Charting a Course in the Aftermath of Bitcoin’s Halving: Opportunities and Challenges Ahead The crypto market witnessed a flurry of historic events throughout April, setting the stage for potential shifts in the digital asset landscape. Amidst geopolitical tensions and U.S. macroeconomic uncertainties, the month unfolded with significant developments that captivated investors worldwide. Bitcoin’s Fourth Halving: A Consolidating Market April marked the long-awaited fourth halving of Bitcoin, reducing block rewards and ushering in a new era for miners. Bitcoin has been oscillating between ,000 and ,700, and repeatedly testing the crucial ,000 support level. Concurrently, ETF outflows totaling 0 million underscored the market’s cautious sentiment amid

Topics:

Live Bitcoin News considers the following as important: Press Release

This could be interesting, too:

Guest User writes Join the Future! ZacroTribe (ZACRO) Presale Opens Soon at %related_posts%.01!

Guest User writes The Future of Financial News Presale is Here: Secure Your ZACRO Tokens for a New Era of Decentralized Insights

Guest User writes The Wait is Almost Over – ZacroTribe (ZACRO) Presale Launching at %related_posts%.01!

Chainwire writes SingularityNET and Privado ID Partner to Establish Decentralized AI Agent Trust Registry

Charting a Course in the Aftermath of Bitcoin’s Halving: Opportunities and Challenges Ahead

The crypto market witnessed a flurry of historic events throughout April, setting the stage for potential shifts in the digital asset landscape. Amidst geopolitical tensions and U.S. macroeconomic uncertainties, the month unfolded with significant developments that captivated investors worldwide.

Bitcoin’s Fourth Halving: A Consolidating Market

April marked the long-awaited fourth halving of Bitcoin, reducing block rewards and ushering in a new era for miners. Bitcoin has been oscillating between $59,000 and $73,700, and repeatedly testing the crucial $60,000 support level. Concurrently, ETF outflows totaling $340 million underscored the market’s cautious sentiment amid broader economic uncertainties. However, stabilized volatility hints at a potential breakout in early to mid-May, as Bitcoin navigates through a mixed macroeconomic backdrop.

Opportunities within Bitcoin Ecosystem

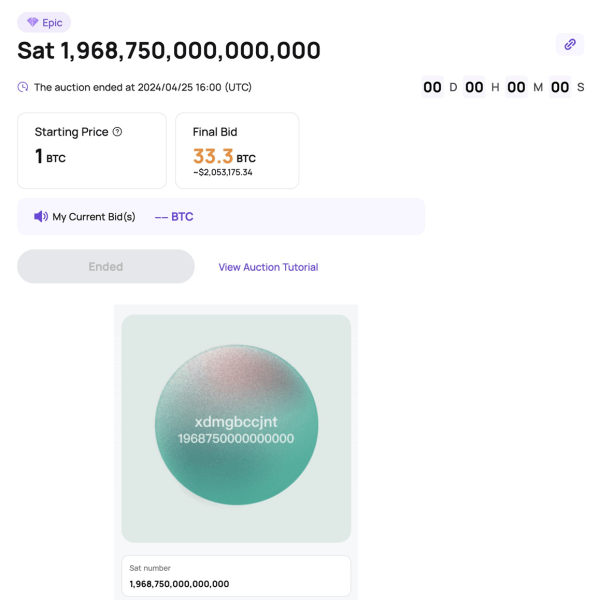

Adding intrigue to the narrative was the first-ever Epic Satoshi auction, organized by CoinEx and concluded at 33.3 BTC. This landmark event not only commemorated the halving but also showcased the burgeoning utility and valuation of rare sats within the Bitcoin network.

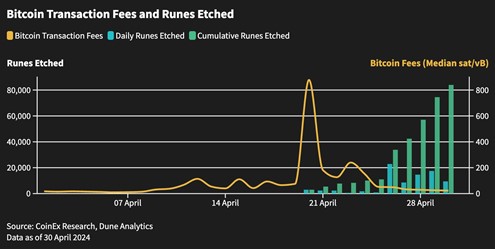

Simultaneously, the birth of the Runes Protocol captured the imagination of market participants, with Runes tokens swiftly amassing a market cap exceeding $900 million and attracting over 450,000 holders by April 30. This excitement was tempered by a surge in transaction fees, peaking at over 1,900 sat/vB before reverting to more typical levels by month’s end.

Ethereum’s Silent Accumulation Amidst Low Gas Fees

While Bitcoin garnered significant attention, on-chain data revealed whale accumulation of Ethereum despite the recent performance lag. The dip in gas fees also creates strategic opportunities for investors. Total value locked (TVL) of leading liquid staking and restaking protocols reached impressive heights, with $39bn and $14bn respectively, contributing to the diminished on chain activity.

Stablecoins Surge as Altcoins Stagnate

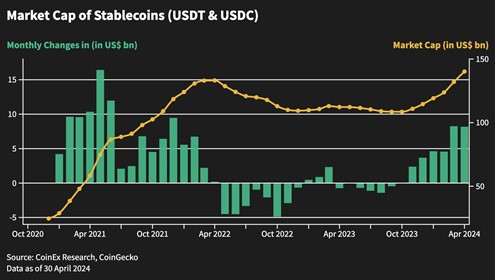

Stablecoins emerged as a cornerstone of stability amidst market turbulence, with USDC and USDT witnessing unprecedented growth, reaching a combined market capitalization of $140 billion.

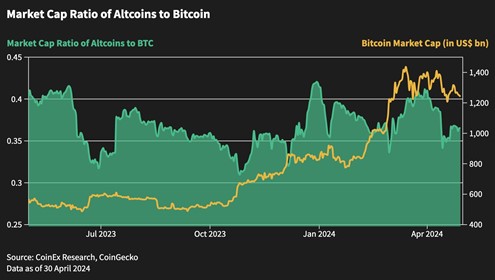

Altcoins, excluding Ethereum, however, faced stagnation relative to Bitcoin, oscillating between 0.3 and 0.4 in terms of the market capitalization ratio. Despite sustained inflows from stablecoins, altcoins struggled to gain momentum, reflecting investor caution amid global economic uncertainties.

Looking Ahead: A Path Forward Amidst Uncertainty

As Bitcoin retraced and economic uncertainties mounted, market sentiment shifted towards risk aversion, triggering widespread liquidation of altcoins. Yet, the underlying liquidity remained robust, signaling potential opportunities on the horizon. With Bitcoin poised to establish a clear trend and broader market stability, investors might anticipate rotation towards the altcoin sector, catalyzing significant inflows into high-quality assets. Whether Bitcoin’s price declines or resumes an upward trajectory, the market is set to experience dynamic shifts, presenting both challenges and opportunities for investors in the months ahead. www.coinex.com

Disclaimer: This is a paid release. The statements, views and opinions expressed in this column are solely those of the content provider and do not necessarily represent those of LiveBitcoinNews. LiveBitcoinNews does not guarantee the accuracy or timeliness of information available in such content. Do your research and invest at your own risk.