The demand for the Purpose Bitcoin ETF has resumed after the mid-May decrease. Consequently, the company’s product has increased the bitcoins it holds by almost 30% in less than two months. Purpose BTC ETF Holds Almost 22.5K Coins CryptoPotato reported earlier this year when Canada’s Ontario Securities Commission (OSC) approved a filing by the financial services company – Purpose Investments – to launch an exchange-traded fund tracking the performance of the primary cryptocurrency. Once released, the Bitcoin ETF enjoyed a highly positive start as it attracted over 0 million in AUM in just a few weeks. However, the market-wide retracement followed in May, propelled by FUD from Elon Musk and China and intensified by over-leveraged positions. Consequently, investors

Topics:

Jordan Lyanchev considers the following as important: AA News, bitcoin etf, BTCEUR, BTCGBP, btcusd, btcusdt, canada, social

This could be interesting, too:

Bitcoin Schweiz News writes VanEck registriert ersten BNB-ETF in den USA – Nächster Meilenstein für Krypto-ETFs?

Bitcoin Schweiz News writes BlackRock bringt Bitcoin-ETP nach Europa – Was bedeutet das für den Kryptomarkt?

Chayanika Deka writes Yuga Labs Secures Major Win as SEC Closes Investigation Without Charges

Andrew Throuvalas writes Bitcoin Soars Back To ,000 After BlackRock CEO Says “Buy The Dip”

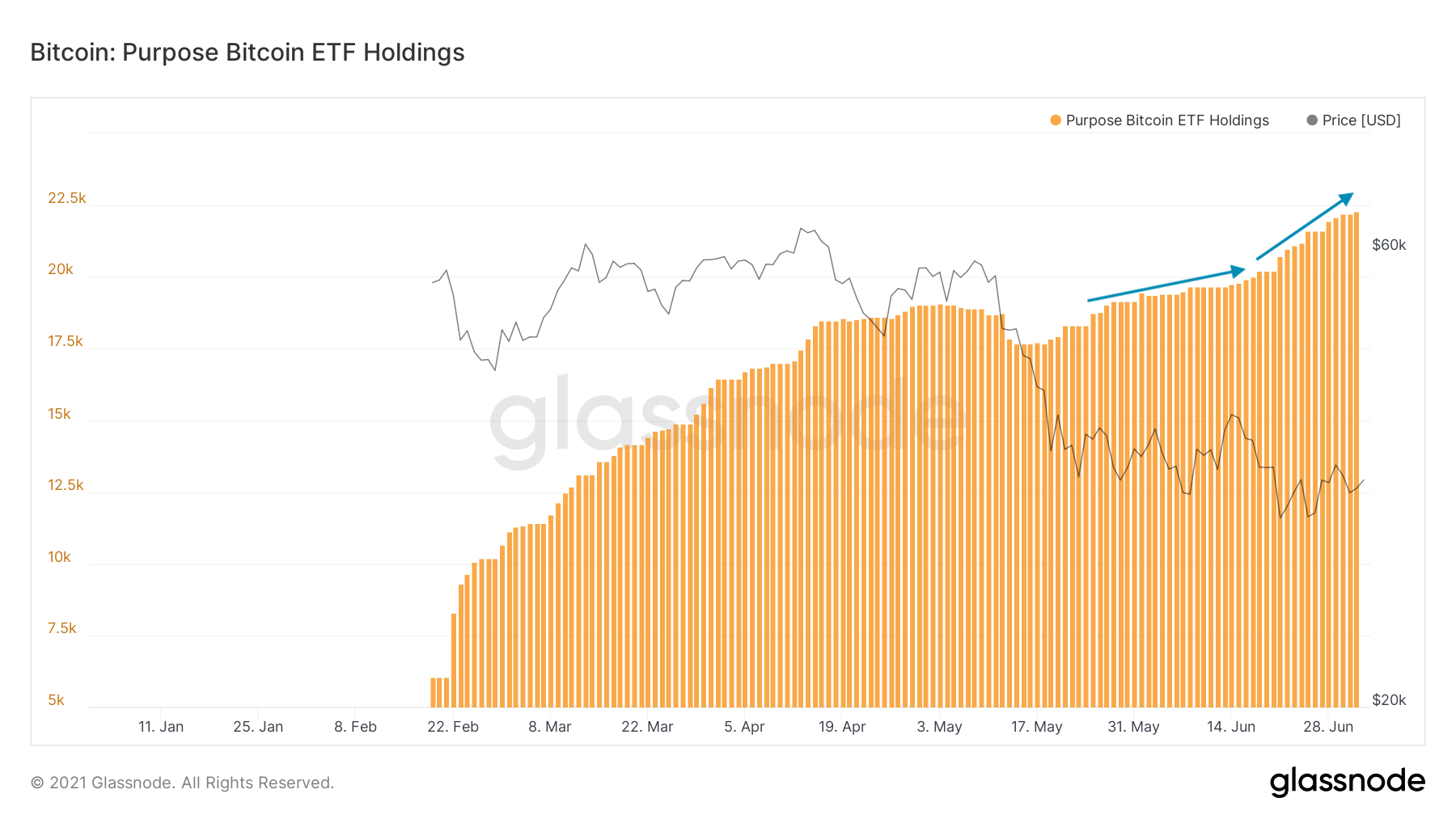

The demand for the Purpose Bitcoin ETF has resumed after the mid-May decrease. Consequently, the company’s product has increased the bitcoins it holds by almost 30% in less than two months.

Purpose BTC ETF Holds Almost 22.5K Coins

CryptoPotato reported earlier this year when Canada’s Ontario Securities Commission (OSC) approved a filing by the financial services company – Purpose Investments – to launch an exchange-traded fund tracking the performance of the primary cryptocurrency.

Once released, the Bitcoin ETF enjoyed a highly positive start as it attracted over $400 million in AUM in just a few weeks. However, the market-wide retracement followed in May, propelled by FUD from Elon Musk and China and intensified by over-leveraged positions.

Consequently, investors stopped allocating funds in the ETF – just the opposite, they sold off considerable portions, and the company’s holdings decreased rapidly. This coincided with numerous reports claiming that institutional demand has declined as well.

However, it seems the trend has changed once more, as Glassnode recently asserted. The analytics company said on June 24th, “since 15-May, a total of 3,446 BTC have flowed into the ETF, an average of 86.15 BTC per day.”

This wasn’t a one-time occurrence, as more recent data from the firm reaffirmed the resuming appetite from investors. Consequently, the Purpose Bitcoin ETF has continued to increase its holdings and currently has just under 22,500 bitcoins. With today’s USD prices, this sizeable amount is close to $800 million.

What About the US?

It’s worth noting that shortly after Canada’s regulator approved the application from Purpose, it did so for two more Bitcoin exchange-traded funds. However, the situation with Canada’s southern neighbor is significantly different.

The US Securities and Exchange Commission continues to reject numerous applications per year. Several companies have filed with the watchdog this year alone, and it seems VanEck could be the closest to a positive outcome. However, the agency delayed the decision once again last month.

Interestingly, the SEC’s Commissioner, Hester Peirce, recently opined that the regulator should have approved a Bitcoin ETF a long time ago as its examination methods are outdated.