Ethereum witnessed a 7% price increase today as the cryptocurrency reaches the 2. Three days ago, Ethereum surged over 15% from the 0 level to reach the April resistance at 5. Against Bitcoin, Ethereum is performing very well after creating a fresh April high at 0.0247 BTC. Key Support & Resistance Levels ETH/USD:Support: 5, 5, 0.Resistance: 7, 4, 0.ETH/BTC:Support: 0.0239 BTC, 0.0229 BTC, 0.0224 BTC.Resistance: 0.0247 BTC, 0.025 BTC, 0.0259 BTC. ETH/USD – Ethereum Breaches Strong 5 Resistance This week, Ethereum was trending lower until it managed to find support at 0, provided by a short term .5 Fib Retracement. The cryptocurrency rebounded from here to reach the April 2020 resistance at 5 and surpass it. If ETH can keep it up, 0 seems the next

Topics:

Yaz Sheikh considers the following as important: ETH Analysis, ETHBTC, Ethereum (ETH) Price, ethusd

This could be interesting, too:

Mandy Williams writes Ethereum Derivatives Metrics Signal Modest Downside Tail Risk Ahead: Nansen

Jordan Lyanchev writes Weekly Bitcoin, Ethereum ETF Recap: Light at the End of the Tunnel for BTC

CryptoVizArt writes Will Weak Momentum Drive ETH to .5K? (Ethereum Price Analysis)

Jordan Lyanchev writes Bybit Hack Fallout: Arthur Hayes, Samson Mow Push for Ethereum Rollback

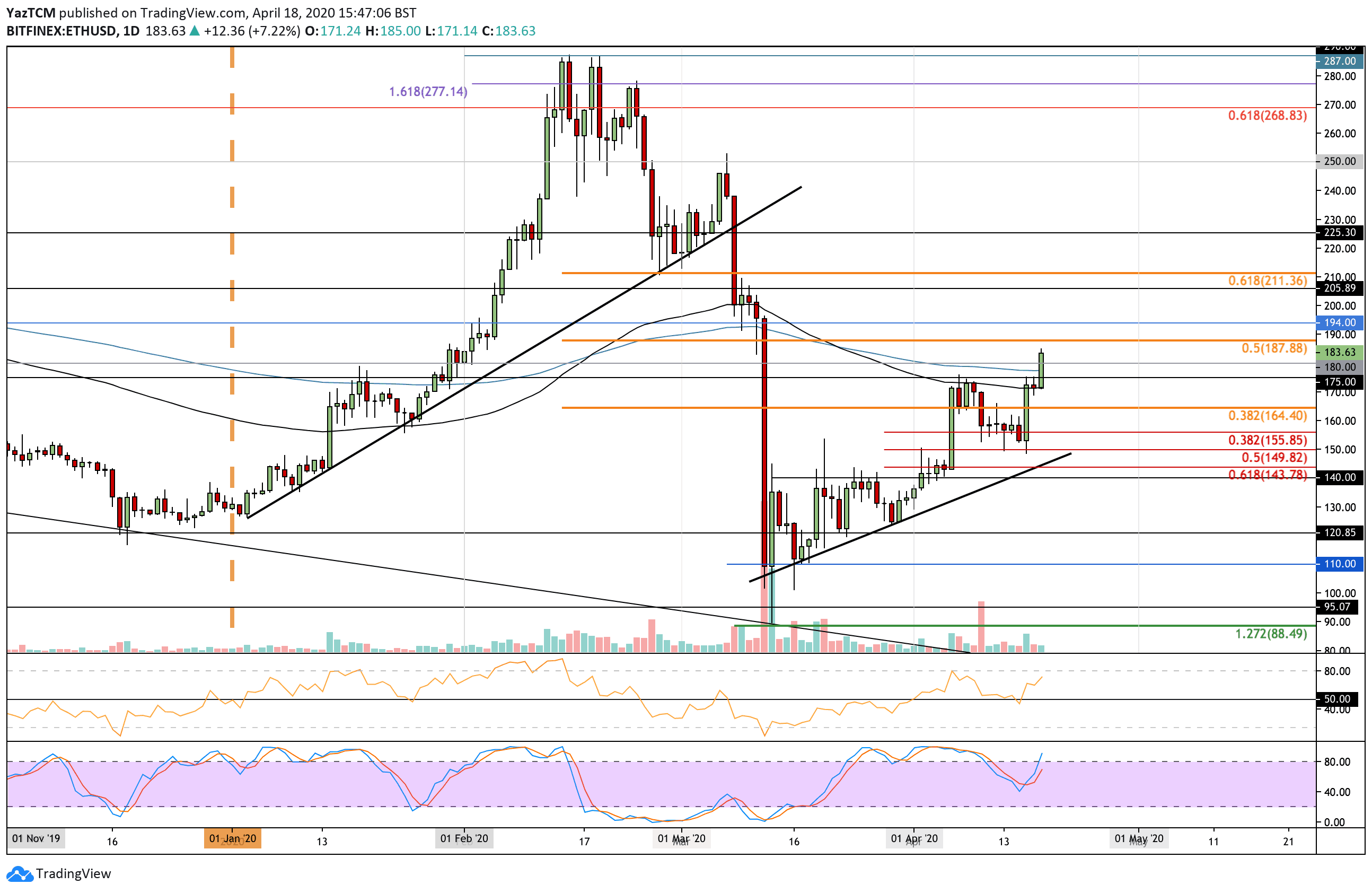

- Ethereum witnessed a 7% price increase today as the cryptocurrency reaches the $182.

- Three days ago, Ethereum surged over 15% from the $150 level to reach the April resistance at $175.

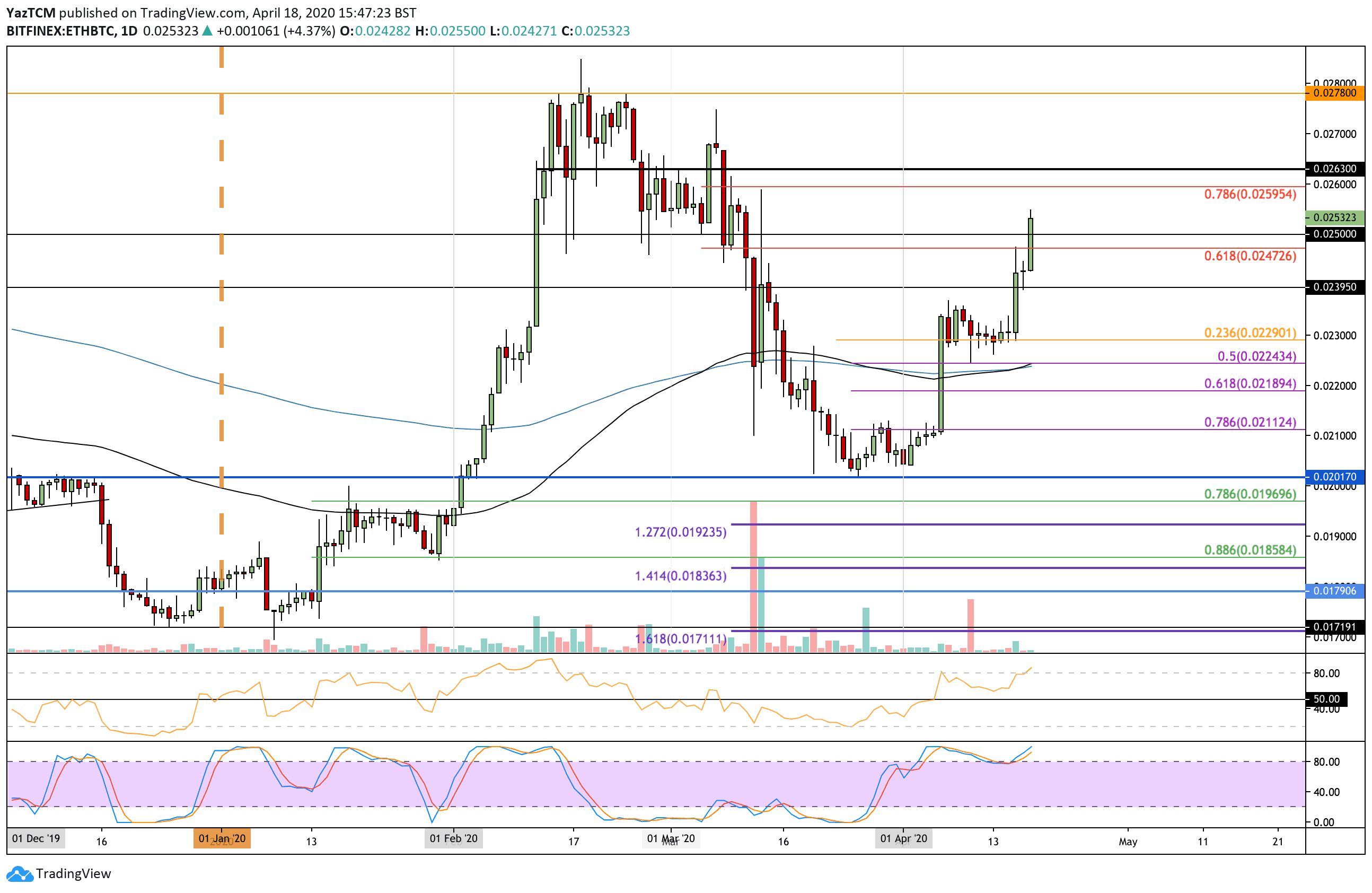

- Against Bitcoin, Ethereum is performing very well after creating a fresh April high at 0.0247 BTC.

Key Support & Resistance Levels

ETH/USD:

Support: $165, $155, $150.

Resistance: $187, $194, $200.

ETH/BTC:

Support: 0.0239 BTC, 0.0229 BTC, 0.0224 BTC.

Resistance: 0.0247 BTC, 0.025 BTC, 0.0259 BTC.

ETH/USD – Ethereum Breaches Strong $175 Resistance

This week, Ethereum was trending lower until it managed to find support at $150, provided by a short term .5 Fib Retracement. The cryptocurrency rebounded from here to reach the April 2020 resistance at $175 and surpass it.

If ETH can keep it up, $200 seems the next likely target.

ETH-USD Short Term Price Prediction

Above the current price, resistance is expected at $187 (bearish .5 Fib Retracement), $194, and $200. Beyond $200, added resistance lies at $205 and $211 (bearish .618 Fib Retracement).

Alternatively, if the sellers push lower, the first level of support lies at $165. Beneath this, support is located at $155 (short term .382 Fib Retracement) and $150 (.5 Fib Retracement).

The RSI is now back above the 50 level after rebounding from it earlier this week. This indicates that the bulls control the market momentum.

ETH/BTC: ETH Creating Fresh April Highs Against Bitcoin

Against Bitcoin, Ethereum found strong support at the .236 Fib Retracement at 0.0229 BTC. It held this level for over 7-days of trading before rebounding from here three days ago.

After rebounding, ETH climbed higher to reach the resistance at 0.0247 BTC, provided by a bearish .618 Fib Retracement. It dropped slightly to the current trading level at 0.0243 BTC but has now reached 0.025 BTC.

ETH/BTC Short Term Price Prediction

Above this, resistance is located at 0.0259 (bearish .786 Fib Retracement), 0.0263 BTC, and 0.027 BTC.

Alternatively, if the sellers push lower, the first level of support lies at 0.0239 BTC. Beneath this, support is located at 0.0229 BTC, 0.0224 BTC (200-days EMA), and 0.0218 BTC.

The RSI is also in overbought conditions as the bulls dominate the market momentum. It might pull back slightly from here, but so long as it remains above the 50 level on the retracement the bulls will remain in charge.