The sudden jump of total value locked on the DeFi platform Compound has caused a flippening event in the decentralized finance sector. The TVL on Compound surpassed MakerDao’s as of yesterday, and the gap continues expanding today.Compound Overtakes MakerDAOMakerDAO has been the predominant force for total value locked for years, according to data from the DeFi monitoring resource – DeFi Pulse. Its influence over the entire marker was so unambiguous that the website tracked “Maker Dominance,” which operated similarly to Bitcoin’s dominance over the cryptocurrency market.The graph below demonstrates the fluctuations of the total value locked on MakerDAO’s since early 2018. The results are rather impressive overall, as the value has been progressively increasing in this period and is

Topics:

Jordan Lyanchev considers the following as important: AA News, compound, defi, ETHBTC, ethusd, makerdao

This could be interesting, too:

Bitcoin Schweiz News writes Manuel Stagars: Eine neue Dokumentation über das Crypto Valley in Entwicklung

Bitcoin Schweiz News writes Tokenisierung live erleben: Von der Regulierung zur Praxis am 10. April in Zug

Bitcoin Schweiz News writes Ethereum Foundation fördert DeFiScan: Ein Meilenstein für Transparenz im DeFi-Sektor

Bitcoin Schweiz News writes Are US Gold Reserves Soon to Be Crypto Tokens? The Blockchain Revolution for National Gold

The sudden jump of total value locked on the DeFi platform Compound has caused a flippening event in the decentralized finance sector. The TVL on Compound surpassed MakerDao’s as of yesterday, and the gap continues expanding today.

Compound Overtakes MakerDAO

MakerDAO has been the predominant force for total value locked for years, according to data from the DeFi monitoring resource – DeFi Pulse. Its influence over the entire marker was so unambiguous that the website tracked “Maker Dominance,” which operated similarly to Bitcoin’s dominance over the cryptocurrency market.

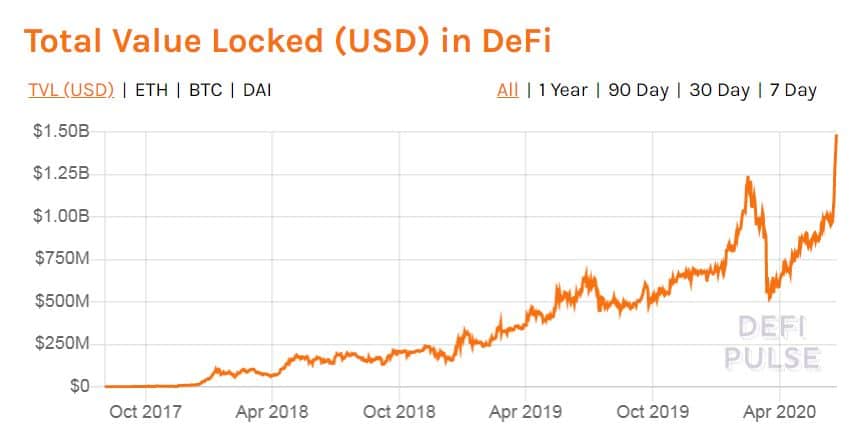

The graph below demonstrates the fluctuations of the total value locked on MakerDAO’s since early 2018. The results are rather impressive overall, as the value has been progressively increasing in this period and is currently at $480 million. Only a few months ago, it reached its ATH of over $750m.

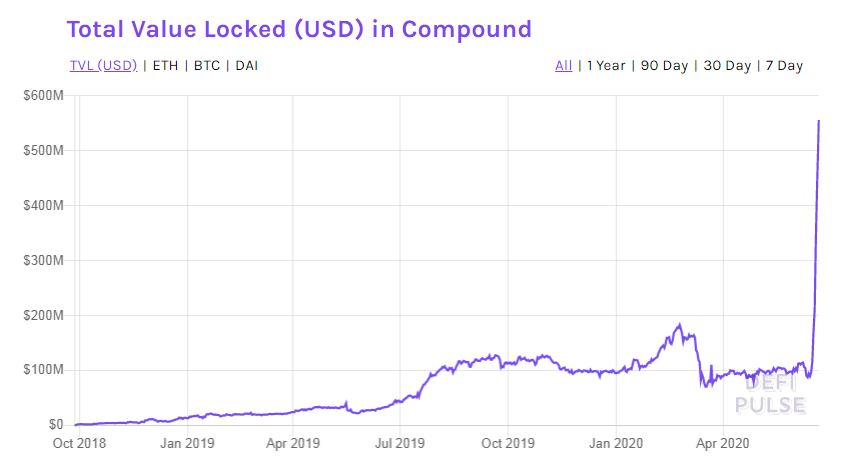

Launched in late 2018, Compound had more modest initial development stages. Although the value locked on the platform surged to nearly $200 million earlier this year, it has been relatively stable in the past few months, swinging for months from $85 million to $110 million.

However, merely a week ago, prompted by the rising buzz in liquidity mining to some extent, the TVL began its decisive ascend. During these seven days, the amount has skyrocketed by over 450% from approximately $100M to $556M at the time of this writing.

This means that Compound is now the DeFi protocol with the highest amount of locked value. DeFi Pulse has also switched from “Maker Dominance” to “Compound Dominance,” which indicates 37.66% as of writing these lines.

COMP Flips MKR

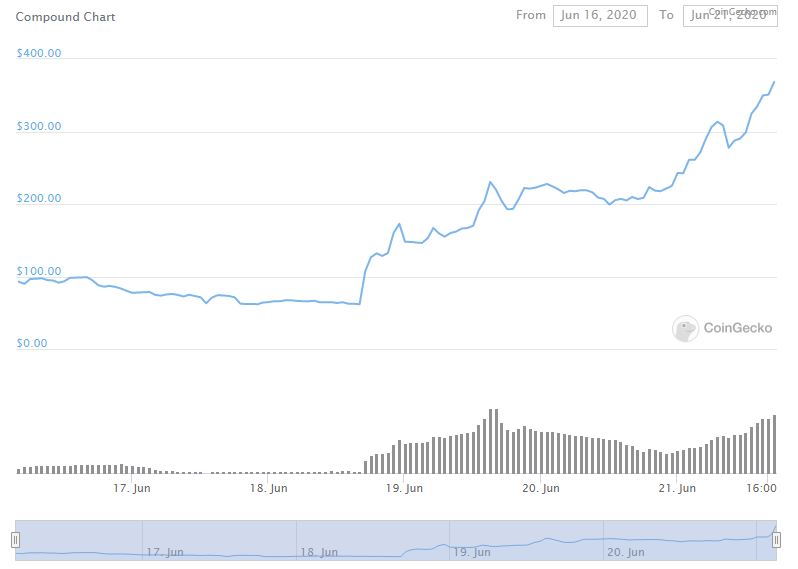

The native cryptocurrencies of both platforms have been moving in correspondence with the TVL. As such, Compound’s COMP has surpassed MakerDAO’s MKR in terms of total market cap.

COMP has been on a massive bull run as of late. During the Coinbase listing announcement last week, the asset price traded at $65. Now, days later, COMP has registered a jump of 466% to the current value of $368. As such, its total market cap of $940m is placing it on the 20th spot, according to CoinGecko.

On the other hand, MKR finds itself at the 29th spot with a price of $520 and a market cap below $470 million.

TVL In DeFi At $1.5B

Naturally, the significant increase in Compound’s numbers has impacted the total value locked across the entire DeFi sector. After reaching the $1 billion milestone earlier this year, the TVL is now rapidly approaching $1.5 billion. This outlines the growth of the decentralized finance field as investors appear more intent to lock funds on DeFi protocols.

DeFi interest rates have been higher than those provided by traditional financial institutions. Co-founder of Ethereum Vitalik Buterin, however, believes that “interest rates significantly higher than what you can get in traditional finance are inherently either temporary arbitrage opportunities or come with unstated risks attached.”