A new report indicated that East Asia remains the most active cryptocurrency market with the most significant number of daily transactions. At the same time, professional traders still account for most of the trading volume, while stablecoins, and especially Tether (USDT), have gained a massive market share.East Asia Dominates Crypto Trading MarketAccording to the recent report compiled by Chainalysis, “East Asia is the world’s largest cryptocurrency market, accounting for 31% of all cryptocurrency transacted in the past 12 months.” Addresses located in the region have received 7 billion worth of digital assets, which is 77% more than the second-highest receiving region – Western Europe.The paper attributed the majority of the volume to the Bitcoin mining activity. The world’s most

Topics:

Jordan Lyanchev considers the following as important: AA News, BTCEUR, BTCGBP, btcusd, btcusdt, China

This could be interesting, too:

Chayanika Deka writes Yuga Labs Secures Major Win as SEC Closes Investigation Without Charges

Andrew Throuvalas writes Bitcoin Soars Back To ,000 After BlackRock CEO Says “Buy The Dip”

Chayanika Deka writes XRP, SOL, and ADA Inclusion in US Crypto Reserve Pushes Traders on Edge

Chayanika Deka writes Why Arthur Hayes Is Bullish on Bitcoin Under Trump’s Economic Strategy

A new report indicated that East Asia remains the most active cryptocurrency market with the most significant number of daily transactions. At the same time, professional traders still account for most of the trading volume, while stablecoins, and especially Tether (USDT), have gained a massive market share.

East Asia Dominates Crypto Trading Market

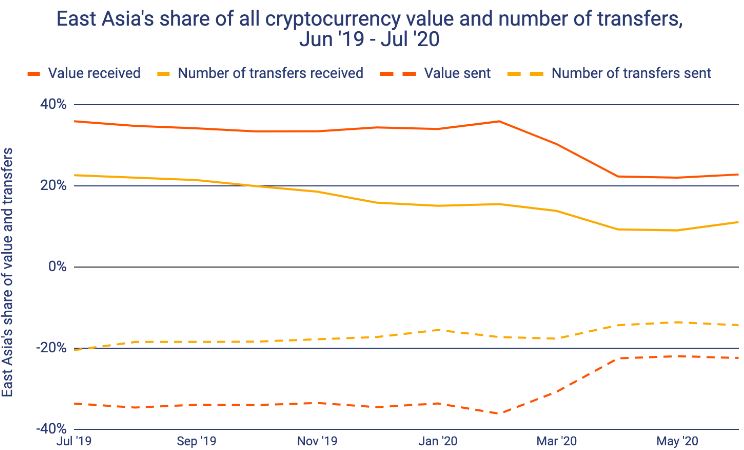

According to the recent report compiled by Chainalysis, “East Asia is the world’s largest cryptocurrency market, accounting for 31% of all cryptocurrency transacted in the past 12 months.” Addresses located in the region have received $107 billion worth of digital assets, which is 77% more than the second-highest receiving region – Western Europe.

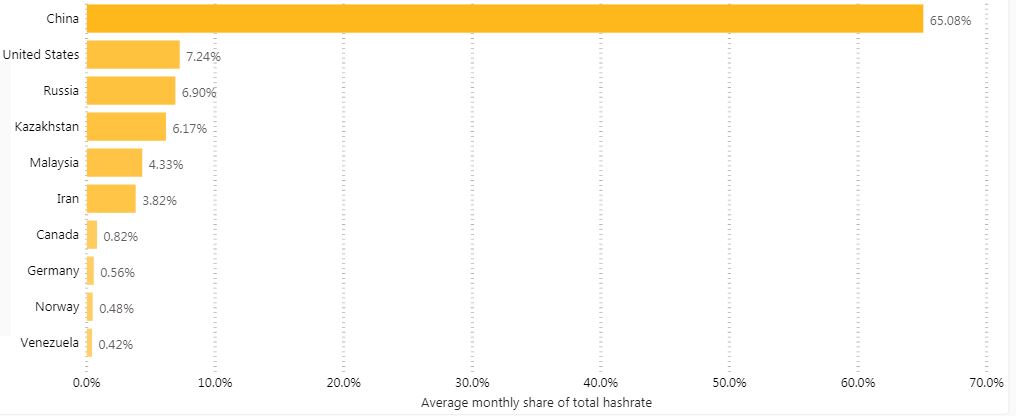

The paper attributed the majority of the volume to the Bitcoin mining activity. The world’s most populated nation China accounts for about 65% of the BTC hashrate. This means that most of the newly-mined bitcoins “start out at Asia-based addresses, giving the market a massive liquidity boost.”

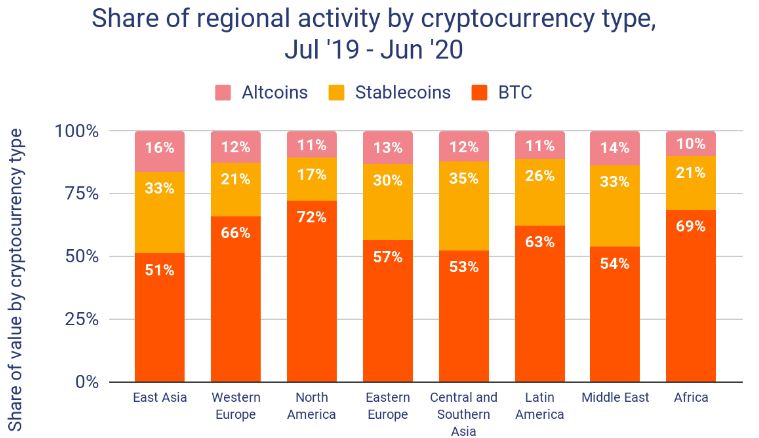

However, stablecoins trading volume has also grown significantly in the past 12 months in the region. Tether, in particular, has enjoyed a massive popularity boost as it represented 93% of all stablecoins’ volume.

Chainanalysis pointed out that USDT’s expanding role comes from the 2017 decision from the Chinese government to ban direct exchanges of yuan for digital assets. As a result, “Tether has become the de facto fiat stand-in for Chinese cryptocurrency users and primary means of on-ramping to Bitcoin and other standard cryptocurrencies.”

East Asia-based users buy USDT “under the table from OTC brokers or through other means such as by using a foreign bank account.” By utilizing the popular stablecoin, traders “can lock in gains without off-ramping into fiat by simply converting other currencies into Tether and leaving the Tether in their wallet or exchange account.”

Professional Traders In Control

The trading volume in East Asia, North America, and Western Europe is driven primarily by professional traders, with roughly 90% of on-chain transfers exceeding $10,000 worth of cryptocurrencies.

However, there’s one main difference between East Asia and North America. While professional traders based in North America focus on Bitcoin and hold the asset for longer, East Asian-based traders “engage in more speculative trading of a wider variety of assets.”

Nevertheless, the retail market in East Asia has also grown in the past year. According to Krishna Sriram, Head of Partnerships at a cryptocurrency security firm, this is because of the expanding electronic payment options.

“Services like AliPay in China and Line in South Korea were already quite popular by the time cryptocurrencies began to gain steam, so the idea of electronic money wasn’t as big of a leap. Japan also saw strong early adoption, as many Japanese corporations saw the value of cryptocurrencies and set up mining operations. Japanese regulators set out clear rules early, which helped exchanges grow there quickly.”