The past 24 hours were somewhat positive for most financial markets, including the cryptocurrency field. While Bitcoin was on the rise and gained 0 intraday, the S&P 500 index and the Dow Jones are up by nearly 2%. Nasdaq marked a new all-time high after an increase of 2.2%Crypto Market Goes UpAlthough Bitcoin was fighting to remain above the coveted ,000 mark hours ago, the bulls managed to gain control and pushed it upwards. The primary cryptocurrency registered price increases as it pumped from ,050 to a daily high of ,375 in a few hourly candles.BTC/USD. Source: TradingViewSince then, BTC has retraced slightly to ,250 as it couldn’t break the significant resistance level at ,400. If the asset is to continue its ascend and eventually reach ,000 again, it has to go

Topics:

Jordan Lyanchev considers the following as important: AA News, Bitcoin (BTC) Price, Bitcoin SV (BSV) Price, BNBBTC, bnbusd, BSVBTC, BSVUSD, btcusd, btcusdt, Chainlink (LINK) Price, EOSBTC, eosusd, ETHBTC, ethusd, LINKBTC, LINKUSD, LTCBTC, ltcusd, Market Updates, s&p 500, Wall Street, xrpbtc, xrpusd, XTZBTC, XTZUSD

This could be interesting, too:

Chayanika Deka writes Yuga Labs Secures Major Win as SEC Closes Investigation Without Charges

Andrew Throuvalas writes Bitcoin Soars Back To ,000 After BlackRock CEO Says “Buy The Dip”

Chayanika Deka writes XRP, SOL, and ADA Inclusion in US Crypto Reserve Pushes Traders on Edge

Chayanika Deka writes Why Arthur Hayes Is Bullish on Bitcoin Under Trump’s Economic Strategy

The past 24 hours were somewhat positive for most financial markets, including the cryptocurrency field. While Bitcoin was on the rise and gained $300 intraday, the S&P 500 index and the Dow Jones are up by nearly 2%. Nasdaq marked a new all-time high after an increase of 2.2%

Crypto Market Goes Up

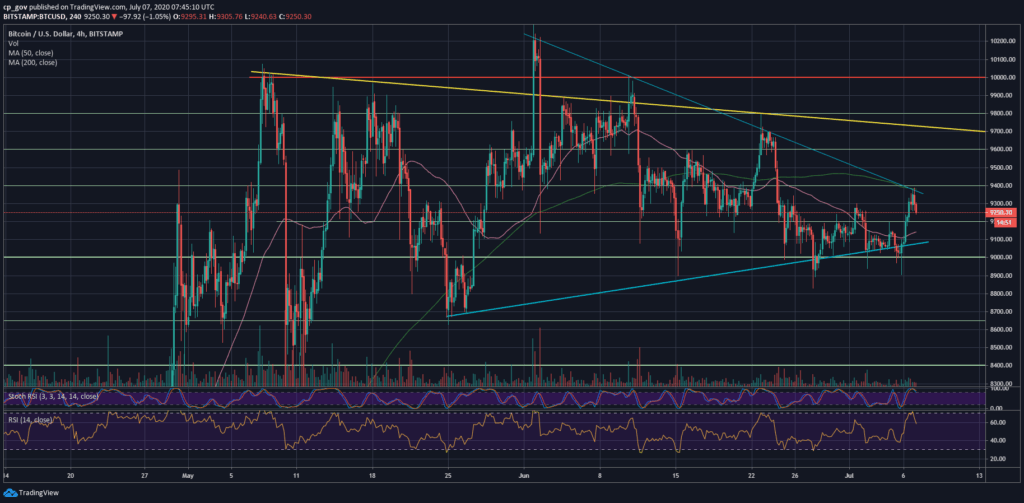

Although Bitcoin was fighting to remain above the coveted $9,000 mark hours ago, the bulls managed to gain control and pushed it upwards. The primary cryptocurrency registered price increases as it pumped from $9,050 to a daily high of $9,375 in a few hourly candles.

Since then, BTC has retraced slightly to $9,250 as it couldn’t break the significant resistance level at $9,400. If the asset is to continue its ascend and eventually reach $10,000 again, it has to go through $9,400, followed by $9,500 and $9,800.

Should BTC reverses and heads south, it can rely on the support level at $9,000.

Altcoins Surge

Green is the predominant color among most alternative coins. Ethereum is up by nearly 2% to $236. Ripple, Litecoin, EOS, Binance Coin, and Tezos are all up by approximately 3%.

Nevertheless, the most significant gainer among the top 10 coins is Bitcoin SV, with a surge of 18%. As a result, BSV is currently trading at $185.

Chainlink also continues its recent decisive run and is in the double-digit territory with an increase of 15%. Merely hours ago, LINK marked its fresh all-time high of $5,64.

Gains Within Legacy Markets

Ever since the COVID-19 pandemic broke out, Bitcoin and the stock markets have been displaying increased correlation. These similarities are evident again now as most US indexes are also seeing green, following the holiday weekend.

The S&P 500 is up by 1.6% to $3,179. While it’s still in the negative year-to-date, the prominent index is closing down and could soon go above the $3,257 level at which it opened on January 2nd, 2020.

The Dow’s gains are slightly higher – 1.78%, and the index is trading now at $26,287. The Nasdaq Composite, however, increased its value the most during yesterday’s trading session by 2.21% to $10,433. It’s worth noting that this is Nasdaq’s new ATH. The index is also well in the green for the entire year as it entered the new century at $9,092.

Today’s futures, however, look a bit grim. The major indices are currently down about 0.5% on average, and if the price doesn’t correct by the time the market opens, we might be in for a slight decrease.