Although BTC has recovered from the two dips beneath ,000, so far over the weekend, the asset struggles with decisively reclaiming the coveted price level and the area between ,000 – ,250. Larger-cap altcoins have also lost some steam, but DeFi tokens have surged in value. Bitcoin Stalls Around K Bitcoin’s impressive performance as of late drove the asset from a low of about ,100 on November 10th to a new yearly high of ,500 last Friday. The community began anticipating further increases, resulting in a new all-time high north of ,000. However, it seems that the primary cryptocurrency has stalled after the most recent gains. Bitcoin lost about 0 if a few hourly candles yesterday and continued dipping to its intraday low of ,750. Nevertheless, the

Topics:

Jordan Lyanchev considers the following as important: AA News, ADABTC, ADAUSD, BCHBTC, bchusd, Bitcoin (BTC) Price, BTCEUR, BTCGBP, btcusd, btcusdt, defi, DOTBTC, DOTUSD, DOTUSDT, ETHBTC, Ethereum (ETH) Price, ethusd, LINKBTC, LINKUSD, LTCBTC, ltcusd, Market Updates, social, UNIBTC, UNIUSD, UNIUSDT

This could be interesting, too:

Bitcoin Schweiz News writes Manuel Stagars: Eine neue Dokumentation über das Crypto Valley in Entwicklung

Bitcoin Schweiz News writes Tokenisierung live erleben: Von der Regulierung zur Praxis am 10. April in Zug

Bitcoin Schweiz News writes Ethereum Foundation fördert DeFiScan: Ein Meilenstein für Transparenz im DeFi-Sektor

Bitcoin Schweiz News writes Are US Gold Reserves Soon to Be Crypto Tokens? The Blockchain Revolution for National Gold

Although BTC has recovered from the two dips beneath $16,000, so far over the weekend, the asset struggles with decisively reclaiming the coveted price level and the area between $16,000 – $16,250. Larger-cap altcoins have also lost some steam, but DeFi tokens have surged in value.

Bitcoin Stalls Around $16K

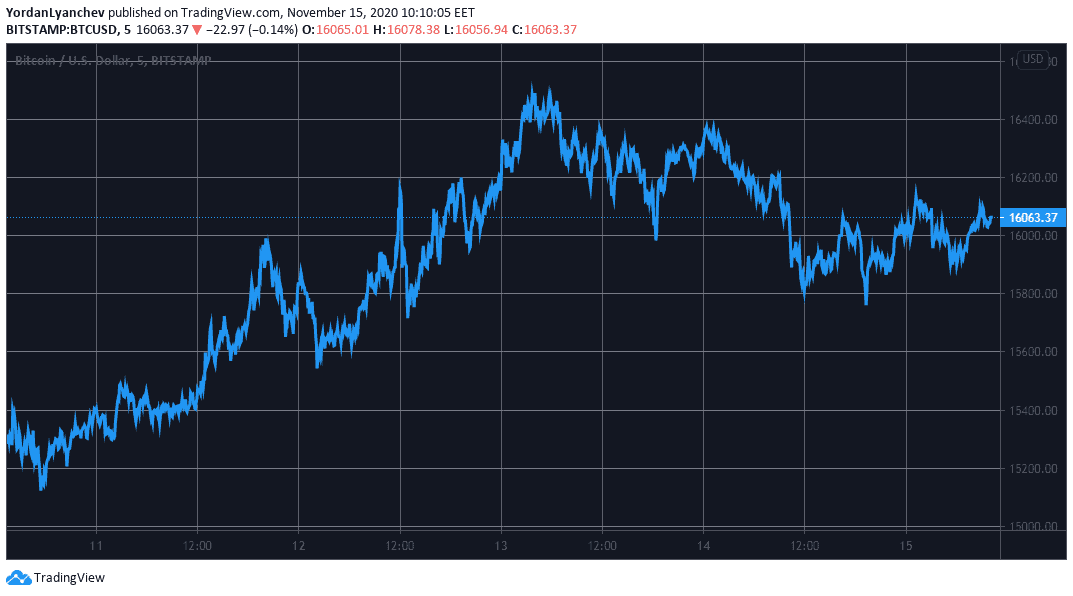

Bitcoin’s impressive performance as of late drove the asset from a low of about $15,100 on November 10th to a new yearly high of $16,500 last Friday. The community began anticipating further increases, resulting in a new all-time high north of $20,000.

However, it seems that the primary cryptocurrency has stalled after the most recent gains. Bitcoin lost about $450 if a few hourly candles yesterday and continued dipping to its intraday low of $15,750.

Nevertheless, the bulls intercepted the price drop and assisted in reconquering the $16,000 mark. As of now, BTC trades just above that level, which is also the first support line.

From a technical point of view, If it drops below it again, Bitcoin could find additional support at $15,600 and $15,450.

Alternatively, BTC must decisively overcome the resistance levels at $16,150 and $16,250 before potentially painting yet another yearly high.

DeFi Tokens Explode

Most alternative coins are slightly in the red. Ethereum has lost about 2% on a 24-hour scale and trades beneath $460 after nearing $480 a few days ago.

Chainlink (-1%), Bitcoin Cash (-2%), Litecoin (-2%), Polkadot (-0.5%), and Cardano (-0.8%) have also decreased slightly.

The situation within the lower, mid-caps, and especially tokens from the decentralized finance field, is substantially different.

SushiSwap is the most impressive gainer since yesterday, with a 28% surge. Moreover, SUSHI has skyrocketed by about 100% over the past seven days and trades at nearly $1.2. UNI, the native token of Uniswap, is also in the deep green after the staking period had finished this week.

THORChain has also increased lately – 21% in a day and 70% in a week. ABBC Coin (20%), Curve DAO Token (16%), Aave (14%), Uniswap (13%), Loopring (10%), and Synthetix (10%) follow.