Blockchain and cryptocurrencies expanded their presence and usage in 2019, says JP Morgan. The giant American multinational investment bank filed a comprehensive report regarding the performance of the technology and digital assets in 2019.Bitcoin AdoptionTwo years after the bank’s CEO, Jamie Dimon regretted calling Bitcoin a “fraud,” JPM issued a 74-page document that involves the largest cryptocurrency. Among the discussed topics, the report outlines Bitcoin’s developments in terms of attracting more institutional investors.JPM’s paper referred to regulated establishments such as the Chicago Mercantile Exchange and the ICE’s Bakkt. It concluded that the interest in CME grew significantly in 2019. Indeed, as Cryptopotato recently reported, the Chicago-based Bitcoin exchange continues to

Topics:

Jordan Lyanchev considers the following as important: AA News, Bitcoin Adoption, Blockchain Adoption, Editorials, jp morgan, Stablecoins

This could be interesting, too:

Christian Mäder writes Die Bitcoin-Weltkarte: Holdings im Fokus

Bitcoin Schweiz News writes Die USA werden zum Bitcoin-Land: Banken benötigen keine spezielle Lizenz mehr für Krypto-Services

Christian Mäder writes Bitcoin-Transaktionsgebühren auf historischem Tief: Warum jetzt der beste Zeitpunkt für günstige Überweisungen ist

Christian Mäder writes Das Bitcoin-Reserve-Rennen der US-Bundesstaaten: Wer gewinnt das Krypto-Wettrüsten?

Blockchain and cryptocurrencies expanded their presence and usage in 2019, says JP Morgan. The giant American multinational investment bank filed a comprehensive report regarding the performance of the technology and digital assets in 2019.

Bitcoin Adoption

Two years after the bank’s CEO, Jamie Dimon regretted calling Bitcoin a “fraud,” JPM issued a 74-page document that involves the largest cryptocurrency. Among the discussed topics, the report outlines Bitcoin’s developments in terms of attracting more institutional investors.

JPM’s paper referred to regulated establishments such as the Chicago Mercantile Exchange and the ICE’s Bakkt. It concluded that the interest in CME grew significantly in 2019. Indeed, as Cryptopotato recently reported, the Chicago-based Bitcoin exchange continues to increase its daily trading volume.

However, the report indicates that Bakkt’s options platform hasn’t reached its full potential yet:

“While the ICE and Bakkt launch represented the advent of centrally-cleared Bitcoin options on a regulated U.S. exchange, a major milestone for the crypto market, the option volumes and open interest have so far been rather small.”

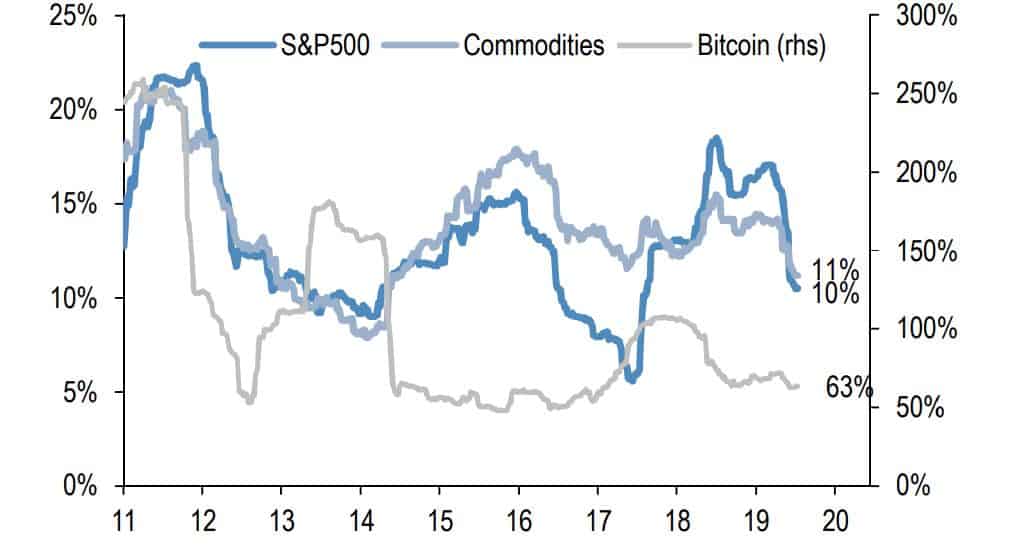

Another vital topic comes in terms of volatility. The document informed that Bitcoin’s volatility reduced last year, but it’s still at least five times greater than core markets such as Equities or Hedges like Commodities.

Blockchain

The paper showcased blockchain’s improvement, as well. It pointed out to serious developments in the technology, including the Chinese pro-blockchain slogan from late 2019.

“Blockchain has moved beyond experimentation and use in payments,” said the report. It also informed that the financial sector, more specifically the areas of settlement and clearing, can benefit significantly by implementing the distributed ledger technology.

However, blockchain hasn’t gone entirely mainstream yet:

“Indeed, we believe that one of the reasons we have not seen even faster mainstream adoption of blockchain is the real world realization that there is a need for the verification of the information going into a blockchain.”

Stablecoins

Outlining once again the volatility among most cryptocurrencies, JPM brought the case for stablecoins. As they remain relatively stable in times of intense price fluctuations, traders usually use them as a hedge in such situations.

The document claimed that their usage increased in 2019. They also have the potential “to grow substantially in global transactional activity despite challenges inherent in the microstructure of operating such a payment system.”

At the same time, privately owned stablecoins such as Facebook’s Libra could continue facing regulatory hurdles. JP Morgan believes that the need for substantial regulatory oversight comes because of rapid adoption.

It’s also worth noting that the giant bank announced plans to creates its own JPM cryptocurrency a year ago.