SEC Chairman Jay Clayton suggests that a bitcoin ETF may be approved once price-manipulation concerns are addressed. | Source: REUTERS / Brendan McDermidSEC Chairman Jay Clayton says the agency is inching closer to finally approving a bitcoin ETF. However, he warns that more work needs to be done to deter price manipulation and ensure a transparent market.Clayton made the assertions during a CNBC interview with Bob Pisani (video below). Pisani asked if we're any closer to seeing a bitcoin ETF soon.Clayton responded by saying, "Yes. But there's work left to be done."Are we any closer to seeing a Bitcoin ETF some day? SEC Chairman Jay Clayton to @CNBC: "yes, but there's work left to be done" @SEC_News @bobpisani @kellycnbc @CNBCTheExchange #bitcoin #crypto pic.twitter.com/iJP3nn9XHc— The

Topics:

Samantha Chang considers the following as important: Bitcoin Regulation, Cryptocurrency News, Jay Clayton, sec

This could be interesting, too:

Bitcoin Schweiz News writes VanEck registriert ersten BNB-ETF in den USA – Nächster Meilenstein für Krypto-ETFs?

Bitcoin Schweiz News writes SEC gibt auf: Ermittlungen gegen Crypto.com offiziell eingestellt

Chayanika Deka writes Yuga Labs Secures Major Win as SEC Closes Investigation Without Charges

Emily John writes SEC Ends Yuga Labs Probe with No Charges

SEC Chairman Jay Clayton says the agency is inching closer to finally approving a bitcoin ETF. However, he warns that more work needs to be done to deter price manipulation and ensure a transparent market.

Clayton made the assertions during a CNBC interview with Bob Pisani (video below). Pisani asked if we're any closer to seeing a bitcoin ETF soon.

Clayton responded by saying, "Yes. But there's work left to be done."

Are we any closer to seeing a Bitcoin ETF some day? SEC Chairman Jay Clayton to @CNBC: "yes, but there's work left to be done" @SEC_News @bobpisani @kellycnbc @CNBCTheExchange #bitcoin #crypto pic.twitter.com/iJP3nn9XHc

— The Exchange (@CNBCTheExchange) September 9, 2019

SEC Fears 'Significant' Bitcoin Price Manipulation

Specifically, Jay Clayton says the Securities and Exchange Commission wants more information about custody as well as assurances against price manipulation.

"How do we know that we can custody and have a hold of these crypto assets?" Clayton said. "That's a key question. An even harder question — given that they trade on largely unregulated exchanges is — 'How can we be sure that those prices aren't subject to significant manipulation?"

The SEC chairman admits that progress has been made on those fronts. However, he warns that "people needed to answer those hard questions for us to be comfortable that this was the appropriate type of product."

'Crypto Mom': SEC Should've Approved Bitcoin ETF

In August, the SEC again delayed making a final decision on three bitcoin ETF applications. While a delay is better than an outright rejection, the move frustrated many in the crypto industry.

Meanwhile, SEC Commissioner Hester Peirce says the agency should've approved a bitcoin ETF already. In June, Peirce blasted the agency for being an out-of-touch dinosaur.

Peirce has repeatedly torched the SEC for its glacial approach toward approving a bitcoin ETF. She says the agency's timidity puts it in the position of being a babysitter for investors.

Lame 'Old' SEC Should've Approved a Bitcoin ETF Already, Scolds Crypto Mom https://t.co/sYBeYIKVrd

— CCN Markets (@CCNMarkets) June 26, 2019

Peirce Scolds SEC: Stop Being Lame Dinosaurs

Moreover, Peirce noted that the SEC has been very closed-minded when it comes to embracing innovation. "The agency is old and has not historically been great with innovation," she quipped.

Hester Peirce is one of five SEC commissioners. They each have differing views on crypto. Peirce was affectionately nicknamed "Crypto Mom" because of her pro-crypto positions.

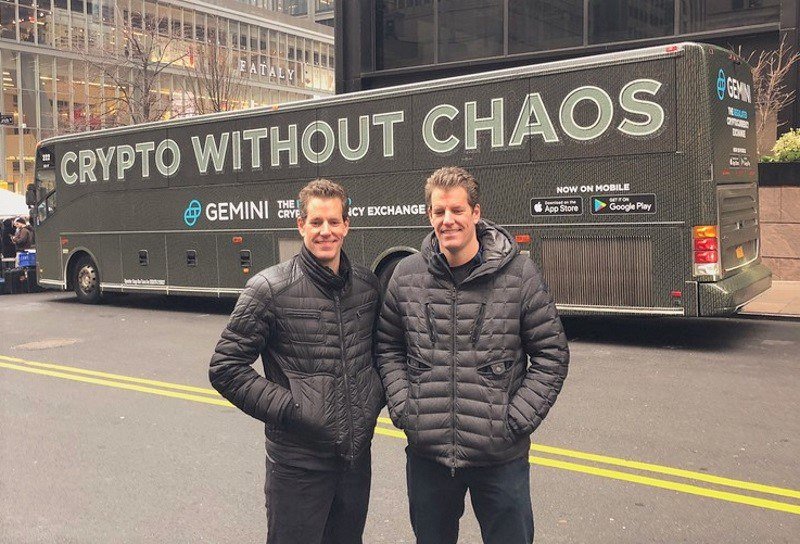

In July 2018, Peirce was the only SEC commissioner who voted to approve the bitcoin ETF application submitted by the Winklevoss twins, Tyler and Cameron.

The rejections — in March 2017 and again in June 2018 — cited the twins' failure to demonstrate how their bitcoin ETF could prevent market manipulation.

Van Eck: Bitcoin ETF could fortify US economy

Gabor Gurbacs, of investment management firm VanEck, says the SEC should approve a bitcoin ETF soon because it could be a major driver of the U.S. economy for the next decade.

"We are waiting finally for regulators to approve a bitcoin ETF, which would bring digital assets under the regulated American capital market," Gurbacs said. "This could be, for the next decade, the driver of our economy."

Gurbacs says the United States should harness these technologies to upgrade its payments systems and capital markets infrastructure. He contends that doing this would make America the world leader in the budding digital economy.