XRP has seen a 13% price surge this week as it reaches resistance at %excerpt%.234.Against BTC, XRP continues to trade sideways as it straddles the 2600 SAT level.Once XRP manages to overcome %excerpt%.2345, the coin might surge back toward %excerpt%.30.Key Support & Resistance LevelsXRP/USDSupport: %excerpt%.22, %excerpt%.20, %excerpt%.185 Resistance: %excerpt%.2345, %excerpt%.25, %excerpt%.262.XRP/BTC:Support: 2600 SAT, 2350 SAT, 2455 SAT.Resistance: 2710 SAT, 2800 SAT, 2900 SAT.XRP/USD: XRP Reaches 100-Days EMA But Struggles To PassSince our last analysis, XRP managed to continue to surge higher. However, it met the expected resistance at %excerpt%.2345 and was unable to overcome here. This area of resistance is further bolstered by the 100-days EMA. XRP continues to remain supported by %excerpt%.228 as the bulls attempt to regroup to break the 100-days

Topics:

Yaz Sheikh considers the following as important: Ripple (XRP) Price, XRP Analysis

This could be interesting, too:

Jordan Lyanchev writes Ripple’s (XRP) Surge to Triggers Over Million in Short Liquidations

Jordan Lyanchev writes Trump Confirms Work on Strategic Crypto Reserve: XRP, ADA, SOL Included

Mandy Williams writes Ripple Releases Institutional DeFi Roadmap for XRP Ledger in 2025

Jordan Lyanchev writes ChatGPT and DeepSeek Analyze Ripple’s (XRP) Price Potential for 2025

- XRP has seen a 13% price surge this week as it reaches resistance at $0.234.

- Against BTC, XRP continues to trade sideways as it straddles the 2600 SAT level.

- Once XRP manages to overcome $0.2345, the coin might surge back toward $0.30.

Key Support & Resistance Levels

XRP/USD

Support: $0.22, $0.20, $0.185

Resistance: $0.2345, $0.25, $0.262.

XRP/BTC:

Support: 2600 SAT, 2350 SAT, 2455 SAT.

Resistance: 2710 SAT, 2800 SAT, 2900 SAT.

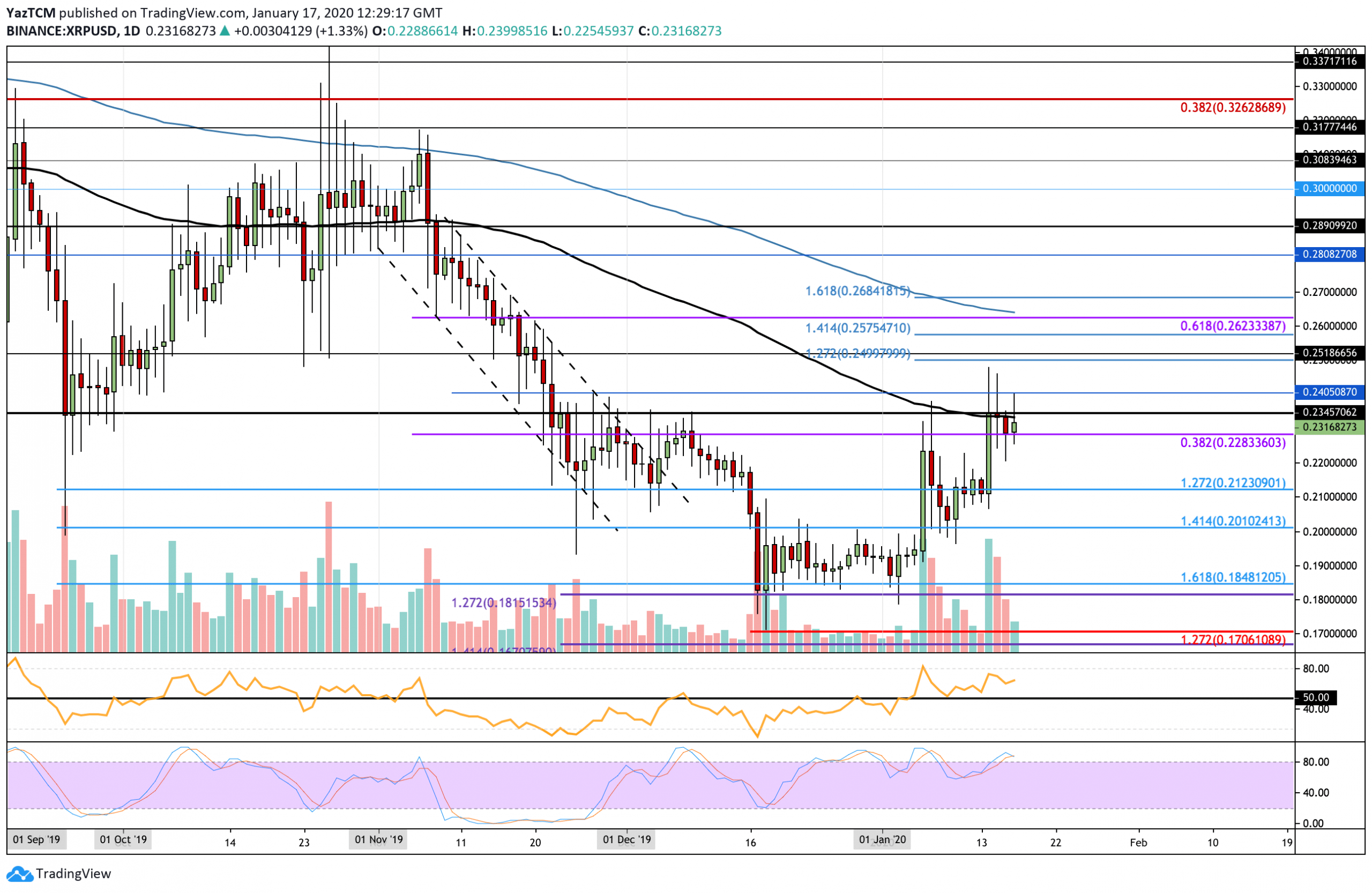

XRP/USD: XRP Reaches 100-Days EMA But Struggles To Pass

Since our last analysis, XRP managed to continue to surge higher. However, it met the expected resistance at $0.2345 and was unable to overcome here. This area of resistance is further bolstered by the 100-days EMA. XRP continues to remain supported by $0.228 as the bulls attempt to regroup to break the 100-days EMA.

XRP is on the cusp of turning bullish if it can pass above the resistance at $0.2345. For XRP to turn neutral, it must drop beneath $0.22, with a further drop beneath $0.185 turning it bearish.

XRP Short Term Price Prediction

If the bulls continue to pressure the market higher and break above the resistance at the 100-days EMA, immediate higher resistance lies at $0.24. Above this, resistance is to be expected at $0.25, $257 (1.414 FIb Extension), and $0.262 (bearish .618 Fib Retracement). The resistance at $0.262 is bolstered by the 200-days EMA. On the other hand, if the sellers push XRP beneath $0.228, initial support toward the downside sits at $0.22. Beneath this, support lies at $0.212, $0.20, and $0.185,

The RSI remains above the 50 level which shows that the bulls remain in control over the market momentum. However, the Stochastic RSI is preparing for a bearish crossover signal which might help to send the market lower.

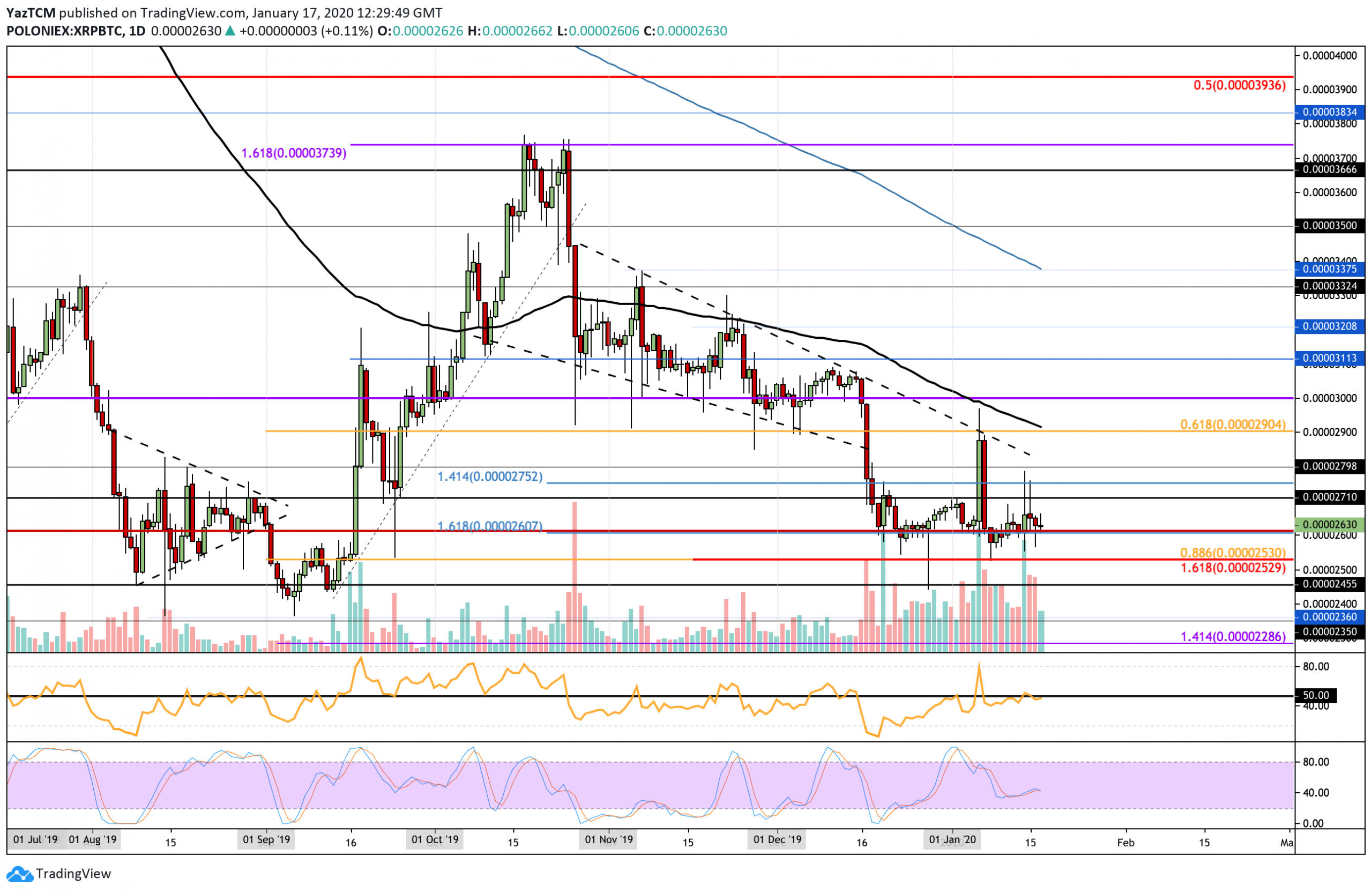

XRP/BTC – XRP Claws Its Way Back Above 2600 SAT as Market Moves Sidewaysxrobtc-

Against BTC, XRP managed to bring itself back above the support at 2600 SAT. The cryptocurrency did also spike higher into 2780 SAT but quickly reversed and fell well beneath 2700 SAT again. It continues to trade sideways between 2600 SAT and 2700 SAT as we wait for the market to decide where to head toward next.

XRP still remains neutral at this moment in time and must pass above the resistance at 3000 SAT before it can turn bullish. Alternatively, if XRP drops beneath the support at 2350 SAT it would turn bearish.

XRP Short Term Price Prediction

If the bears push the market beneath 2600 SAT, immediate support is located at 2350 SAT which is provided by the .886 Fibonacci Retracement level. Beneath this, support lies at 2455 SAT, 2400 SAT and, 2360 SAT. On the other hand, if the bulls regroup and push higher, resistance is located at 2710 SAT, 2800 SAT, 2900 SAT, and 3000 SAT.

The RSI continues to trade along the 50 level as the indecision within the market continues. For a bullish break higher, we must see the RSI rising above 50 to confirm that the bulls have taken charge of the market momentum.