The last few days have been quite terrible as the cryptocurrency market shreds every single gain it has amassed since the start of the year. Bitcoin even slumped to as low as ,700 for an hour for the first time in 12 months. The price crash left traders in dismay, with many scratching their heads and counting losses. Traders wonder what is behind the recent sell-off and the quick recovery, which was definitely abnormal, even for a volatile asset like Bitcoin. This was the worst daily drop in the price of Bitcoin since it was starting to trade.As a matter of fact, BitMEX is by far the leading Bitcoin futures and derivatives exchange. Hence, when any abnormal behavior happens, all eyes are always on the margin exchange, and specifically, it’s perceptual contracts between Bitcoin and

Topics:

Mandy Williams considers the following as important: AA News, Bitcoin (BTC) Price, Bitcoin Shorts and Longs, Bitmex, btcusd

This could be interesting, too:

Chayanika Deka writes Yuga Labs Secures Major Win as SEC Closes Investigation Without Charges

Andrew Throuvalas writes Bitcoin Soars Back To ,000 After BlackRock CEO Says “Buy The Dip”

Chayanika Deka writes XRP, SOL, and ADA Inclusion in US Crypto Reserve Pushes Traders on Edge

Chayanika Deka writes Why Arthur Hayes Is Bullish on Bitcoin Under Trump’s Economic Strategy

The last few days have been quite terrible as the cryptocurrency market shreds every single gain it has amassed since the start of the year. Bitcoin even slumped to as low as $3,700 for an hour for the first time in 12 months. The price crash left traders in dismay, with many scratching their heads and counting losses.

Traders wonder what is behind the recent sell-off and the quick recovery, which was definitely abnormal, even for a volatile asset like Bitcoin. This was the worst daily drop in the price of Bitcoin since it was starting to trade.

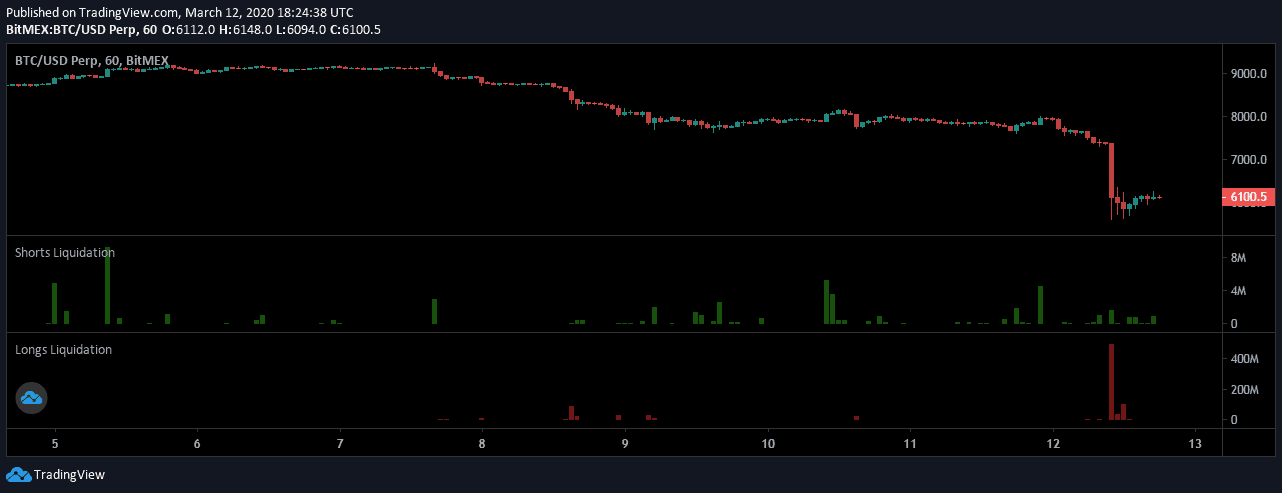

As a matter of fact, BitMEX is by far the leading Bitcoin futures and derivatives exchange. Hence, when any abnormal behavior happens, all eyes are always on the margin exchange, and specifically, it’s perceptual contracts between Bitcoin and USD.

Bitcoin Vs. FIAT

Before diving into the subject, as a general thought, that’s what makes Bitcoin different than other FIAT currencies. Just like happened yesterday on Wall Street, once the indexes plunging more than 5% and 8%, there are breaks in trading, whereas 20% daily plunge will shut the ongoing trading. Bitcoin presents a free-world asset, and no one will stop it’s trading in a 20% daily price fluctuation.

Apparently, BitMEX went down at the earlier hours of Friday, between 02:16 and 02:40 UTC. This coincidentally matched the time Bitcoin fell to $3,700. The exchange claimed it experienced “hardware issues” and trading services did not resume until 03:00 UTC.

During that period, along with yesterday’s trading, BitMEX’s liquidations and Bitcoin futures saw a massive spike in volumes. “Between 02:16 and 02:40 UTC 13 March 2020, we became aware of a hardware issue with our cloud service provider causing BitMEX requests to be delayed. Normal service resumed at 03:00 UTC,” the exchange tweeted.

The Liquidation Engine

Sam Bankman-Fried, CEO of crypto exchange FTX and Alameda Research, doubted that BitMex had any hardware issues.

“There’s a critical ratio: Liquidations triggered per dollar move/liquidity per dollar. The ratio was huge today. There were endless liquidations, and the BitMEX order book was basically nonexistent.” Bankman-Fried explains and adds that in his opinion since the liquidity was nonexistent, the price could go to zero in a case that BitMEX didn’t go offline.

As evidence, Bankman-Fried noted that once BitMEX went offline, the liquidation process halted, and Bitcoin quickly recovered back above $5,000.

BitMEX Denies Allegations

BitMEX exchange was quick to discard the accusation saying that it is nothing but a conspiracy theory formed by a competitor: “Sam, you know better than us to deal with this type of conspiracy theory, especially since you operate a platform in the space and under. The BitMEX insurance fund is the largest in the industry by orders of magnitude and remains healthy,” According to BitMEX official Twitter handle.

We must admit that it’s natural to blame BitMEX, as the leading exchange by volume, in everything that happens to the price of Bitcoin. Notably, a collapse of 50% in a matter of one day. Whether BitMEX is responsible or not – this is a subject that still has no absolute answer.

The last thing to keep in mind is that FTX and BitMEX are competitors; hence, Bankman-Fried is biased after all.