Bitcoin (BTC) miners have suddenly begun offloading their BTC holdings to crypto exchanges, signaling a potential reversal of months of upward price momentum. Per a Sunday post from SignalQuant – an author for Bitcoin analytics firm CryptoQuant – paying attention to short-term miner behavior may be necessary for “wise investment.” The Meaning Of Miner Deposits Miners are the first recipients of all new BTC issued by the Bitcoin network, as well as all transaction fees paid by users. As such, they are the ultimate dictators of whether new coins enter the market’s circulating supply, or remain dormant. “Miners have historically been one of the largest whales, and when they deposit big amounts of BTC to exchanges, the price experiences significant downward pressure,” wrote

Topics:

Andrew Throuvalas considers the following as important: AA News, Bitcoin (BTC) Price, Bitcoin Mining

This could be interesting, too:

Christian Mäder writes Die Bitcoin-Weltkarte: Holdings im Fokus

Chayanika Deka writes Yuga Labs Secures Major Win as SEC Closes Investigation Without Charges

Andrew Throuvalas writes Bitcoin Soars Back To ,000 After BlackRock CEO Says “Buy The Dip”

Chayanika Deka writes XRP, SOL, and ADA Inclusion in US Crypto Reserve Pushes Traders on Edge

Bitcoin (BTC) miners have suddenly begun offloading their BTC holdings to crypto exchanges, signaling a potential reversal of months of upward price momentum.

Per a Sunday post from SignalQuant – an author for Bitcoin analytics firm CryptoQuant – paying attention to short-term miner behavior may be necessary for “wise investment.”

The Meaning Of Miner Deposits

Miners are the first recipients of all new BTC issued by the Bitcoin network, as well as all transaction fees paid by users. As such, they are the ultimate dictators of whether new coins enter the market’s circulating supply, or remain dormant.

“Miners have historically been one of the largest whales, and when they deposit big amounts of BTC to exchanges, the price experiences significant downward pressure,” wrote SignalQuant in his analysis.

CryptoQuant voters unanimously voted for miners’ sale of coins as a bearish indicator.

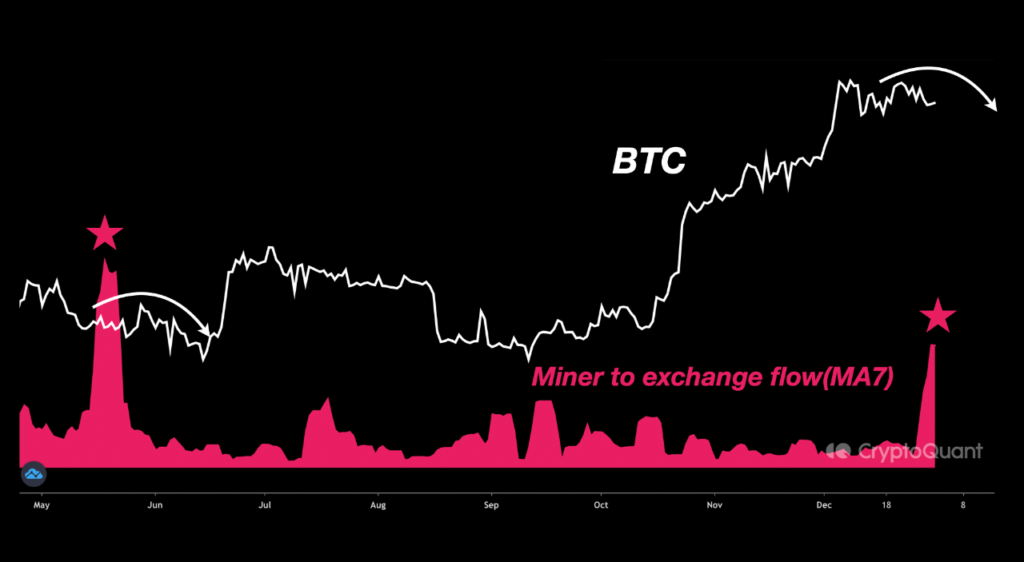

The analyst referenced mid-May of 2023 when a surge in miner deposits was followed by a gradual slide in Bitcoin’s price from rough $27,000 to $25,500 by mid-June. This took place after a two-month-long Bitcoin rally above $30,000, inspired by a combination of U.S. bank failures and excitement over Ordinals.

Today, BTC faces a similar situation: having now rallied beyond $45,000 amid excitement for imminent Bitcoin spot ETF approvals, miners have offloaded hundreds of millions of dollars in BTC over the past week.

The selloff is the largest since May and reflects a similar sign of profit taking from miners during a period of especially lucrative BTC prices.

Likewise, it also follows a period of high Ordinals activity, which has driven up network transaction fees and given miners an all-new major source of profit. As of January, the world’s largest miners are averaging 1.73 BTC per block in fees – a 27% bonus on their standard 6.25 BTC block subsidy.

Late last month, Bitcoin crossed $100 million in cumulative fees.

Is Bitcoin About To Explode?

Contrary to SignalQuant, Matrixport recently posited that Bitcoin could surge beyond $50,000 this month after ETF approvals invite a wave of capital in search of BTC.

“Institutional investors cannot afford to miss out on any potential rally again and, therefore, have to buy immediately when the markets open for trading in 2024,” wrote the crypto platform on Monday. “We expect an immediate rally that once again catches investors off-guard.”

By the end of the year, Matrixport has suggested Bitcoin could reach $125,000 – much like Standard Chartered’s $120,000 price prediction last year.