Confirmed coronavirus cases continue to grow globally. The Saudi Arabia Kingdom launched an unexpected oil price war against former ally Russia.As a result, the traditional financial markets are plummeting severely. At the same time, Bitcoin showcases a positive correlation with them and drops below ,000 – for the first time since January 2020.The 2020 Oil Price WarThe coronavirus outbreak hit all financial markets and sectors. Oil is no exception. In an attempt to artificially inflate the decreasing prices, the Organization of the Petroleum Exporting Countries (OPEC) recently decided to reduce the supply of crude oil to world markets by 1.5m barrels per day.Russia, one of the main exports of oil, however, refused to follow OPEC’s recommendation to cut production. It led to a 10%

Topics:

Jordan Lyanchev considers the following as important: AA News, Bitcoin (BTC) Price, coronavirus, nasdaq, s&p 500

This could be interesting, too:

Chayanika Deka writes Yuga Labs Secures Major Win as SEC Closes Investigation Without Charges

Andrew Throuvalas writes Bitcoin Soars Back To ,000 After BlackRock CEO Says “Buy The Dip”

Chayanika Deka writes XRP, SOL, and ADA Inclusion in US Crypto Reserve Pushes Traders on Edge

Chayanika Deka writes Why Arthur Hayes Is Bullish on Bitcoin Under Trump’s Economic Strategy

Confirmed coronavirus cases continue to grow globally. The Saudi Arabia Kingdom launched an unexpected oil price war against former ally Russia.

As a result, the traditional financial markets are plummeting severely. At the same time, Bitcoin showcases a positive correlation with them and drops below $8,000 – for the first time since January 2020.

The 2020 Oil Price War

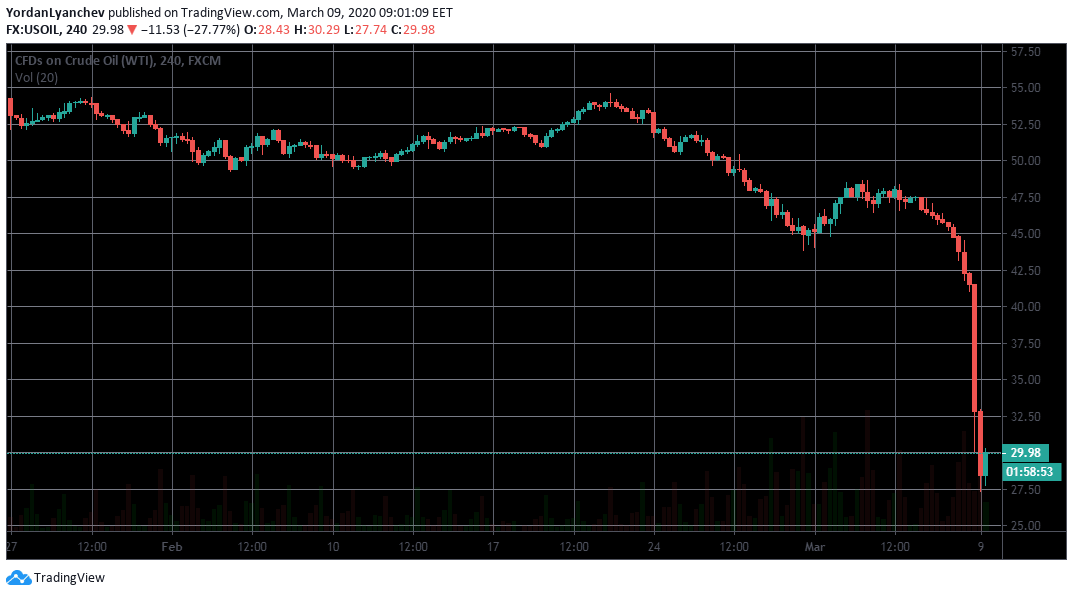

The coronavirus outbreak hit all financial markets and sectors. Oil is no exception. In an attempt to artificially inflate the decreasing prices, the Organization of the Petroleum Exporting Countries (OPEC) recently decided to reduce the supply of crude oil to world markets by 1.5m barrels per day.

Russia, one of the main exports of oil, however, refused to follow OPEC’s recommendation to cut production. It led to a 10% sell-off on Friday. Saudi Arabia acted against it and reduced its selling prices by $6 to $8 in an attempt to retake the Russian share of the market.

Thus began what the traditional media is referring to as the Oil Price War, leading to one of the worst trading days in history. The U.S. oil prices, for instance, crashed with approximately 35% from $41.5 to $27.2. This is the lowest price level since the Gulf War in 1991.

Traditional Financial Markets Collapse

The coronavirus continues to expand, and confirmed cases worldwide exceed 110,000. The effects on the stock markets are evident. The S&P 500 (SPX) futures had hit their stop after pointing on another 5% plunge.

The situation among the other popular U.S.-based indexes is similar. The Nasdaq Composite (COMP) futures is showing a 4.8% drop, while the Dow Jones futures are at 5.05%. Europe’s situation is even worse, as most of the markets forecasting an 8-10% drop, while Italy’s stock exchange pointing on a 10% start of trading.

Asia and the Asia Pacific region bleed out, as well. Australian’s S&P/ASX 200 dropped with over 6% Monday morning, which is its most significant plunge since the global financial crisis in 2008.

Japan’s Nikkei 225 nosedived with 5.6% and is currently at its lowest closing point in more than a year. South Korea’s Kospi fell with 4%, and Hong Kong’s Hang Seng is down with 3.5%.

Bitcoin Under $8,000

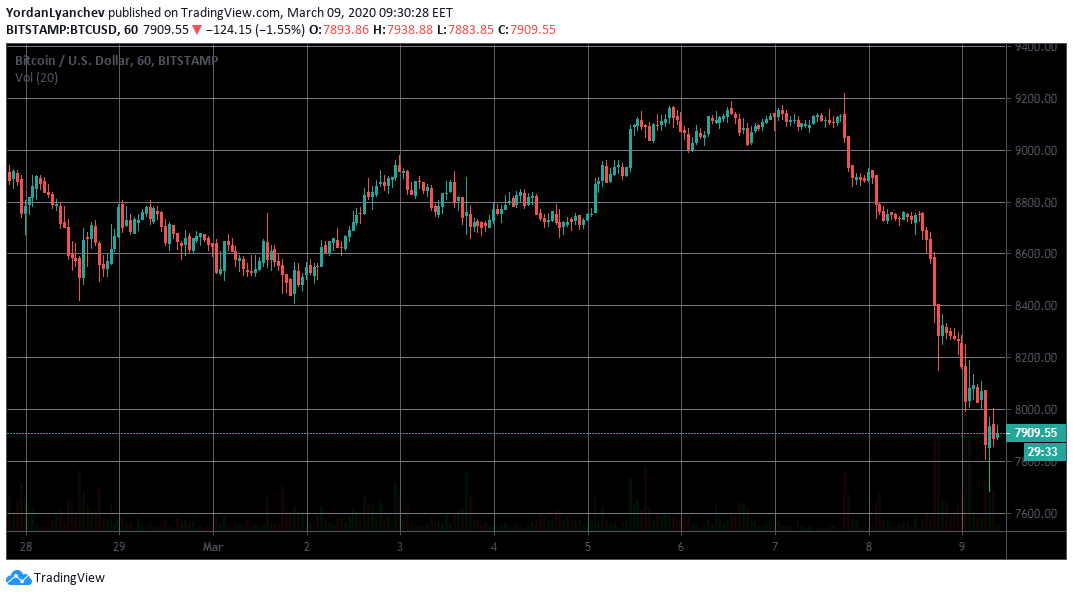

Bitcoin followed the tumbling traditional financial markets. The largest digital asset’s plunge began initially on Saturday, after hitting a high of $9200.

Even though some speculated that it would bounce off the $8,700 support level, the worst was yet to come. On Sunday, BTC lost another sizeable chunk of value and dropped to $8,250. That couldn’t stop it either, and a few hours later, Bitcoin found itself decreasing again – this time, it went as low as $7,600.

Thus, the leading cryptocurrency by market cap plunged by over 15% during the weekend. It has recovered slightly and is currently trading at above $7,900, but it still appears somewhat bearish.

Amid the latest negative price actions, Bitcoin shows, once again, a positive correlation with the traditional financial markets. Safe-haven or not?