The cryptocurrency index and beta fund provider, BitWise, recently published a report regarding how financial advisors look at digital assets. Partnering with numerous information sources on the matter, the company concludes that cryptocurrencies are becoming more attractive to advisors and their clients.Increased Interest For CryptocurrenciesBitWise and ETF Trends conducted the report by questioning 415 U.S.-based financial advisors. The paper seeks to understand how they and their clients look at cryptocurrencies as potential inclusions in their portfolios.76% of all financial advisors responded that they had received questions from clients about cryptocurrencies during 2019. In other words, interest is there.Additionally, 35% believe that some or all of their customers are investing in

Topics:

Jordan Lyanchev considers the following as important: AA News, Editorials

This could be interesting, too:

Chayanika Deka writes Yuga Labs Secures Major Win as SEC Closes Investigation Without Charges

Andrew Throuvalas writes Bitcoin Soars Back To ,000 After BlackRock CEO Says “Buy The Dip”

Chayanika Deka writes XRP, SOL, and ADA Inclusion in US Crypto Reserve Pushes Traders on Edge

Chayanika Deka writes Why Arthur Hayes Is Bullish on Bitcoin Under Trump’s Economic Strategy

The cryptocurrency index and beta fund provider, BitWise, recently published a report regarding how financial advisors look at digital assets. Partnering with numerous information sources on the matter, the company concludes that cryptocurrencies are becoming more attractive to advisors and their clients.

Increased Interest For Cryptocurrencies

BitWise and ETF Trends conducted the report by questioning 415 U.S.-based financial advisors. The paper seeks to understand how they and their clients look at cryptocurrencies as potential inclusions in their portfolios.

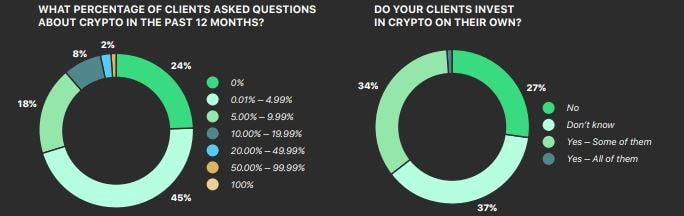

76% of all financial advisors responded that they had received questions from clients about cryptocurrencies during 2019. In other words, interest is there.

Additionally, 35% believe that some or all of their customers are investing in digital assets outside of their advisory relationship. Another 37% said that they are not certain. The remaining 27% of advisors are confident that their clients are not currently investing in any cryptocurrencies.

Despite the increased interest, only 6% of all financial advisors have allocated digital assets in their clients’ portfolios. The main reasons for this include regulatory concerns and high volatility.

However, 42% of the financial advisors already purchasing cryptocurrencies intend to increase the digital asset holdings in the next 12 months. 58% prefer to stick with the current position, and none of the advisors consider decreasing or eliminating the cryptocurrency investment.

Motivation For Choosing Cryptocurrencies

For the second straight year, the financial advisors noted the same most attractive reason for investing in digital assets. According to 54% of them, the lack of correlation between cryptocurrencies and the traditional financial markets is the most significant reason.

Indeed, the largest digital asset has demonstrated, on several occasions, its negative correlation with the traditional markets. For instance, during the most heated days of the trade war between China and the U.S., stocks were decreasing, while Bitcoin was surging.

Something rather similar happened a few weeks ago when the markets dropped again during the coronavirus outbreak and the tension between the U.S. and Iran.

Another reason for investing in cryptocurrencies is the potential for high returns. Moreover, 63% of the advisors believe that the price of Bitcoin will rise in the next five years, up from 55% last year. Contrary, 37% said that BTC will drop, and 8% of them even believe that the largest digital asset will have a value of $0 in five years.