Despite briefly tanking following the results of the US Presidential elections, Bitcoin has reclaimed the ,000 mark and registered its third-highest weekly close. The altcoins have also recovered yesterday’s losses, and the market cap has jumped back to 0 billion. Bitcoin’s Third-Best Weekly Close Bitcoin peaked at a new yearly high on Friday as the uncertainty of the US elections grew. However, once the results came in, meaning that the 46th US President will be Joseph Biden, BTC plummeted. As reported by CryptoPotato, the primary cryptocurrency lost nearly ,000 of value in hours and bottomed at ,350. Nevertheless, Bitcoin started recovering almost immediately and shot back up above ,000. BTC even reached an intraday high of ,660 before decreasing

Topics:

Jordan Lyanchev considers the following as important: AA News, ADABTC, ADAUSD, BCHBTC, bchusd, Bitcoin (BTC) Price, BNBBTC, bnbusd, BTCEUR, BTCGBP, btcusd, btcusdt, DOTBTC, DOTUSD, DOTUSDT, ETHBTC, Ethereum (ETH) Price, ethusd, LINKBTC, LINKUSD, LTCBTC, ltcusd, Market Updates, social, United States, Wall Street, xrpbtc, xrpusd

This could be interesting, too:

Chayanika Deka writes Yuga Labs Secures Major Win as SEC Closes Investigation Without Charges

Andrew Throuvalas writes Bitcoin Soars Back To ,000 After BlackRock CEO Says “Buy The Dip”

Chayanika Deka writes XRP, SOL, and ADA Inclusion in US Crypto Reserve Pushes Traders on Edge

Chayanika Deka writes Why Arthur Hayes Is Bullish on Bitcoin Under Trump’s Economic Strategy

Despite briefly tanking following the results of the US Presidential elections, Bitcoin has reclaimed the $15,000 mark and registered its third-highest weekly close. The altcoins have also recovered yesterday’s losses, and the market cap has jumped back to $440 billion.

Bitcoin’s Third-Best Weekly Close

Bitcoin peaked at a new yearly high on Friday as the uncertainty of the US elections grew. However, once the results came in, meaning that the 46th US President will be Joseph Biden, BTC plummeted.

As reported by CryptoPotato, the primary cryptocurrency lost nearly $1,000 of value in hours and bottomed at $14,350.

Nevertheless, Bitcoin started recovering almost immediately and shot back up above $15,000. BTC even reached an intraday high of $15,660 before decreasing slightly to its current level of around $15,250.

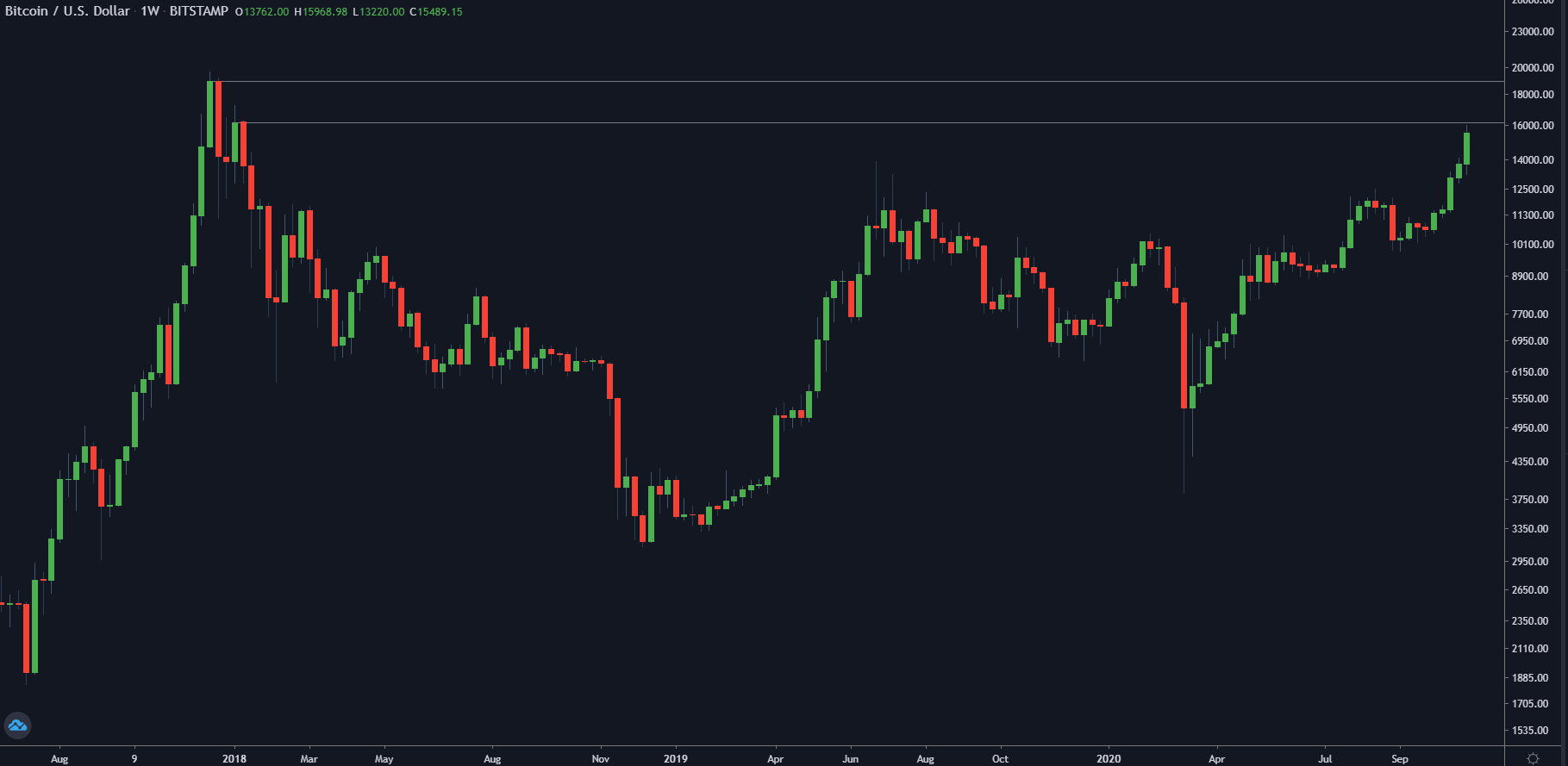

As the popular Bitcoin analyst CryptoBull pointed out, this was BTC’s “3rd-highest weekly close ever” and the highest since January 2018.

The technical aspects indicate that Bitcoin needs to overcome the resistance lines at $15,750 and $16,000 to paint new records. In case of a breakdown, the support levels that could contain its drop lie at $15,385, $15,150, and $15,000.

It’s worth noting that the legacy markets will open for trading today for the first time since it became known that the former vice president Biden will replace the incumbent US President Donald Trump come January. As such, it’s would be compelling to follow if and how that will impact all financial markets.

So far, the futures contracts of the three most prominent Wall Street indexes have been on the rise.

Altcoins’ Recovery Session

The alternative coins had it the worst during the recent blood bath. In the past 24 hours, though, they have been mostly in green.

Ethereum’s 1.6% increase has taken ETH to $442. Binance Coin (1%), Chainlink (2%), and Litecoin (1%) have all shown signs of recovery. Bitcoin Cash (4.5%) is the most impressive gainer from the top 10.

THORChain has surged the most since yesterday. RUNE’s 20% pump has taken the asset above $0.60. Loopring (19%), NEAR Protocol (14%), Aave (13%), Decentraland (13%), Energy Web Token (12%), and Band Protocol (10%) follow.

Overall, the cumulative market capitalization of all digital assets has increased to $445 billion after dumping to $423 billion yesterday.