Following an increase of 42% during Q2 2020, Bitcoin’s closing price of ,140 was the third-highest position the asset has seen at the end of a quarter, trailing only to Q2 2019 and Q4 2017. On a yearly scale, BTC is also outperforming the S&P 500, WTI, gold, and the US dollar.Bitcoin Goes Up In Q2 2020The end of June marked the closing of the second quarter of 2020. As such, the popular cryptocurrency monitoring company Skew explored various aspects of Bitcoin’s performance during that period.Bitcoin Quarterly Results. Source: SkewAfter the negative Q1 this year, in which the primary cryptocurrency lost 10% of its value, despite plunging by 50% in mid-March, the asset has shown massive gains of over 42% in Q2.Thus, Q2 continues to be Bitcoin’s favorite yearly quarter. As CryptoPotato

Topics:

Jordan Lyanchev considers the following as important: AA News, Bitcoin (BTC) Price, btcusd, btcusdt, s&p 500

This could be interesting, too:

Chayanika Deka writes Yuga Labs Secures Major Win as SEC Closes Investigation Without Charges

Andrew Throuvalas writes Bitcoin Soars Back To ,000 After BlackRock CEO Says “Buy The Dip”

Chayanika Deka writes XRP, SOL, and ADA Inclusion in US Crypto Reserve Pushes Traders on Edge

Chayanika Deka writes Why Arthur Hayes Is Bullish on Bitcoin Under Trump’s Economic Strategy

Following an increase of 42% during Q2 2020, Bitcoin’s closing price of $9,140 was the third-highest position the asset has seen at the end of a quarter, trailing only to Q2 2019 and Q4 2017. On a yearly scale, BTC is also outperforming the S&P 500, WTI, gold, and the US dollar.

Bitcoin Goes Up In Q2 2020

The end of June marked the closing of the second quarter of 2020. As such, the popular cryptocurrency monitoring company Skew explored various aspects of Bitcoin’s performance during that period.

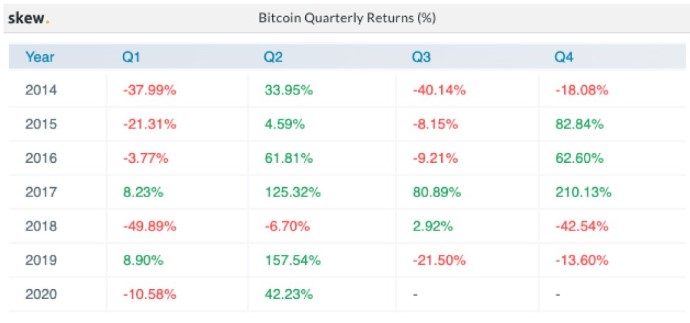

After the negative Q1 this year, in which the primary cryptocurrency lost 10% of its value, despite plunging by 50% in mid-March, the asset has shown massive gains of over 42% in Q2.

Thus, Q2 continues to be Bitcoin’s favorite yearly quarter. As CryptoPotato reported before, the largest cryptocurrency has marked increases throughout almost all Q2s since 2014. The only exception came during the 2018 bear market when BTC lost 6.7% of its value in the second quarter.

The increase of 42.23% means in USD terms that Bitcoin has surged from $6,420 at the end of Q1 to $9,140 at the end of Q2. According to Skew, this rather impressive number means that BTC had its “third-best quarterly close in its young history.”

The two occasions in which Bitcoin had demonstrated higher closing prices were during the parabolic price increase of 2017 when it ended at $13,660 and in the bull market of last year when it was at $10,590 after Q2.

Bitcoin Beats the S&P 500, Gold, WTI In 2020

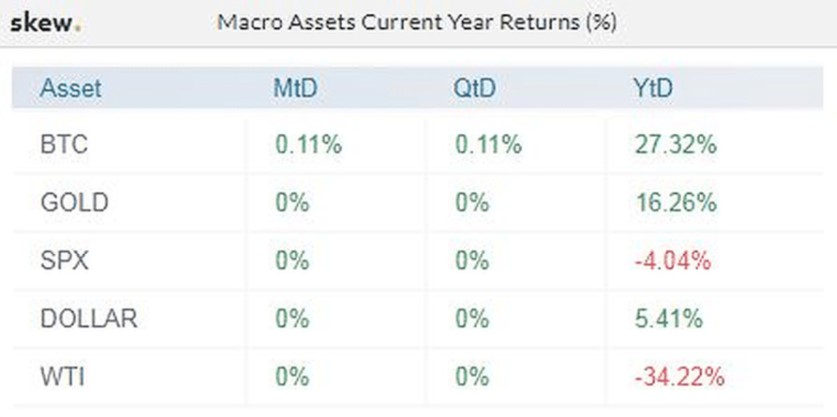

The data analytics company also analyzed the performance of several assets since the start of the year. Aside from Bitcoin, those included gold, the S&P 500 index, the US dollar, and crude oil (WTI).

WTI has been on a significant downtrend since the COVID-19 pandemic caused nation-wide lockdowns. At one point, it even went in negative territory as its supply was substantially higher than the demand. Although it managed to recover to some extent since then, it still shows -34.22 YTD results.

The S&P is also down with -4.04%, per the data from Skew. The USD is up by 5.41%, which may be somewhat surprising to some after printing trillions of dollars to flush into the markets and the economy in an attempt to fight the financial crisis. However, it’s worth noting that numerous prominent economists have warned that the dollar’s long-term effects could be quite damaging.

Gold, on the other hand, being traditionally regarded as a safe-haven asset prone to perform well during a crisis, has indeed increased its value in 2020. The bullion is up 16.26%.

Out of all examined assets, however, the one that stands out with the highest gains so far in 2020 is Bitcoin. BTC marks a 6-month increase of 27.31%. Interestingly, the primary cryptocurrency was also the best performing asset of the past decade, with an ROI of 8,900,000%.