Gold, oil, and even the US dollar, which have served as a reliable store of value for years, could soon lose that status, according to the Winklevoss twins.According to them, Bitcoin is the value to substitute and when this comes, it could facilitate a surge in its price to 0,000 and beyond.The Major Problems With USDIn a comprehensive post, the Winklevoss twins discussed the past, present, and plausible future of finance, global economies, safe haven tools such as gold, oil, and USD, and Bitcoin’s potential role in the entire equation.The post explored in detail the approach taken by the US government towards its own currency. The USD, which has served as the global reserve fiat currency for several decades, has begun decreasing in value and status partly because the government “was

Topics:

Jordan Lyanchev considers the following as important: AA News, Bitcoin (BTC) Price, Bitcoin Long-Term Prediction, BTCEUR, BTCGBP, btcusd, btcusdt, United States, winklevoss twins

This could be interesting, too:

Chayanika Deka writes Yuga Labs Secures Major Win as SEC Closes Investigation Without Charges

Andrew Throuvalas writes Bitcoin Soars Back To ,000 After BlackRock CEO Says “Buy The Dip”

Chayanika Deka writes XRP, SOL, and ADA Inclusion in US Crypto Reserve Pushes Traders on Edge

Chayanika Deka writes Why Arthur Hayes Is Bullish on Bitcoin Under Trump’s Economic Strategy

Gold, oil, and even the US dollar, which have served as a reliable store of value for years, could soon lose that status, according to the Winklevoss twins.

According to them, Bitcoin is the value to substitute and when this comes, it could facilitate a surge in its price to $500,000 and beyond.

The Major Problems With USD

In a comprehensive post, the Winklevoss twins discussed the past, present, and plausible future of finance, global economies, safe haven tools such as gold, oil, and USD, and Bitcoin’s potential role in the entire equation.

The post explored in detail the approach taken by the US government towards its own currency. The USD, which has served as the global reserve fiat currency for several decades, has begun decreasing in value and status partly because the government “was spending money like a drunken sailor, cutting taxes like Crazy Eddie, and printing money like a banana republic,” even before the COVID-19 pandemic.

Instead, those in power should have run a budget surplus during the so-called pro-business cycles. Meaning, the government should have been “spending frugally, saving prudently, or some combination thereof – and printing money sparingly.”

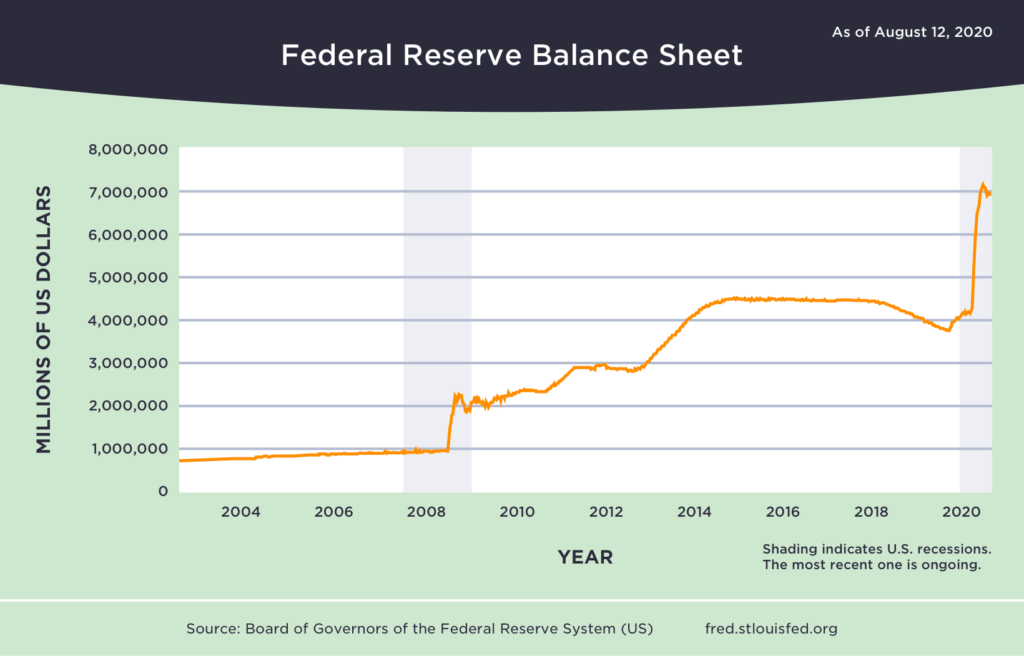

However, “what began as a shot in the arm during the credit crisis of 2008, never stopped, despite the US economy being out of the woods for years.” These actions, which the twins have named as pure “addiction,” had disrupted the stock markets as well, as every time the Fed tried quantitative easing (QE) even before the COVID-19, the markets “recoiled viscerally and became combative.”

“And if stock market gains are your measure of success, you will choose not to upset the apple cart, even if it’s widely untethered to reality. You will naturally avoid a painful intervention and rehabilitation and continue to kick the can down the road as long as you can.”

The actions taken by the Fed to alleviate some of the economic pain caused by the pandemic resulted in the printing of “two-thirds as much money in the last six months as it did over the prior 11 years.” The Fed’s balance sheet has exploded after committing to a “YOLO whatever it takes QE posture going forward.”

Ultimately, all of this means that the “specter of inflation (or hyperinflation) is staring down on us,” and the USD is and will keep decreasing in value and status compared to other assets.

Issues With Oil And Gold

The twins asserted that “oil is no longer a reliable store of value.” They based their conclusion on the events around the pandemic when oil prices went into negative territory because of the storage and lack of demand issues.

Although they have recovered since then, the brothers believe that the technological advancements in the sector have dramatically increased the supply of oil, while global forces are reducing the demand with renewable energy initiatives and political pressure to decrease carbon footprints.

Gold, on the other hand, is currently a reliable store of value and is regarded as the classic inflation hedge. However, it has potential problems as well, such as its supply. The supply of gold is unknown, even though the precious metal is scarce on Earth. Nevertheless, as the founders of the Gemini cryptocurrency exchange recently pointed out, gold can be harnessed from space.

The “Space Gold Rush” has begun with NASA’s Psyche mission scheduled for 2022 with Elon Musk winning the contract to launch it. And, despite NASA claiming that it doesn’t plan to mine metals from asteroid yet, the organization (or others) could have a change of heart soon, which may plummet gold’s value.

“It seems entirely plausible that Elon Musk will be able to put a machine on an asteroid, drill a hole, and retrieve the extractions back to Earth within his lifetime. Even a semi-credible effort that foreshadows this long-term inevitability will crater the price of gold.”

Other potential problems with the precious metal include its portability as it’s “hard to move gold during a pandemic, during a war, and if there’s a change in government attitude towards your property rights. It’s hard to move gold, period.”

The Answer Could Lie In Bitcoin

The Winklevoss brothers noted that several, different in essence, goods have served as money throughout history – shells, beads, metal, paper backed by metal, paper not backed by metal, and more. Money is “whatever we all agree it is,” and it could be an asset purpose-built for internet usage, working the same way as the email does. Enter Bitcoin.

“Bitcoin is not just a scarce commodity; it’s the only known commodity in the universe that has a deterministic and fixed supply. As a result, Bitcoin is not subject to any of the potential supply shocks that gold (or any commodity for that matter) may face in the future.”

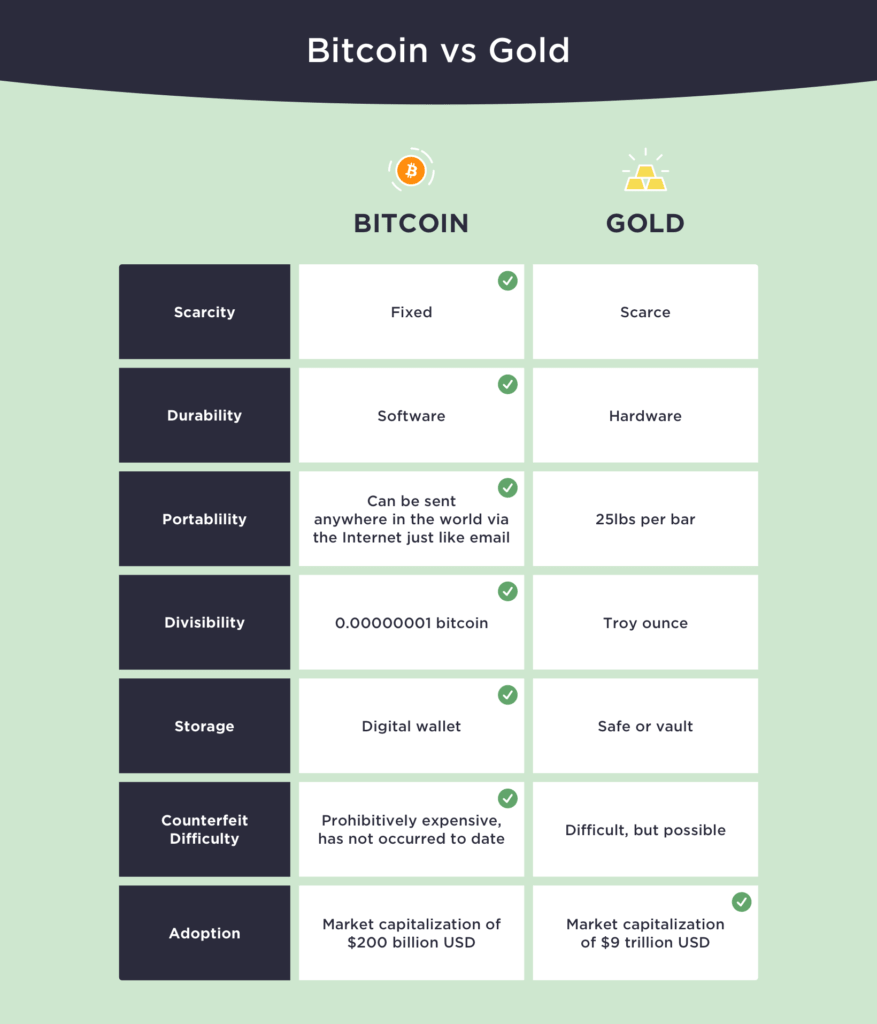

By referring to the chart above, the twins highlighted all of BTC’s superiorities over gold. Those include the scarcity (21 million bitcoins ever to exist), durability, portability (BTC can be sent anywhere in the world and it requires just an internet connection), divisibility, storage, and counterfeit difficulty. A recent example showcased that despite indeed being difficult, it’s not impossible to counterfeit gold.

One measure that gold is massively outperforming Bitcoin is the total market cap of the two assets, which could actually present an opportunity for BTC to skyrocket in price. The twins said that the TMC of “above-ground gold is conservatively $9 trillion.”

“If we are right about using a gold framework to value Bitcoin, and Bitcoin continues on this path, then the bull case scenario for Bitcoin is that it is undervalued by a multiple of 45. Said differently, the price of Bitcoin could appreciate 45x from where it is today, which means we could see a price of $500,000 per bitcoin.”

Although such a massive price sounds quite optimistic, to say the least, the brothers believe that it could even exceed it if we take into consideration “some portion of the $11.7 trillion of fiat foreign exchange reserves held by governments” and insert it into BTC.