Ethereum increase by a total of 4% over the past 24 hours as it reaches 9. ETH has managed to surge by a total of 13% this week – making it the highest performing top 5 cryptocurrency. Against Bitcoin, Ethereum rebounded at 0.025 BTC as it heads back toward the April 2020 highs. Key Support & Resistance Levels ETH/USD:Support: 0, 5, 7.Resistance: 7, 8, 4.ETH/BTC:Support: 0.025 BTC, 0.0247 BTC, 0.024 BTC.Resistance: 0.026 BTC, 0.0263 BTC, 0.027 BTC. ETH/USD: Ethereum Rebounds From 0 Ethereum dropped from the resistance at 8 over the past few days, but it managed to rebound at the 0 level yesterday. It now trades around the 200-days MA mark at 8, providing resistance. If ETH can break the next resistance at 8 soon, it should be clear to make a run at the

Topics:

Yaz Sheikh considers the following as important: ETH Analysis, ETHBTC, Ethereum (ETH) Price, ethusd

This could be interesting, too:

Mandy Williams writes Ethereum Derivatives Metrics Signal Modest Downside Tail Risk Ahead: Nansen

Jordan Lyanchev writes Weekly Bitcoin, Ethereum ETF Recap: Light at the End of the Tunnel for BTC

CryptoVizArt writes Will Weak Momentum Drive ETH to .5K? (Ethereum Price Analysis)

Jordan Lyanchev writes Bybit Hack Fallout: Arthur Hayes, Samson Mow Push for Ethereum Rollback

- Ethereum increase by a total of 4% over the past 24 hours as it reaches $179.

- ETH has managed to surge by a total of 13% this week – making it the highest performing top 5 cryptocurrency.

- Against Bitcoin, Ethereum rebounded at 0.025 BTC as it heads back toward the April 2020 highs.

Key Support & Resistance Levels

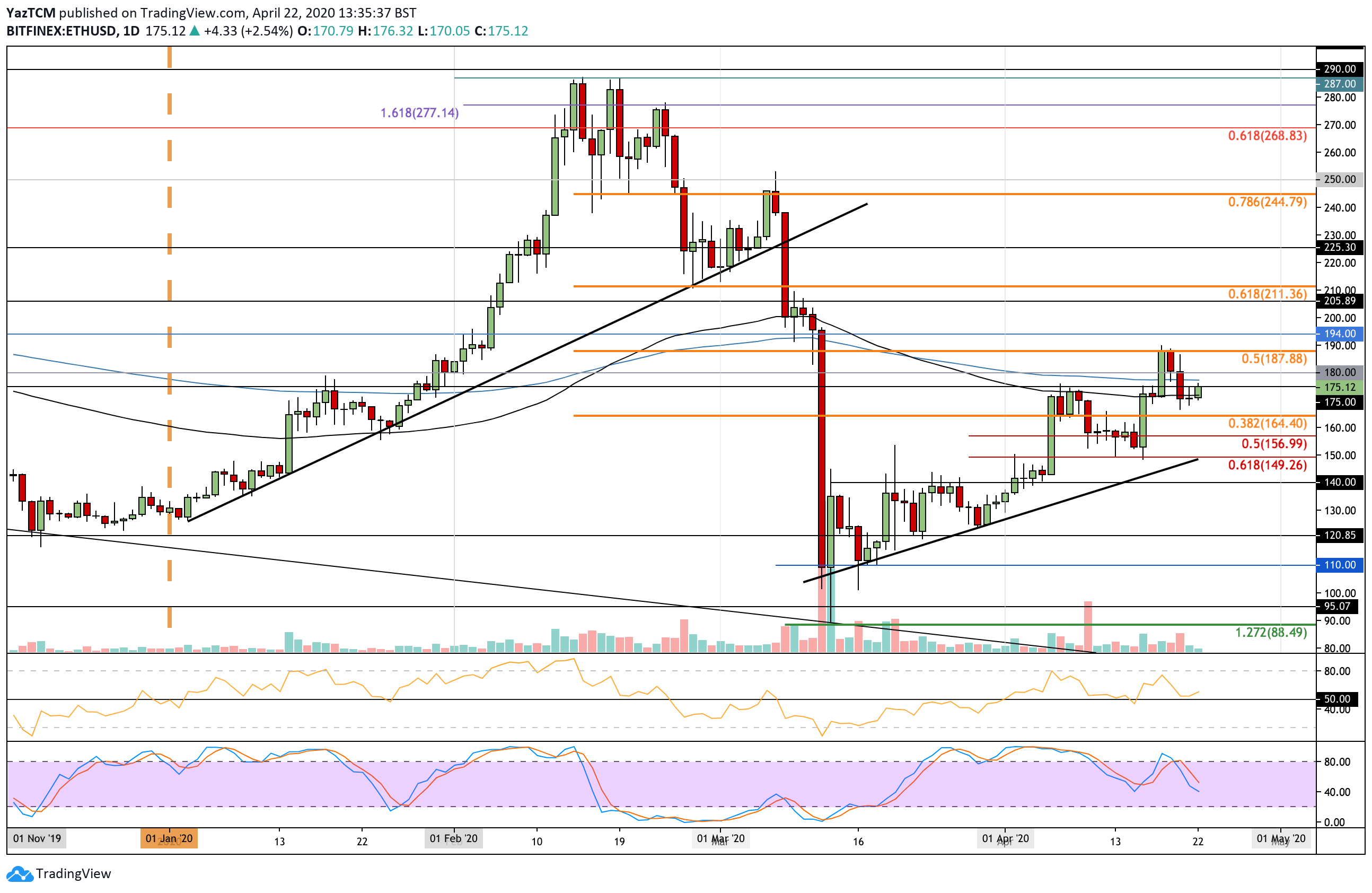

ETH/USD:

Support: $170, $165, $157.

Resistance: $177, $188, $194.

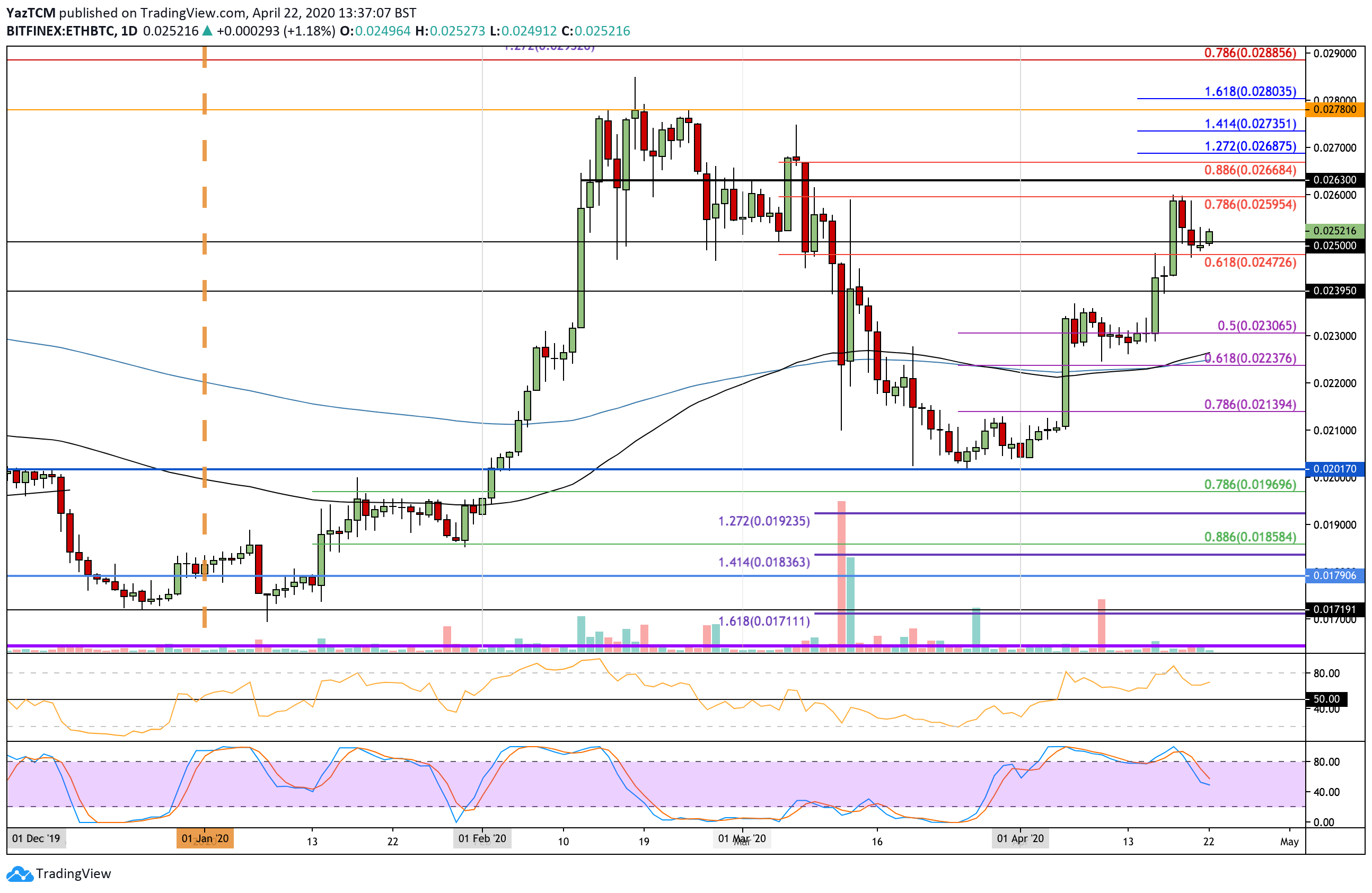

ETH/BTC:

Support: 0.025 BTC, 0.0247 BTC, 0.024 BTC.

Resistance: 0.026 BTC, 0.0263 BTC, 0.027 BTC.

ETH/USD: Ethereum Rebounds From $170

Ethereum dropped from the resistance at $188 over the past few days, but it managed to rebound at the $170 level yesterday. It now trades around the 200-days MA mark at $178, providing resistance.

If ETH can break the next resistance at $188 soon, it should be clear to make a run at the $200 level by the end of the week.

ETH/USD Short Term Price Prediction

Above the current 200 MA level, resistance lies at $188 (bearish .5 Fib Retracement), $194, and $200. Beyond $200, resistance is located at $206 and $211 (bearish .618 Fib Retracement).

Alternatively, if the sellers push lower, support is located at $170. Beneath this, support lies at $165, $157 (.5 Fib Retracement), and $150 (.618 Fib Retracement).

The RSI rebounded from 50 to indicate that the bulls are still in control of the market momentum. If it continues to rise, ETH can be expected to break $188 over the coming days.

ETH/BTC: ETH Finds Support at 0.025 BTC.

Against Bitcoin, Ethereum dropped lower from the resistance at 0.026 BTC but managed to find strong support at 0.025 BTC yesterday.

It has now pushed higher as it trades at 0.0252 BTC and is looking to re-test the resistance at 0.026 BTC.

ETH/BTC Short Term Price Prediction

If the bulls push higher, the first level of resistance lies at 0.026 BTC (bearish .786 Fib Retracement). Above this, resistance lies at 0.0263 BTC, 0.0266 (bearish .866 Fib Retracement), and 0.0268 BTC (1.272 Fib Extension).

Alternatively, the first level of support lies at 0.025 BTC. Beneath this, support is located at 0.0247 BTC, 0.0239 BTC, and 0.023 BTC.

The RSI remains well above the 50 line as the bulls dominate the market momentum. It still has room to push higher before becoming overbought, which indicates that ETH can head higher.