Tether, the issuer of the dollar-pegged stablecoin USDT, is in the limelight again as the company’s treasury minted fresh USDT worth more than a billion dollars in a single month.Tether Mints 1.6B USDT in April.From April 1, 2020, to April 30, accumulated records from Whale Alert, a platform that tracks large crypto transactions from and to exchanges, revealed that the Tether Treasury printed a total of 1.58 billion USDT worth just shy of .59 billion.Tether minted 480 million USDT tokens in the first two weeks of April, and 1.1 billion tokens were printed throughout the rest of the month despite the growing criticisms.Tether USDT Prints in AprilAccording to Tether’s official transparency page, total assets worth of USDT currently stands at a little more than .9 billion, while its

Topics:

Mandy Williams considers the following as important: AA News, btcusd, btcusdt

This could be interesting, too:

Chayanika Deka writes SEC Closes Investigation Into Gemini, Winklevoss Seeks Reimbursement

Wayne Jones writes CZ Criticizes Safe Wallet’s Post-Mortem on Bybit Hack

Mandy Williams writes Bitcoin ETFs Record Over .6B in Outflows in the Past 2 Weeks

Wayne Jones writes This Trending AI Token Hits New ATH After Binance Listing

Tether, the issuer of the dollar-pegged stablecoin USDT, is in the limelight again as the company’s treasury minted fresh USDT worth more than a billion dollars in a single month.

Tether Mints 1.6B USDT in April.

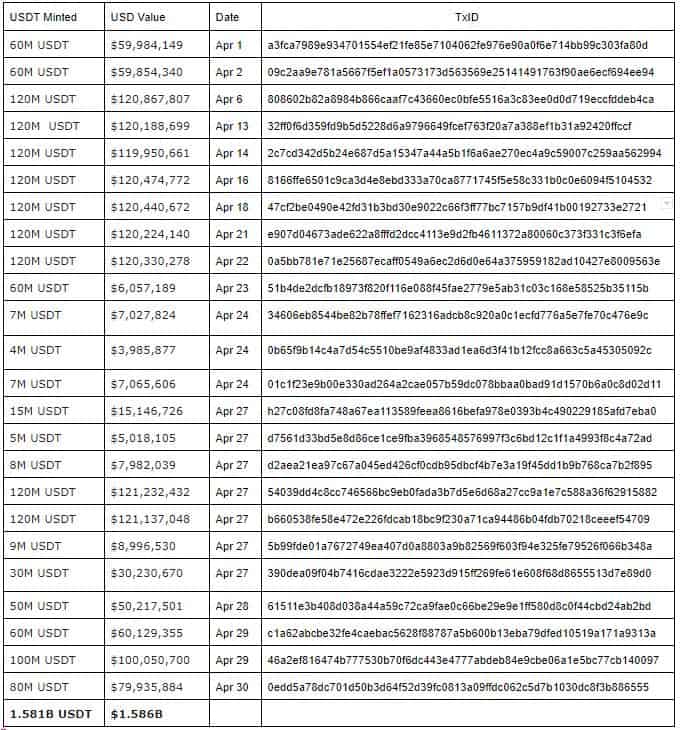

From April 1, 2020, to April 30, accumulated records from Whale Alert, a platform that tracks large crypto transactions from and to exchanges, revealed that the Tether Treasury printed a total of 1.58 billion USDT worth just shy of $1.59 billion.

Tether minted 480 million USDT tokens in the first two weeks of April, and 1.1 billion tokens were printed throughout the rest of the month despite the growing criticisms.

According to Tether’s official transparency page, total assets worth of USDT currently stands at a little more than $7.9 billion, while its market cap according to CoinGecko is at 7.8 billion.

Bitcoin Gained Momentum With Each Batch Of USDT Minted

Bitcoin and the rest of the crypto markets recorded terrible losses in March. The leading cryptocurrency crashed from above $9,200 to a low of $3,700 in a few days but managed to end the month with a price of $6,400.

It is a widespread belief in the crypto space that the issuance of large amounts of fiat pegged token, in this case, USDT, is a sign of an impending bull run for Bitcoin.

On the one hand, that could be true as BTC surged from the $6,400 level at the start of April to almost $9,700 at month’s end, which coincides with the period Tether’s “printer went brrrr.” But on the other hand, the recent price surge could be an effect of the upcoming Bitcoin halving event expected to occur in less than ten days from now when the network hits block 630,000.

Why is Tether Treasury Minting More USDT?

Tether USDT remains the largest stablecoin in the increasingly competitive stablecoin market. Data from CoinMarketCap also reveals that the token has the highest daily trade volume in the entire cryptocurrency markets with $52,679,441,866 traded over the last 24 hours, surpassing Bitcoin’s daily volume by 10.8 $billion.

It is believed that increased demand for the dollar-pegged stablecoins is the reason why Tether is printing more USDT since the company controls a large share of the stablecoin market.

In several tweets from Whale Alert about freshly minted USDT, Paolo Ardoino, CTO Bitfinex, and Tether always say that the batch of minted tokens was to replenish the USDT inventory. He claims that although it is authorized, it is not an issued transaction, which means that the amount printed will be used to fulfill the next issuance requests.

PSA: 120M USDt inventory replenish.

Note this is a authorized but not issued transaction, meaning that this amount will be used as inventory for next period issuance requests.— Paolo Ardoino (@paoloardoino) April 27, 2020