High volatility hit the cryptocurrency market with sharp declines from across the map. Bitcoin’s price dropped to a daily low of ,600 in a matter of minutes. During this period, BitMEX had noted long liquidations worth almost 0 million in an hour.BitMEX Liquidation Chart Off The RoofBitcoin’s price recorded a massive dump from ,350 to a low of ,600 in just one hour. As a result, 4 million worth of open long positions got liquidated on the leading Bitcoin margin trading exchange, BitMEX.BitMEX Bitcoin Liquidations. Source: coinalyze.netHuge double-digit price fluctuations like today, caused open long positions to get closed due to the fact that the stop-loss is reached. Besides, most traders protect themselves with stop-loss commands. During volatile days, it’s wise to set up

Topics:

Jordan Lyanchev considers the following as important: AA News, Bitcoin (BTC) Price, Bitcoin Shorts and Longs, Bitmex

This could be interesting, too:

Chayanika Deka writes Yuga Labs Secures Major Win as SEC Closes Investigation Without Charges

Andrew Throuvalas writes Bitcoin Soars Back To ,000 After BlackRock CEO Says “Buy The Dip”

Chayanika Deka writes XRP, SOL, and ADA Inclusion in US Crypto Reserve Pushes Traders on Edge

Chayanika Deka writes Why Arthur Hayes Is Bullish on Bitcoin Under Trump’s Economic Strategy

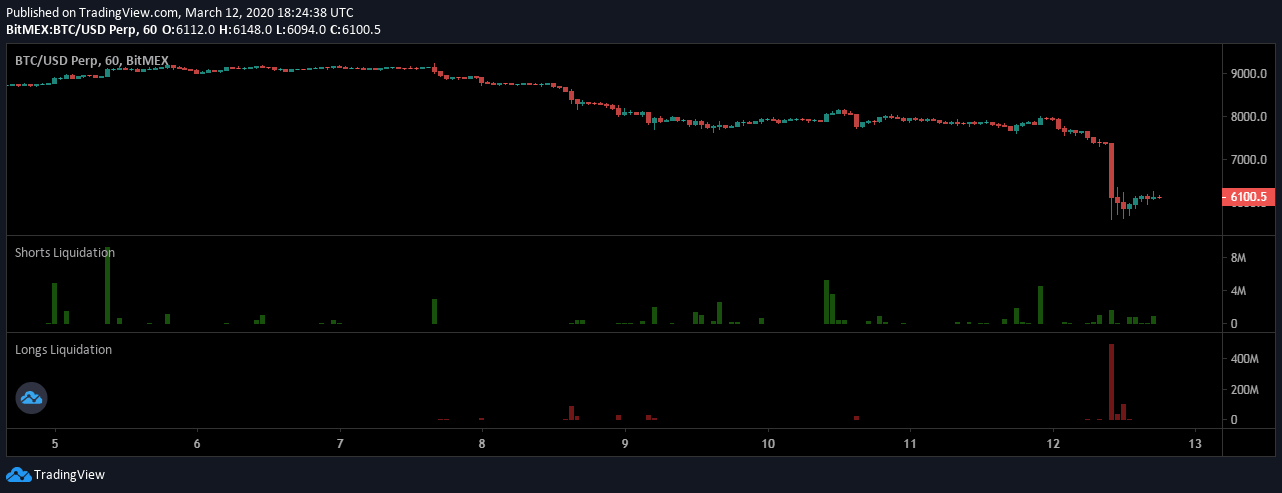

High volatility hit the cryptocurrency market with sharp declines from across the map. Bitcoin’s price dropped to a daily low of $5,600 in a matter of minutes. During this period, BitMEX had noted long liquidations worth almost $500 million in an hour.

BitMEX Liquidation Chart Off The Roof

Bitcoin’s price recorded a massive dump from $7,350 to a low of $5,600 in just one hour. As a result, $484 million worth of open long positions got liquidated on the leading Bitcoin margin trading exchange, BitMEX.

Huge double-digit price fluctuations like today, caused open long positions to get closed due to the fact that the stop-loss is reached. Besides, most traders protect themselves with stop-loss commands. During volatile days, it’s wise to set up further stop losses and not to trade using high leverage.

Additionally, once a long position gets liquated, it actually creates a ‘sell’ command. This leads to a term known as ‘long squeeze,’ which describes the domino effect caused when many orders are liquidated in a short while.

This is the place to remind that margin trading, and especially crypto margin trading carries high risk. Even though it could lead to large gains, it could also do a lot of harm, especially with inexperienced traders.

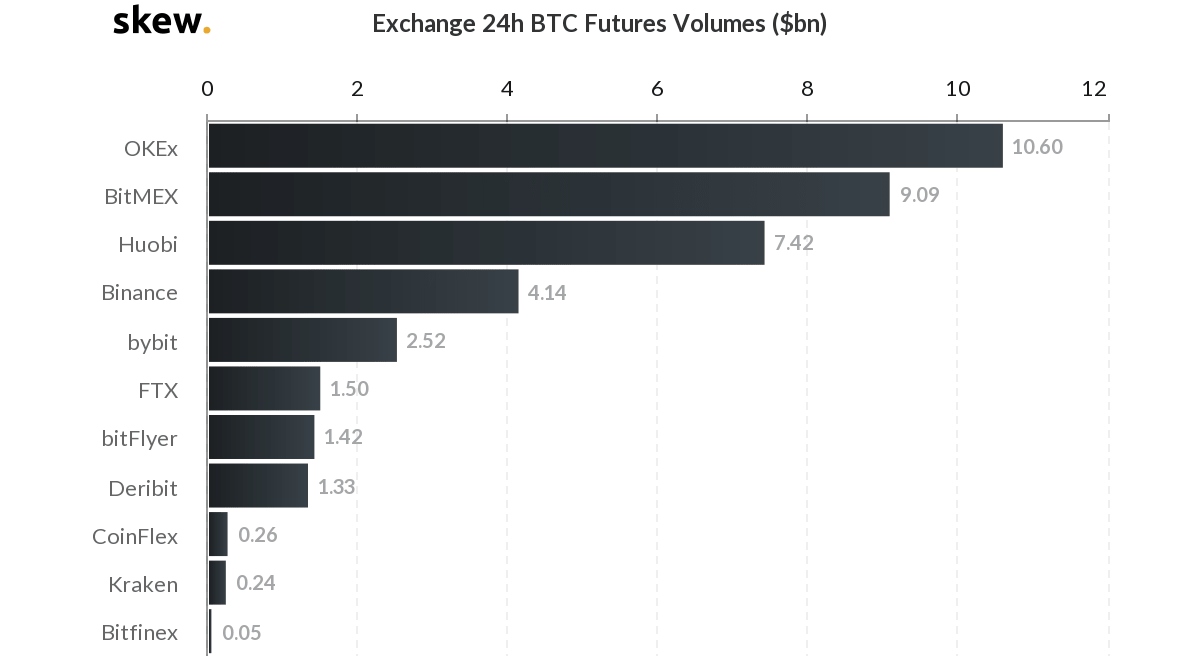

Trading Volume Reaches Sky-High

Today’s volatility also brought a significant Bitcoin Futures trading volume, according to information provided by Skew. OKEx has received the largest share of volume over the past 24 hours, which exceeds $10B. BitMEX follows with over $9B, and Huobi is next with $7.4B.

Interestingly enough, only a few days ago, the Bitcoin options trading volume reached a new all-time high. It came during another day of adverse price movements from the leading digital asset by market cap.

Record-Breaking 1 Day Price Drop

The liquidations and the high trading volume are direct consequences of the massive sell-off that Bitcoin experienced today.

In what became the most notable price drop over the past seven years, Bitcoin price descended by 30% – from a daily high of $8,000 to $5,600. As of writing these lines, Bitcoin managed to recover slightly, and it trades now above the $6,000 mark. Still, the lowest BTC price since May 2019.

Ultimately, Bitcoin lost almost $40 billion of its market capitalization, which is now down to $110 billion. The altcoins followed the violent move strictly downwards. Some of the most notable saw price declines of up to 40%. Consequently, Ethereum is now below $140, Litecoin under $35, and Binance Coin struggles at $12.