The veteran Bitcoin margin trading exchange BitMEX went down for over an hour a few days ago. While the community speculated on several plausible reasons, BitMEX published a post today explaining what happened, how they can prevent similar occurrences in the future, and assuring that all customer funds are safe.Why BitMEX Went DownThe platform “experienced unscheduled downtime” on May 19th between 12:00 UTC and 13:40 UTC. In the blog post from earlier today, BitMEX explained that it was “a result of an unexpected server restart.” Almost immediately, the teams of engineers and developers began working on it, and the company announced the issue to its customers minutes later.The post explains that the initial problem was “partially” fixed within the first 20 minutes. However, the trading

Topics:

Jordan Lyanchev considers the following as important: AA News, bitcoin futures, Bitmex, btcusd, btcusdt

This could be interesting, too:

Chayanika Deka writes Yuga Labs Secures Major Win as SEC Closes Investigation Without Charges

Andrew Throuvalas writes Bitcoin Soars Back To ,000 After BlackRock CEO Says “Buy The Dip”

Chayanika Deka writes XRP, SOL, and ADA Inclusion in US Crypto Reserve Pushes Traders on Edge

Chayanika Deka writes Why Arthur Hayes Is Bullish on Bitcoin Under Trump’s Economic Strategy

The veteran Bitcoin margin trading exchange BitMEX went down for over an hour a few days ago. While the community speculated on several plausible reasons, BitMEX published a post today explaining what happened, how they can prevent similar occurrences in the future, and assuring that all customer funds are safe.

Why BitMEX Went Down

The platform “experienced unscheduled downtime” on May 19th between 12:00 UTC and 13:40 UTC. In the blog post from earlier today, BitMEX explained that it was “a result of an unexpected server restart.” Almost immediately, the teams of engineers and developers began working on it, and the company announced the issue to its customers minutes later.

The post explains that the initial problem was “partially” fixed within the first 20 minutes. However, the trading engine server “abruptly restarted a second time,” which led to the same issues appearing all over again.

Ultimately, they managed to fix the entire system in less than two hours, the announcement claims. By 13:40 UTC, trading had resumed successfully.

To avoid similar events in the future, the company says it’s implementing several safety procedures. Starting from 2019, BitMEX is allocating more and more engineering resources to “ensure high-availability and platform resiliency.”

The exchange is also introducing architectural improvements that reduce the software and hardware failures. Additionally, the company is simulating outages weekly in a “non-production environment” to verify the “correctness of all procedures.”

When a widely-used cryptocurrency exchange experience similar downtime, customers are typically most interested and concerned about their funds. In this particular case, BitMEX reassured that “at no point during this event were any customer funds at risk.”

The statement also added that no liquidations had occurred while the platform was offline, and all “pending and new customer withdrawals were processed within 90 minutes of coming back online.”

BitMEX Loses Trading Volume Power

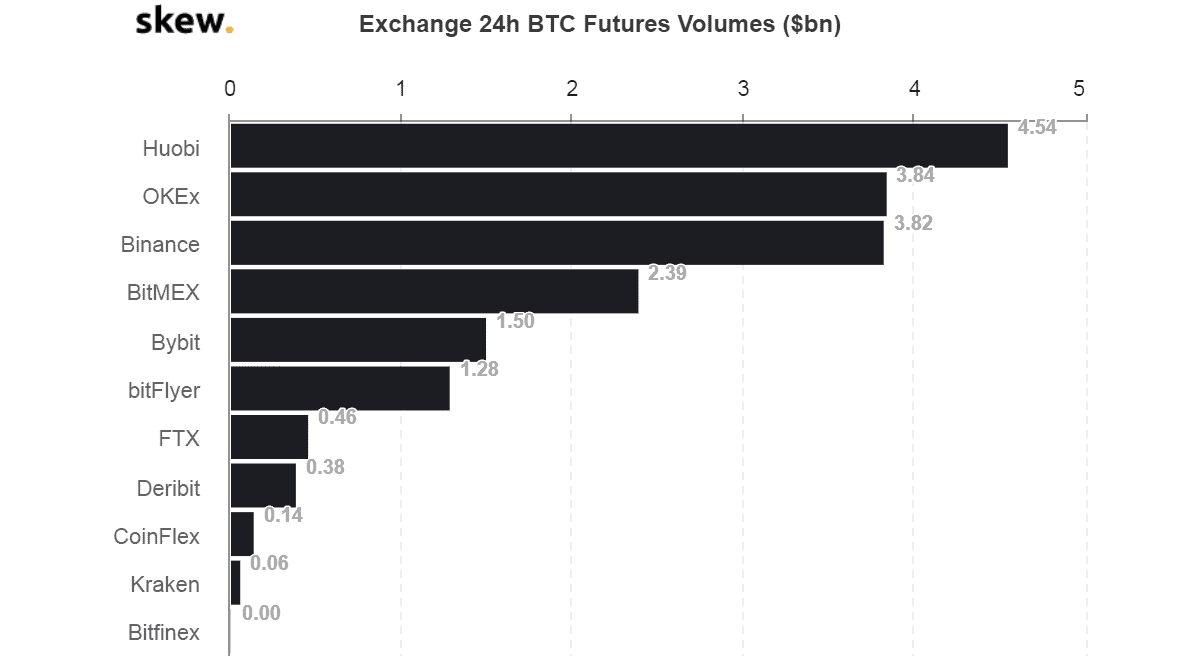

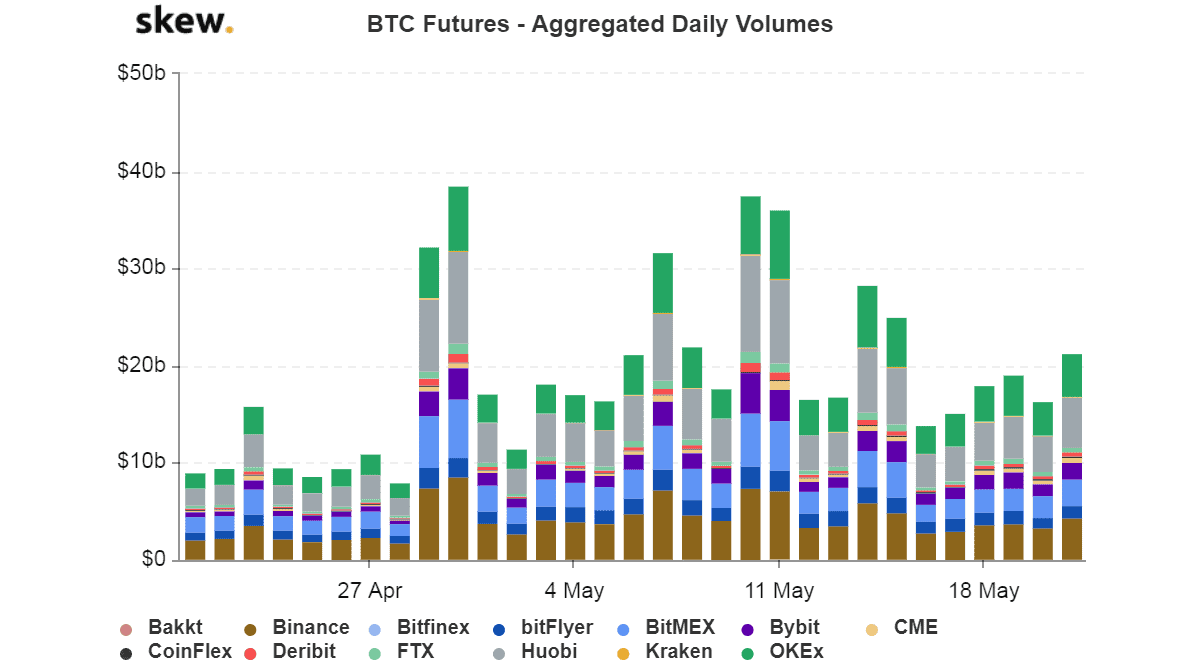

Aside from the platform issues, BitMEX has been losing steam in terms of the trading volume. According to information from the cryptocurrency monitoring resource Skew, the once-first-seeded Bitcoin margin trading exchange has lost even its spot in the top three platforms by aggregated trading volume.

Binance Futures, OKEx, and Huobi are currently the exchanges marking the most significant BTC futures daily volume.