The extreme levels of volatility reached the U.S. dollar as well, and the world’s reserve currency is losing value. It comes only days after the historic .2T “stimulus package,” which aims to help individuals and businesses in need.Amid the rising threat of inflation and concerns amongst numerous experts, the cryptocurrency community broached Bitcoin’s scarcity as an alternative to the constant increase of fiat money in circulation.U.S. Measures Harm The DollarThe novel coronavirus appeared to have been the catalyst for major health but also a financial crisis. Aside from its deadly effect on people’s health, it’s also damaging the global economy. Businesses closed, citizens are under lockdown, and the stock markets tumble. Wall Street, the leading financial market, suffered

Topics:

Jordan Lyanchev considers the following as important: AA News, coronavirus, Donald Trump, Peter Schiff, United States

This could be interesting, too:

Bitcoin Schweiz News writes GameStop nimmt Bitcoin in Firmenreserven auf

Chayanika Deka writes Yuga Labs Secures Major Win as SEC Closes Investigation Without Charges

Andrew Throuvalas writes Bitcoin Soars Back To ,000 After BlackRock CEO Says “Buy The Dip”

Chayanika Deka writes XRP, SOL, and ADA Inclusion in US Crypto Reserve Pushes Traders on Edge

The extreme levels of volatility reached the U.S. dollar as well, and the world’s reserve currency is losing value. It comes only days after the historic $6.2T “stimulus package,” which aims to help individuals and businesses in need.

Amid the rising threat of inflation and concerns amongst numerous experts, the cryptocurrency community broached Bitcoin’s scarcity as an alternative to the constant increase of fiat money in circulation.

U.S. Measures Harm The Dollar

The novel coronavirus appeared to have been the catalyst for major health but also a financial crisis. Aside from its deadly effect on people’s health, it’s also damaging the global economy. Businesses closed, citizens are under lockdown, and the stock markets tumble. Wall Street, the leading financial market, suffered record-breaking losses.

Naturally, the Federal Reserve had to interfere. It started by cutting interest rates to historic lows and made sure commercial banks continue lending to companies, cities, and states. The next measure, though, really grasped the people’s attention. A stimulus package totaling of $6.2 trillion, which President Donald Trump openly endorsed:

“The beautiful thing about our country is $6.2 trillion – because it is $2.2 plus $4 – it’s $6.2 trillion, and we can handle that easily because of who we are, what we are. It’s our money; we are the ones; it’s our currency.”

What he might not take under consideration, though, is the effects on the dollar after the world’s most substantial stimulus package. While Americans earning less than $75,000 per year will receive a check for $1,200, that money might be worth a lot less soon.

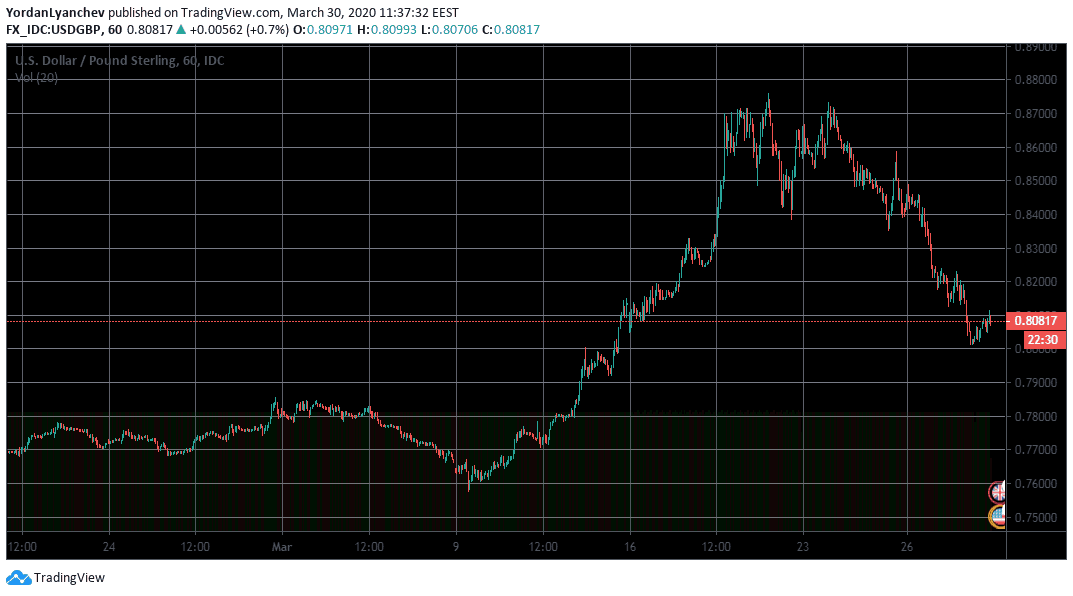

Shortly after signing the bill, the USD started losing value against most fiat currencies. For example, it’s down by 4% when compared to the Euro and the Canadian Dollar. Even more, it declined by 7% against the British Pound.

Hyperinflation Perhaps?

American popular economist and Euro Pacific Capital CEO, Peter Schiff, recently criticized the government’s actions. He warned that printing such extensive quantities of money in a relatively short period will collapse the dollar’s value. In fact, he even mentioned hyperinflation as a possibility in the U.S.:

“I think hyperinflation, as bad as that is, I used to think that was the worst-case scenario. Now, it’s kind of the most probable. It’s not a guarantee, but in order to avoid hyperinflation, things will have to get really, really bad.”

Bitcoin’s Case

Amid the rising number of fiat currencies in circulation, the cryptocurrency community saw this as an opportunity for Bitcoin to shine. After all, it was created during the last financial crisis, and it’s a scarce digital asset. Meaning that there’s a 21 million cap of the maximum bitcoins ever to exist. No government or any centralized authority figure can decide to “print” more just for the sake of it.

Moreover, every four years, an event called “Halving” slashes in half the amount of produced BTC. The next one is coming in less than two months, and the block reward will reduce to 6.25 BTC per block. Since fewer bitcoins are generated, the pre-programmed inflation rate will only decrease in time. Today, that rate is at approximately 3.7%, and it will drop to 1.8% after the Halving.

Co-founder at Morgan Creek Digital and popular cryptocurrency proponent, Anthony “Pomp” Pompliano was among the first who brought up Bitcoin as an alternative:

“Fiat money is getting more plentiful. Bitcoin is getting more scarce. Educate yourself. No one will look out for you, but you.” – he Tweeted.