This could be interesting, too:

Chayanika Deka writes Yuga Labs Secures Major Win as SEC Closes Investigation Without Charges

Andrew Throuvalas writes Bitcoin Soars Back To ,000 After BlackRock CEO Says “Buy The Dip”

Chayanika Deka writes XRP, SOL, and ADA Inclusion in US Crypto Reserve Pushes Traders on Edge

Chayanika Deka writes Why Arthur Hayes Is Bullish on Bitcoin Under Trump’s Economic Strategy

A new analysis implies an inverse correlation between the price of Bitcoin and the total supply of USDT on cryptocurrency exchanges. According to it, the declining amount of Tether sitting on exchanges could soon propel another increase in BTC’s price.

Bitcoin’s Price Related To USDT On Exchanges?

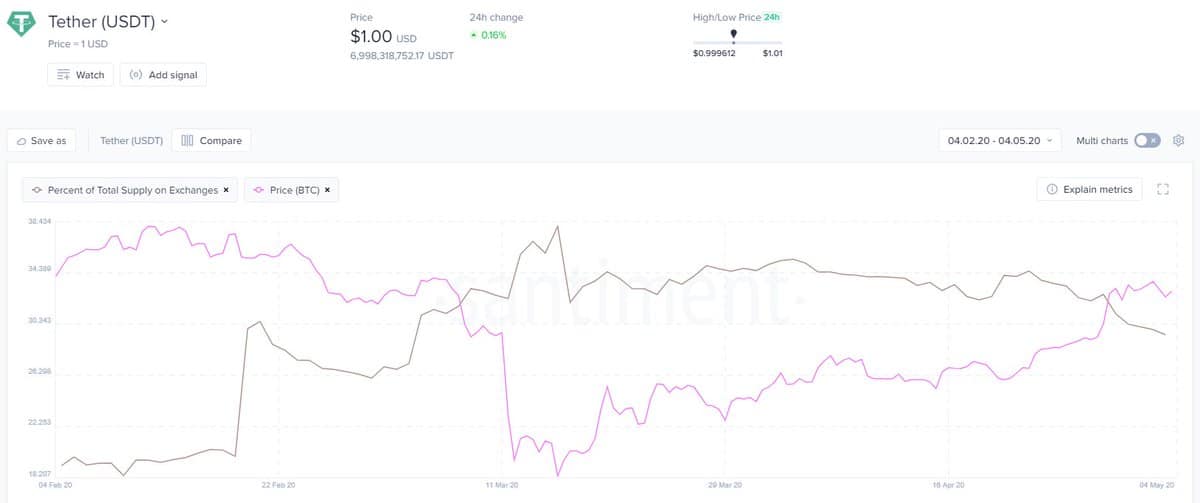

New data compiled by the cryptocurrency monitoring company, Santiment, relates the movement of Bitcoin’s price over the past three months to the total supply of USDT on exchanges.

Starting from February, when BTC was trading at about $9,500, the amount of USDT sitting on exchanges was relatively low.

In the following weeks, however, the supply of USDT grew substantially and reached a three-month high in mid-March. This coincided with the violent price slumps on Black Thursday when Bitcoin lost about 50% of its value in a matter of hours.

As Cryptopotato reported at the time, over $1 billion worth of various stablecoins were sitting aside on exchanges, following the massive sell-offs.

The primary cryptocurrency has been recovering since mid-March, and the supply of USDT on exchanges was continuously high. Yet, Bitcoin went through a serious surge lately and is currently hovering around the $9,000 mark after several days of fluctuations. At the same time, Tether’s supply on exchanges has been declining.

Thus, Santiment concluded that the chart from above “clearly indicates that there is an inverse correlation between Bitcoin’s price and USDT’s supply on exchange. With this metric for the #1 stablecoin trending down, the #1 crypto asset can potentially make another push toward $9,000 and beyond.”

Does Tether Indeed Influence Bitcoin’s Price?

Aside from Santiment’s viewpoint, the most popular stablecoin has been linked several times before to artificially inflating BTC’s price.

One study published in 2018 and updated in 2019 claimed that the parabolic price increase of 2017/2018 was caused “probably by market manipulation.” More specifically, it pointed fingers that major USDT purchases were timed with the declines in the market to stabilize its bottom.

Tether quickly refuted all allegations, saying that their stablecoin has never been involved in any price manipulation. More recent research on the matter also sided with Tether but in a different aspect. It noted that “no systematic evidence” exists to support the assertion that Tether issuance is affecting cryptocurrency prices.

Whether or not USDT is, in fact, responsible for some Bitcoin price developments is still unclear, despite the numerous claims in either direction. However, with the declining supply of Tether on exchanges and the growing interest in BTC a week before the upcoming halving, more intense volatility could be anticipated shortly.