Following a few days of adverse price movements, most of the cryptocurrency market is recovering and is in the green today. Bitcoin is up to ,500, Ethereum is trading above 0 for the first time since Tuesday. Even more impressive gains are evident from the lower-cap alts.Bitcoin Back Above ,500The primary cryptocurrency saw its fair share of price dumps in the past few days. BTC even experienced quite volatile developments following an announcement from the US Federal Reserve regarding its new plans to target inflation averaging 2% over time. A sharp dip met a quick price pump, and BTC bottomed at ,100.However, the bulls didn’t allow any further declines and have continuously driven the price upwards. At the time of this writing, Bitcoin is hovering around the ,500 mark.

Topics:

Jordan Lyanchev considers the following as important: AA News, AMPLBTC, AMPLUSD, AMPLUSDT, BCHBTC, bchusd, Bitcoin (BTC) Price, BNBBTC, bnbusd, BSVBTC, BSVUSD, BTCEUR, BTCGBP, btcusd, btcusdt, DOTBTC, DOTUSD, DOTUSDT, ERDBTC, ERDUSD, ETHBTC, Ethereum (ETH) Price, ethusd, LINKBTC, LINKUSD, LTCBTC, ltcusd, Market Updates, xrpbtc, xrpusd, YFIBTC, YFIUSD, YFIUSDT

This could be interesting, too:

Chayanika Deka writes Yuga Labs Secures Major Win as SEC Closes Investigation Without Charges

Andrew Throuvalas writes Bitcoin Soars Back To ,000 After BlackRock CEO Says “Buy The Dip”

Chayanika Deka writes XRP, SOL, and ADA Inclusion in US Crypto Reserve Pushes Traders on Edge

Chayanika Deka writes Why Arthur Hayes Is Bullish on Bitcoin Under Trump’s Economic Strategy

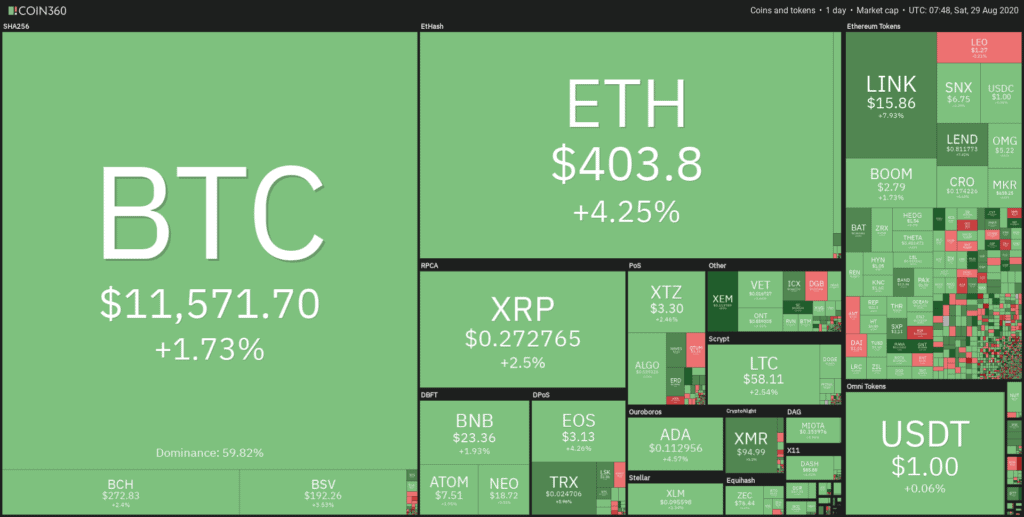

Following a few days of adverse price movements, most of the cryptocurrency market is recovering and is in the green today. Bitcoin is up to $11,500, Ethereum is trading above $400 for the first time since Tuesday. Even more impressive gains are evident from the lower-cap alts.

Bitcoin Back Above $11,500

The primary cryptocurrency saw its fair share of price dumps in the past few days. BTC even experienced quite volatile developments following an announcement from the US Federal Reserve regarding its new plans to target inflation averaging 2% over time. A sharp dip met a quick price pump, and BTC bottomed at $11,100.

However, the bulls didn’t allow any further declines and have continuously driven the price upwards. At the time of this writing, Bitcoin is hovering around the $11,500 mark. Should the asset embark on another increase, it needs to overcome the first resistance decisively at $11,650, followed by $11,800, and the psychological level of $12,000.

Alternatively, the first support lies at $11,300, while $11,150 and $11,000 are next in case BTC dips again.

The increased correlation between Bitcoin and gold materialized again during the past few days. The precious metal dived similarly to BTC following the Fed news to $1,910 per ounce, but it closed at above $1,960 yesterday.

Altcoins Recover: The Sushi Coins Skyrocket

Ethereum nosedived to $370 a few days back, but it has followed Bitcoin on the way up. After a 4% increase in the past 24 hours, ETH is trading above $400, while Ripple is up by 2% to $0.27.

Chainlink and Polkadot continue with their impressive performance as of late with 8% gains. With its latest developments, DOT found a spot in the top 10 coins by market cap and even surpassed LINK in the top 5 at one point. However, Chainlink has reclaimed its position since then, and it will be compelling to follow the battle between the two.

More notable gains come from the lower-cap alts. UMA leads the race with a 40% increase, followed by Storj (34%), and bZx Protocol surges by 30% after listing on the leading cryptocurrency exchange by volume – Binance.

Yearn.Finance rises by another 28%, and one YFI trades now at $18,800, which is 1.6 BTC. Golem (26%), NEM (24%), Ampleforth (20%), Siacoin (19%), Flexacoin (16%), Elrond (15%), Decentraland (14%), Kusama (14%), Lisk (12%), and Waves (10%) complete the double-digit price pump club.

Some of the above gains – mainly UMA and AMPL – are related to Sushi, the new trend in the farmed coins. Sushi is basically forking the Uniswap interface and adding more token features to it, such as stats.

Although Serum (-12%), THORChain (-8%), Numeraire (-7%), and a few other coins are in the red, the total market has gained nearly $15 billion to $361 billion since the dip on Thursday.