Ethereum fell by a steep 6.7% over the past 24 hours as it drops toward 0.The cryptocurrency was struggling at the 0 level over the first two weeks of June but has remained supported at 5 thus far.Against Bitcoin, Ethereum struggles at the 0.025 BTC level.Key Support & Resistance LevelsETH/USD:Support: 5, 5, 5.Resistance: 0, 5, 4.ETH/BTC:Support: 0.0245 BTC, 0.0243 BTC, 0.0239 BTC.Resistance: 0.0253 BTC, 0.026 BTC, 0.0265 BTC.ETH/USD: Ethereum Losing Battle At 0.Ethereum fell 6.7% today as it dropped toward 0 from the 0 level. The coin has struggled to break above 0 for the entire period of June 2020 but has remained supported at 5 and rebounded from there today.It broke past prior resistance at 5 at the end of May as it surged toward 0 but

Topics:

Yaz Sheikh considers the following as important: ETH Analysis, ETHBTC, Ethereum (ETH) Price, ethusd

This could be interesting, too:

Mandy Williams writes Ethereum Derivatives Metrics Signal Modest Downside Tail Risk Ahead: Nansen

Jordan Lyanchev writes Weekly Bitcoin, Ethereum ETF Recap: Light at the End of the Tunnel for BTC

CryptoVizArt writes Will Weak Momentum Drive ETH to .5K? (Ethereum Price Analysis)

Jordan Lyanchev writes Bybit Hack Fallout: Arthur Hayes, Samson Mow Push for Ethereum Rollback

- Ethereum fell by a steep 6.7% over the past 24 hours as it drops toward $230.

- The cryptocurrency was struggling at the $250 level over the first two weeks of June but has remained supported at $225 thus far.

- Against Bitcoin, Ethereum struggles at the 0.025 BTC level.

Key Support & Resistance Levels

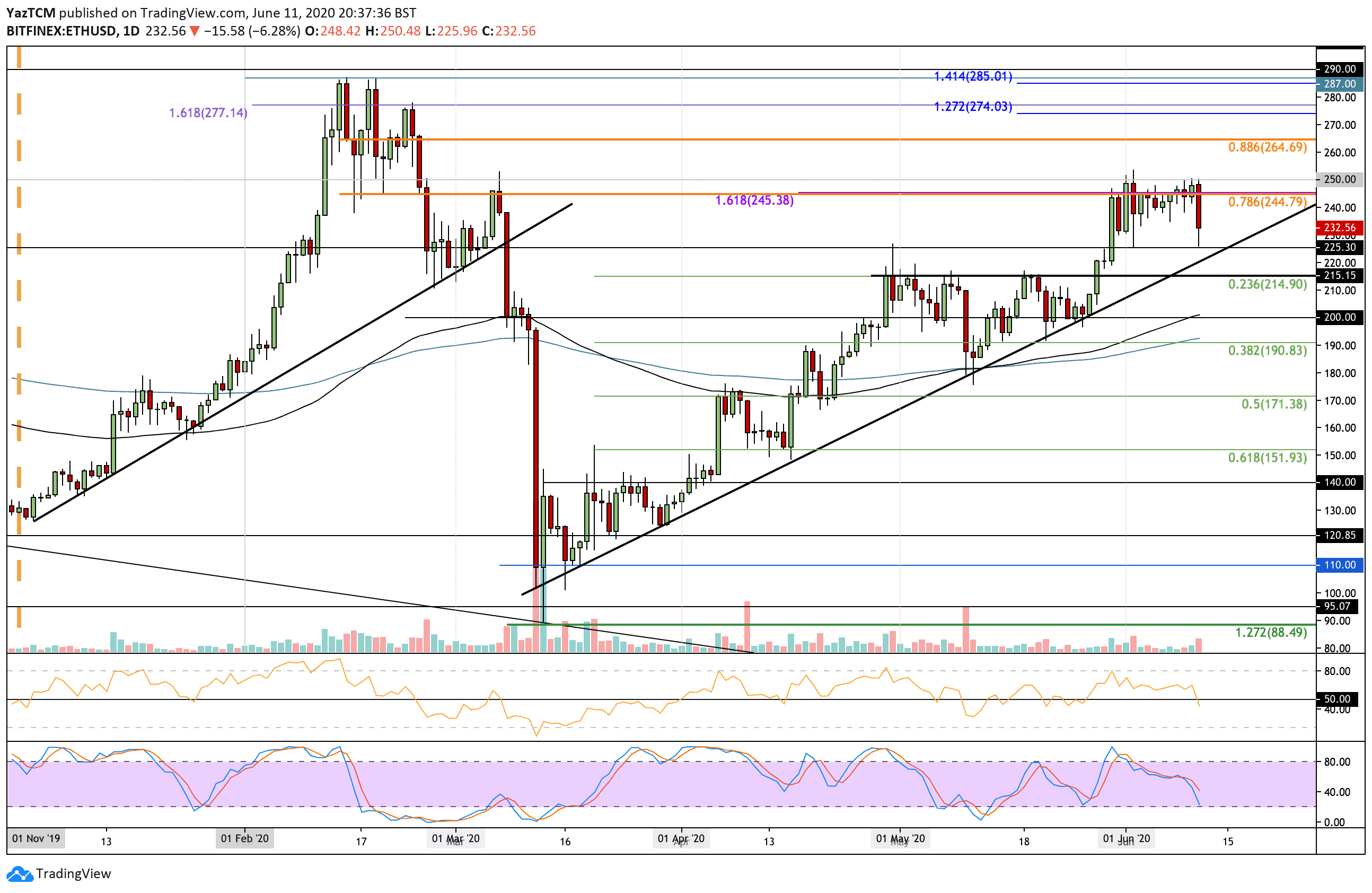

ETH/USD:

Support: $235, $225, $215.

Resistance: $250, $265, $274.

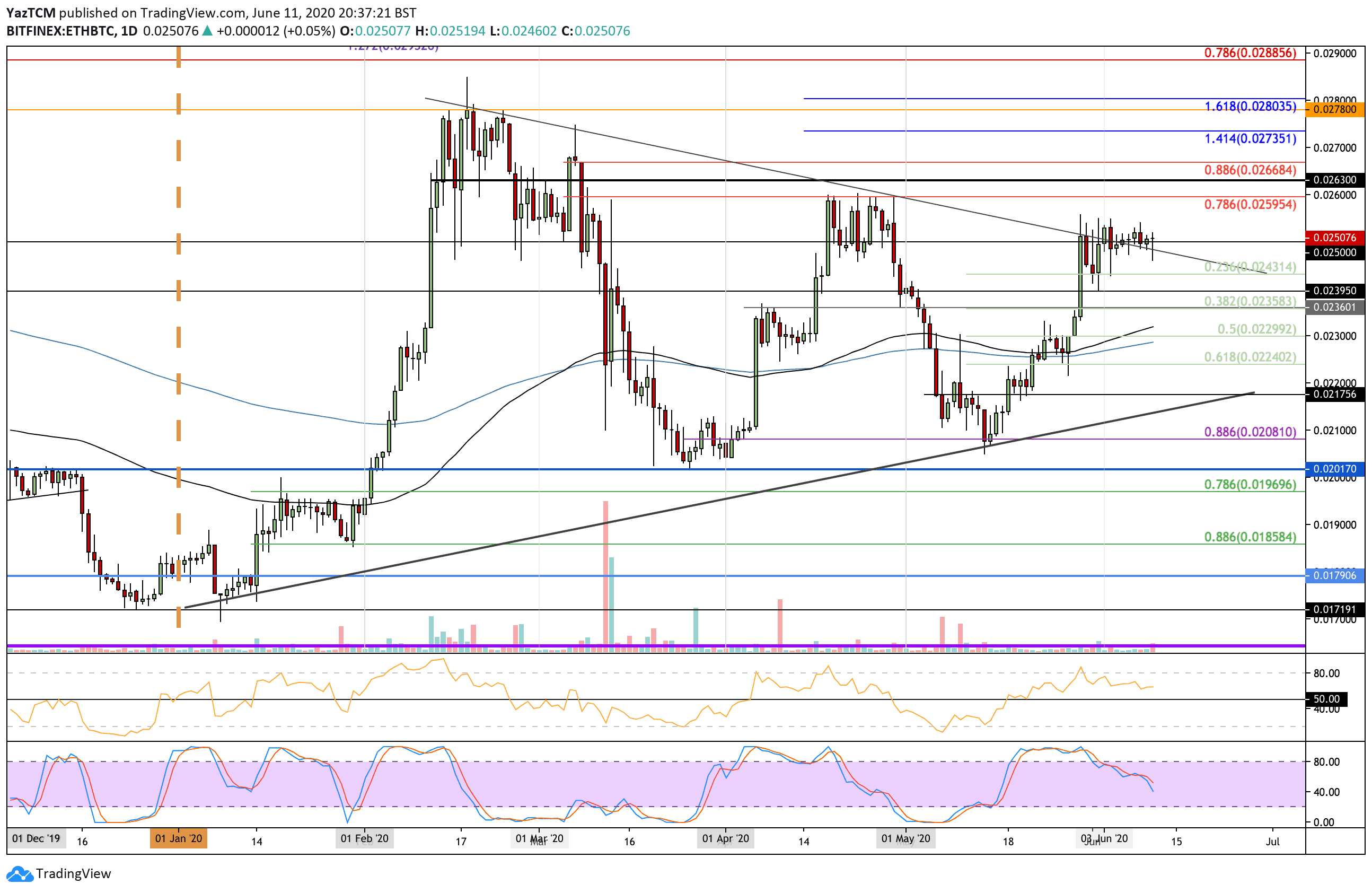

ETH/BTC:

Support: 0.0245 BTC, 0.0243 BTC, 0.0239 BTC.

Resistance: 0.0253 BTC, 0.026 BTC, 0.0265 BTC.

ETH/USD: Ethereum Losing Battle At $250.

Ethereum fell 6.7% today as it dropped toward $230 from the $250 level. The coin has struggled to break above $250 for the entire period of June 2020 but has remained supported at $225 and rebounded from there today.

It broke past prior resistance at $215 at the end of May as it surged toward $250 but has been unable to close above there ever since. A break of $250 should set the stage for ETH to be catapulted toward $300.

ETH-USD Short Term Price Prediction

Looking ahead, if the sellers push lower again, the first level of support lies at $225. Beneath this, added support is located at $215 and $200 (100-day EMA).

On the other side, if the buyers push higher and break $250, resistance can then be found at $265 (bearish .886 Fib Retracement), $274, and $285.

The RSI dropped beneath the 50 line today to indicate that the sellers are taking full control of the market momentum. If the RSI continues to dip further, ETH could be expected to head back toward $200 over the coming days.

ETH/BTC: ETH Falls Back Beneath 0.025 BTC.

Against Bitcoin, Ethereum failed to break above the 0.0253 BTC resistance. It fell lower over the past three days as it broke beneath 0.025 BTC but has since rebounded to trade here once again.

For Ethereum to continue its bullish run against BTC, it would need to break the resistance at 0.0253 BTC and head above the April highs at 0.026 BTC.

ETH-BTC Short Term Price Prediction

If the sellers continue to push ETH further lower, the first levels of support lie at 0.025 BTC and 0.0245 BTC. Beneath this, support is expected at 0.0243 BTC (.236 Fib Retracement), 0.0239 BTC, and 0.0235 BTC (.382 Fib Retracement).

On the other side, if the buyers can break 0.0253 BTC, resistance can be found at 0.026 BTC (bearish .786 Fib Retracement), 0.0263 BTC, and 0.0266 BTC (bearish .886 Fib Retracement).

The RSI is also falling, which indicates increasing selling momentum.