After breaking the previous yearly high and briefly spiking to ,000, BTC has retraced slightly and trades beneath that level. Simultaneously, Ethereum surged to a new high since early September, while Chainlink’s impressive weekly performance has taken the asset to the 5th spot in terms of market cap. Bitcoin Sees New YTD High But Retraces BTC has performed quite decisively lately. The asset jumped to a new year-to-date high on Friday of just shy ,000. Although it retraced since then and even tanked to ,300 at one point, the cryptocurrency has primarily maintained a price tag north of ,000. The impressive performance continued yesterday. Bitcoin initiated a leg up starting from ,500 that resulted in successfully tapping ,000. This meant a new highest

Topics:

Jordan Lyanchev considers the following as important: AA News, ADABTC, ADAUSD, BCHBTC, bchusd, Bitcoin (BTC) Price, BNBBTC, bnbusd, BTCEUR, BTCGBP, btcusd, btcusdt, Chainlink (LINK) Price, defi, ETHBTC, Ethereum (ETH) Price, ethusd, LINKBTC, LINKUSD, LTCBTC, ltcusd, Market Updates, xrpbtc, xrpusd, YFIBTC, YFIUSD, YFIUSDT

This could be interesting, too:

Bitcoin Schweiz News writes Manuel Stagars: Eine neue Dokumentation über das Crypto Valley in Entwicklung

Bitcoin Schweiz News writes Tokenisierung live erleben: Von der Regulierung zur Praxis am 10. April in Zug

Bitcoin Schweiz News writes Ethereum Foundation fördert DeFiScan: Ein Meilenstein für Transparenz im DeFi-Sektor

Bitcoin Schweiz News writes Are US Gold Reserves Soon to Be Crypto Tokens? The Blockchain Revolution for National Gold

After breaking the previous yearly high and briefly spiking to $16,000, BTC has retraced slightly and trades beneath that level.

Simultaneously, Ethereum surged to a new high since early September, while Chainlink’s impressive weekly performance has taken the asset to the 5th spot in terms of market cap.

Bitcoin Sees New YTD High But Retraces

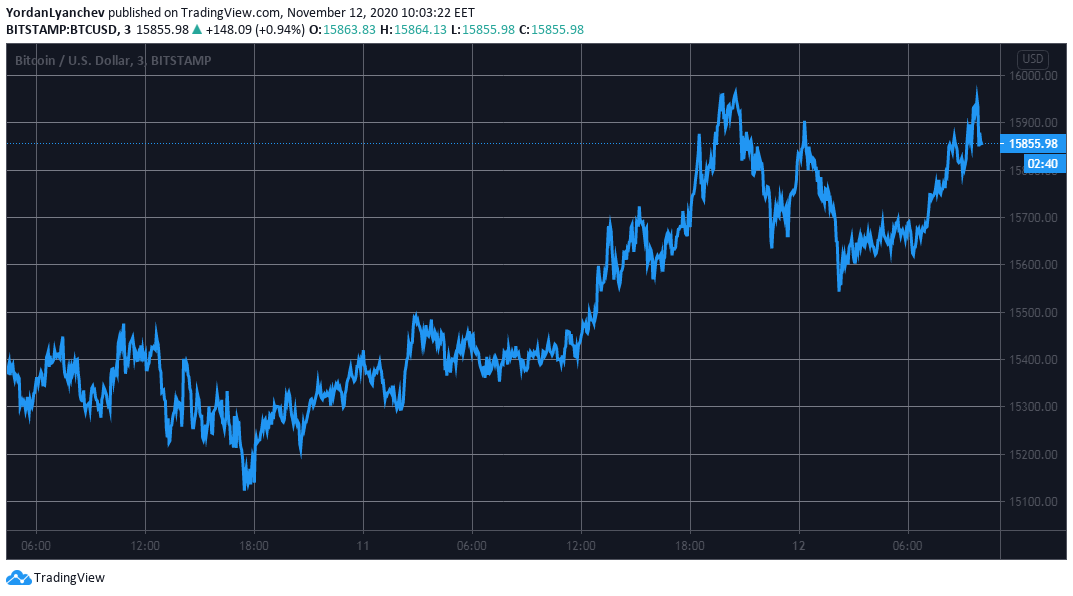

BTC has performed quite decisively lately. The asset jumped to a new year-to-date high on Friday of just shy $16,000. Although it retraced since then and even tanked to $14,300 at one point, the cryptocurrency has primarily maintained a price tag north of $15,000.

The impressive performance continued yesterday. Bitcoin initiated a leg up starting from $15,500 that resulted in successfully tapping $16,000. This meant a new highest price point since January 2018, and that BTC came just 25% away from its ATH from December 2017.

However, the increase seemed shortlived as the asset quickly fell and tested $15,500 once again. Nevertheless, the bulls intercepted the drop and drove BTC close to the $16,000 mark once more. The subsequent rejection reduced BTC’s value to its current level – north of $15,800.

The technical aspects suggest that if Bitcoin overcomes the first resistance at $16,000, it could face the next ones at $16,170 and $16,250. Alternatively, BTC could rely on $15,600, $15,200, and $15,000 if another retracement arrives.

ETH To A Two-Month High, Chainlink Back In Top 5

Most alternative coins followed Bitcoin’s move up. Ethereum gained about $15 in a few minutes from $460 to $475, which resulted in ETH’s highest price level since September 2nd. At the time, the second-largest cryptocurrency touched $485. Ethereum has declined slightly and hovers around $465.

Ripple also spiked but got rejected at the $0.26 mark. On a 24-hour scale, XRP has increased by about 1%. Binance Coin (-0.5%), Cardano (-0.2%), and Litecoin (-0.5%) have slightly dropped in value.

Although Chainlink (-1.6%) has lost the most value since yesterday, LINK has been on a roll in the past week. The asset has increased by more than 20%, which has helped reclaim the top 5 spot.

The most notable gainer from the past 24 hours is Blockstack, with its 13% surge. OMG Network (11%), ICON (10%), Decred (10%), and Dash (8%) follow.

After skyrocketing yesterday, most DeFi tokens have retraced today. Loopring (-11%), Yearn.Finance (-10%), Synthetix (-9.5%), Decentraland (-9%), and NEAR Protocol (-9%) are all in the red.