Bitcoin suffered a 3% price drop on Wednesday, coinciding with the largest flow of BTC from miners to exchanges in over a year.BTC Flows From Miners to ExchangesThat’s according to data from blockchain analysts at Glassnode, which showed a huge transfer of 2,650 BTC going from Bitcoin miners to the Bitfinex exchange on Tuesday. Seen below, that equates to the largest transfer of BTC from miners to exchanges since March 26, 2019.The last time such a large volume of BTC moved from miners to exchanges was over a year ago. Source: GlassnodeBased on Tuesday’s price point, the 2,650 BTC inflow amounted to just under million in dollar terms. Shortly afterward, Bitcoin underwent a short, sharp drop from ,764 down to ,381, which occurred in five hours early on Wednesday morning.The Bitcoin

Topics:

Greg Thomson considers the following as important: AA News, Bitcoin (BTC) Price, btcusd, btcusdt

This could be interesting, too:

Chayanika Deka writes Yuga Labs Secures Major Win as SEC Closes Investigation Without Charges

Andrew Throuvalas writes Bitcoin Soars Back To ,000 After BlackRock CEO Says “Buy The Dip”

Chayanika Deka writes XRP, SOL, and ADA Inclusion in US Crypto Reserve Pushes Traders on Edge

Chayanika Deka writes Why Arthur Hayes Is Bullish on Bitcoin Under Trump’s Economic Strategy

Bitcoin suffered a 3% price drop on Wednesday, coinciding with the largest flow of BTC from miners to exchanges in over a year.

BTC Flows From Miners to Exchanges

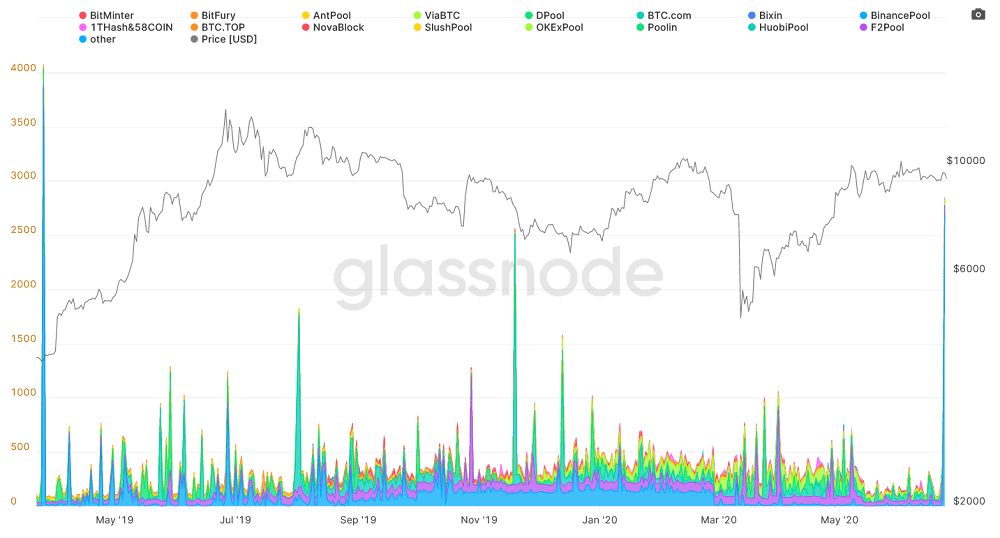

That’s according to data from blockchain analysts at Glassnode, which showed a huge transfer of 2,650 BTC going from Bitcoin miners to the Bitfinex exchange on Tuesday. Seen below, that equates to the largest transfer of BTC from miners to exchanges since March 26, 2019.

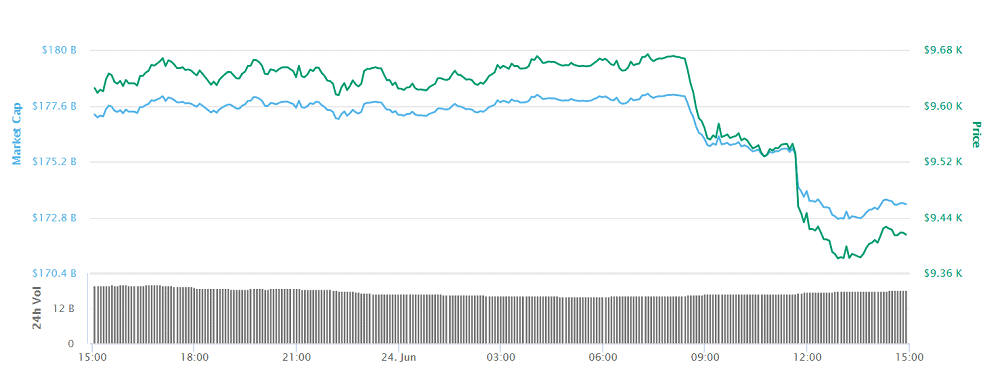

Based on Tuesday’s price point, the 2,650 BTC inflow amounted to just under $25 million in dollar terms. Shortly afterward, Bitcoin underwent a short, sharp drop from $9,764 down to $9,381, which occurred in five hours early on Wednesday morning.

Between Bitfinex’s USD, USDT, GBP, JPY, and EUR pairs, Bitcoin transfers accounted for just under 60% of the exchanges total volume on Wednesday, according to CoinMarketCap.

Bitcoin Price Increases After Exchange Dump?

Despite the fear and uncertainty which typically accompanies any large movement of coins from miners to exchanges, there may still be a silver lining at play.

The last time such a large volume of BTC moved from miners to exchanges, the Bitcoin price reacted with a 226% increase. This took place between March and June of 2019 when the Bitcoin price climbed from $3,985 up to $13,003.

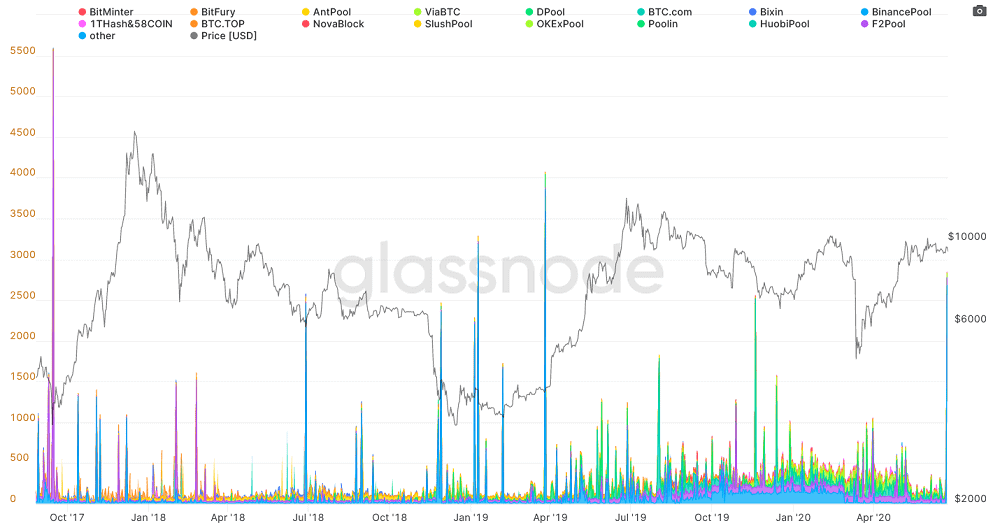

Likewise, if we stretch all the way back to 2017, we see the same thing happen again. Seen below, a huge transfer of BTC to exchanges in September 2017 was followed by a price surge which carried Bitcoin from $3,701 to its all-time high of $20,089. That equated to an increase of 441%.

As per data from Bitinfocharts, Bitcoin’s mining profitability remains 45% less than it was before the recent block reward halving. With that in mind, it would be easy to assume the movement of coins from miners to exchanges could be a sign of a miner capitulation.

Yet the historical data points seen above suggest there could be a price surge just around the corner.