Following yesterday’s surge to about ,500, Bitcoin has retraced slightly and trades at about ,350. Most altcoins have also calmed after charting two consecutive days of gains.Bitcoin Steady Above KAs reported yesterday, the primary cryptocurrency initiated an impressive leg up. Bitcoin went from about ,900 to its new monthly high of nearly ,500 with just a few hourly candles.After registering such notable gains in a relatively short period, BTC has retraced slightly and calmed. The asset currently sits at about ,350.From a technical perspective, Bitcoin now faces the first resistance at around ,400 – ,500. Should the cryptocurrency overcomes it, BTC could head towards ,800, followed by ,000.In case of a price breakdown, Bitcoin could rely on the support lines

Topics:

Jordan Lyanchev considers the following as important: AA News, BCHBTC, bchusd, Bitcoin (BTC) Price, BNBBTC, bnbusd, BTCEUR, BTCGBP, btcusd, btcusdt, Chainlink (LINK) Price, DOTBTC, DOTUSD, DOTUSDT, ETHBTC, Ethereum (ETH) Price, ethusd, LINKBTC, LINKUSD, Market Updates, Ripple (XRP) Price, SXPBTC, SXPUSD, SXPUSDT, xrpbtc, xrpusd, YFIBTC, YFIUSD, YFIUSDT

This could be interesting, too:

Chayanika Deka writes Yuga Labs Secures Major Win as SEC Closes Investigation Without Charges

Andrew Throuvalas writes Bitcoin Soars Back To ,000 After BlackRock CEO Says “Buy The Dip”

Chayanika Deka writes XRP, SOL, and ADA Inclusion in US Crypto Reserve Pushes Traders on Edge

Chayanika Deka writes Why Arthur Hayes Is Bullish on Bitcoin Under Trump’s Economic Strategy

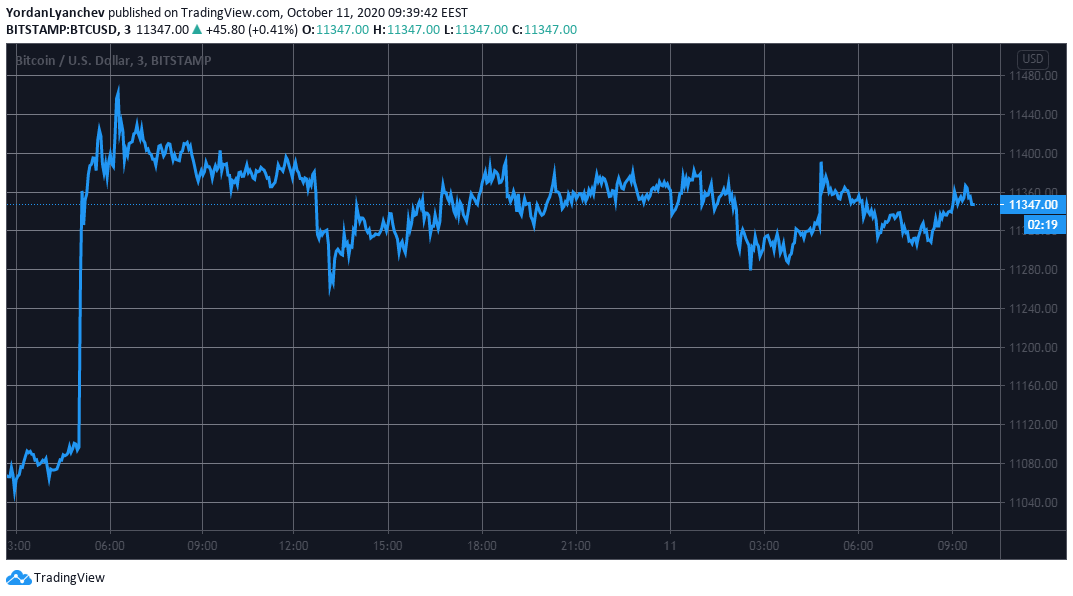

Following yesterday’s surge to about $11,500, Bitcoin has retraced slightly and trades at about $11,350. Most altcoins have also calmed after charting two consecutive days of gains.

Bitcoin Steady Above $11K

As reported yesterday, the primary cryptocurrency initiated an impressive leg up. Bitcoin went from about $10,900 to its new monthly high of nearly $11,500 with just a few hourly candles.

After registering such notable gains in a relatively short period, BTC has retraced slightly and calmed. The asset currently sits at about $11,350.

From a technical perspective, Bitcoin now faces the first resistance at around $11,400 – $11,500. Should the cryptocurrency overcomes it, BTC could head towards $11,800, followed by $12,000.

In case of a price breakdown, Bitcoin could rely on the support lines at $11,200, $11,000, and $10,800.

Despite the price increase, though, the data analytics company Santiment warns that the community could be expecting a retrace soon. The keyword “short” has hit a 2-month high on the social media discourse channels Santiment follows, which has “historically been a great identifier of market polarization.”

Altcoins Slightly Retrace

The past two days were rather impressive for the alternative coins, and the entire crypto market cap gained about $30 billion. The situation has calmed on a 24-hour scale with some red charted among most altcoins.

Ethereum, Ripple, and Bitcoin Cash have retraced by about 1%. ETH trades at $372, XRP – $0.255, and BCH has dipped below $240.

Binance Coin and Chainlink have lost 3% since yesterday to $28 and $10.4, respectively. Polkadot is the most substantial loser from the top 10 after a 4.2% decline. Nevertheless, DOT still trades above $4.

Further losses are evident from lower and mid-cap altcoins. Yearn.Finance has lost 16% of value. UMA (-14%), Celo (-9%), Kusama (-9%), Augur (-6.5%), and Swipe (-6.5%) are next.

It’s worth noting that several coins have doubled-down on their recent gains. Ren has jumped by another 17% to $0.33. Arweave (10%), Storj (7%), Cosmos (7%), and Uniswap (6) follow.