Bitcoin went on a wild ride yesterday when news of a COVID-19 vaccine broke out, but has calmed since then and currently trades at around ,300. The leading alternative coins have also cooled down as Ethereum sits around 0 and Ripple at %excerpt%.25. Bitcoin Calms After Increased Volatility The primary cryptocurrency demonstrated high fluctuations in the past week. It topped at a new yearly high of about ,000 on Friday but then nosedived a few days later to below ,300. The volatility remained high over the past 24 hours when reports emerged that the American multinational pharmaceutical corporation Pfizer had developed a COVID-19 vaccine that worked successfully in over 90% of the trial cases. As a result, BTC lost momentum together with the tech stocks, such as ZOOM,

Topics:

Jordan Lyanchev considers the following as important: AA News, BCHBTC, bchusd, Bitcoin (BTC) Price, BTCEUR, BTCGBP, btcusd, btcusdt, Chainlink (LINK) Price, ETHBTC, Ethereum (ETH) Price, ethusd, LINKBTC, LINKUSD, LTCBTC, ltcusd, Market Updates, Ripple (XRP) Price, social, xrpbtc, xrpusd, YFIBTC, YFIUSD, YFIUSDT

This could be interesting, too:

Chayanika Deka writes Yuga Labs Secures Major Win as SEC Closes Investigation Without Charges

Andrew Throuvalas writes Bitcoin Soars Back To ,000 After BlackRock CEO Says “Buy The Dip”

Chayanika Deka writes XRP, SOL, and ADA Inclusion in US Crypto Reserve Pushes Traders on Edge

Chayanika Deka writes Why Arthur Hayes Is Bullish on Bitcoin Under Trump’s Economic Strategy

Bitcoin went on a wild ride yesterday when news of a COVID-19 vaccine broke out, but has calmed since then and currently trades at around $15,300. The leading alternative coins have also cooled down as Ethereum sits around $450 and Ripple at $0.25.

Bitcoin Calms After Increased Volatility

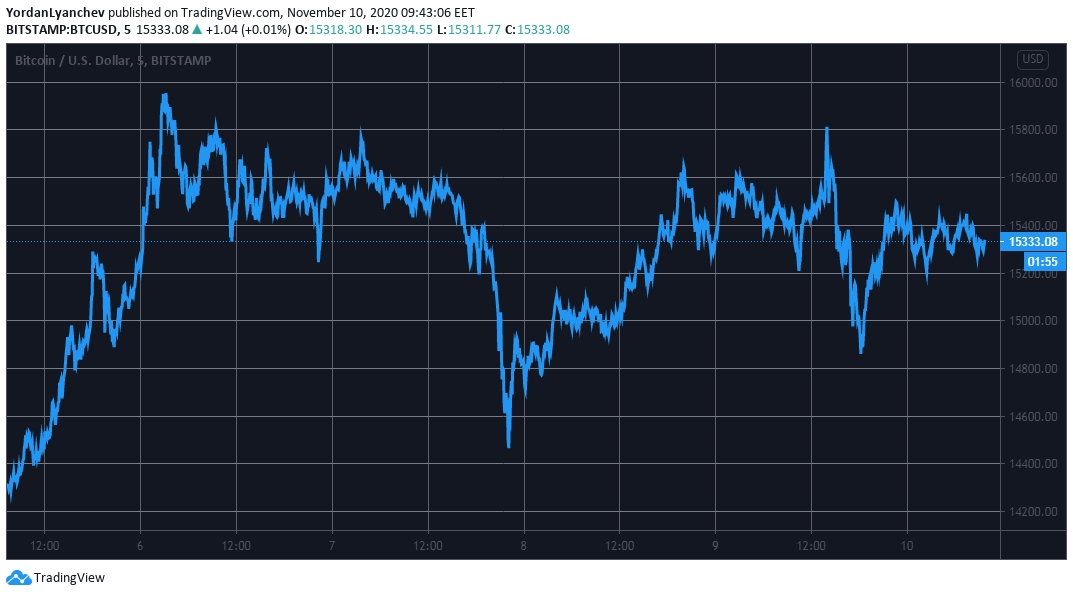

The primary cryptocurrency demonstrated high fluctuations in the past week. It topped at a new yearly high of about $16,000 on Friday but then nosedived a few days later to below $14,300.

The volatility remained high over the past 24 hours when reports emerged that the American multinational pharmaceutical corporation Pfizer had developed a COVID-19 vaccine that worked successfully in over 90% of the trial cases.

As a result, BTC lost momentum together with the tech stocks, such as ZOOM, PayPal, and DocuSign. As of now, Bitcoin bottomed at $14,800 (on Bistamp) and had since recovered.

From a technical point of view, the next resistance lines lie at $15,400, $15,750, and the psychological $16,000. Alternatively, BTC could rely on support levels at $15,000, $14,900, and $14,600 in case of another breakdown.

Altcoins Take It Easy – YFI Trading Above Bitcoin

The alternative coins were not exempt from the high volatility as of late. However, they have also calmed on a 24-hour scale, similarly to Bitcoin.

Ethereum traded at $370 precisely a week ago on November 3rd. Since then, the second-largest digital asset gained up to $100 at one point. It retraced slightly in the past few days and currently sits at about $450.

Ripple tested $0.27 a few days ago after a 13% increase. XRP couldn’t break above it and has slipped back to $0.25.

Litecoin (-3%) and Bitcoin Cash (-3%) have lost the most value from the top 10. As a result, LTC has dipped below $60, while BCH struggles with $260. Chainlink is the best performer here, with a 2% increase.

Despite the relatively calm large-cap altcoins, some lower and mid-cap ones have seen impressive gains. Civic (67%) leads the way. Moreover, CVC has surged by nearly 500% in the past week, which has found it a place within the top 100.

Golem (40%) and Yearn Finance (17%, trading for more than 1 BTC once again) are next. Interestingly, YFI’s price tag is higher than BTC’s now – $17,100.

Further representatives of the double-digit price increase club include Ocean Protocol (16%), Decentraland (13%), Aave (11%), NEAR Protocol (11%), and Status (10%).