Binance’s monthly trading report for August was just released. Data from the report points to striking growth trends in the world’s largest cryptocurrency exchange.However, the key takeaway that stood out was open interest touching the billion mark for the first time since the launch of Binance’s crypto futures trading platform.Crypto Futures Open Interest Tops Billion On BinanceAs per the August trading report, Binance’s crypto futures platform recorded an all-time high open-interest figure of billion last month.The crypto exchange behemoth noted that the stratospheric rise in open interest coincided with Bitcoin’s price rise to ,000 during the beginning of August. Also, when BTC attempted to break past the ,400 mark, which is the current 2020 high, futures open interest

Topics:

Himadri Saha considers the following as important: AA News, Binance Futures, bitcoin futures, BNBBTC, bnbusd, BTCEUR, BTCGBP, btcusd, btcusdt

This could be interesting, too:

Chayanika Deka writes Yuga Labs Secures Major Win as SEC Closes Investigation Without Charges

Andrew Throuvalas writes Bitcoin Soars Back To ,000 After BlackRock CEO Says “Buy The Dip”

Chayanika Deka writes XRP, SOL, and ADA Inclusion in US Crypto Reserve Pushes Traders on Edge

Chayanika Deka writes Why Arthur Hayes Is Bullish on Bitcoin Under Trump’s Economic Strategy

Binance’s monthly trading report for August was just released. Data from the report points to striking growth trends in the world’s largest cryptocurrency exchange.

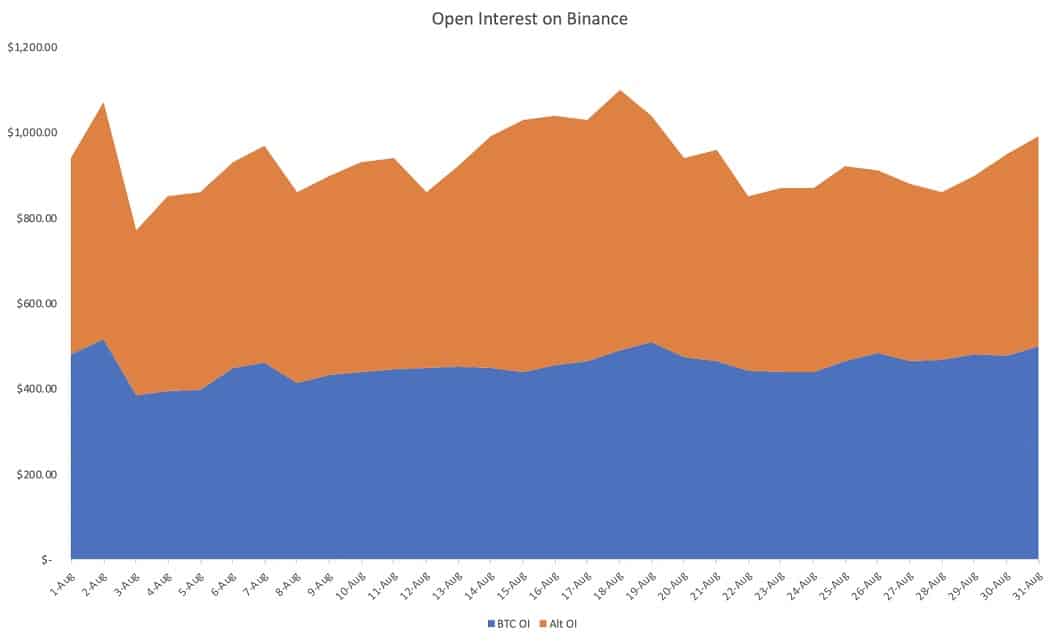

However, the key takeaway that stood out was open interest touching the $1 billion mark for the first time since the launch of Binance’s crypto futures trading platform.

Crypto Futures Open Interest Tops $1 Billion On Binance

As per the August trading report, Binance’s crypto futures platform recorded an all-time high open-interest figure of $1 billion last month.

The crypto exchange behemoth noted that the stratospheric rise in open interest coincided with Bitcoin’s price rise to $12,000 during the beginning of August. Also, when BTC attempted to break past the $12,400 mark, which is the current 2020 high, futures open interest hit $1 billion again.

As CryptoPotato explained, open interest in futures trading denotes the number of active contracts held by traders and investors. This amounts to open positions that have not been settled or closed out.

This implies that traders were looking to register their bets on the future prices of Bitcoin and other cryptocurrencies as much as possible in hopes of cashing in on the ongoing rally.

Since then, open interest has stabilized, Binance mentioned. But according to the platform:

average daily open interest in August has grown to $950 million, a 35% increase vs. $700 million in July

Altcoins Pushed Explosive Futures Volume Growth on Binance

Another takeaway from August, as per the report, was the growth in futures trading volume. As per the numbers, Binance observed a 79 percent month-on-month volume growth to $195 billion, with the daily average volume clocking $6.3 billion.

According to Binance, altcoins – especially DeFi coins – contributed to this significant rise in futures trading volumes. As the report mentioned:

A significant portion of the volume growth is attributed to Altcoin contracts as traders shift their attention towards Altcoins, in particular, DeFi-related cryptocurrencies…. The Altcoin volume dominance grew from 38% to 68% towards the month-end, averaging at 53% in August. In comparison, the average percentage of Altcoin volume in July was 45%.

August 14 was the day when Binance recorded the highest volume in altcoin futures, with over $5.8 billion worth of contracts traded that day. Daily volume across altcoin futures averaged at $3.4 billion.

Also, the report pointed out that in the month of August, Binance’s overall share in the altcoin futures sphere catapulted to as high as 41 percent. And why?

Increased interest in contracts such as DOT, OMG, WAVES, and LEND…

The same evened out in the 35 – 40 percent range towards the end of the month.

With regards to Bitcoin futures, Binance noted a stable open interest trend despite a general lack of trading activity. The exchange feels that traders/investors are entering long positions wrt BTC as open interest gradually grew towards the month-end.