In 2020, BitMax has strived to build its deep background and expertise in financial markets, make key breakthroughs and successfully set itself apart from its competitors. BitMax, an industry-leading digital asset trading platform built by Wall Street quant trading veterans, hosted “The Pursuit of Excellence, Breakthrough, and Win-Win” at Renaissance Beijing Wangfujing Hotel in celebration of the company’s two-year anniversary. The event brought together over 200 blockchain investors, traders, users, and enthusiasts from across the globe. Dr. Cao Jing, Founder and CEO of BitMax, delivered a speech at the opening ceremony, showcasing his great confidence in the future of BitMax and the fast-evolving digital asset ecosystem.2020 has been a remarkable year for BitMax. The platform has

Topics:

<title> considers the following as important:

This could be interesting, too:

Emmanuel (Parlons Bitcoin) writes Un code moral pour l’âge d’or, la règle Bitcoin

Bitcoin Schweiz News writes April-Boom an den Märkten: Warum Aktien und Bitcoin jetzt durchstarten

Bitcoin Schweiz News writes VanEck registriert ersten BNB-ETF in den USA – Nächster Meilenstein für Krypto-ETFs?

Fintechnews Switzerland writes Revolut Hits Milestone of One Million Users in Switzerland

Bitcoin Schweiz News writes US-Rezession als Bitcoin-Turbo? BlackRock überrascht mit kühner Prognose

In 2020, BitMax has strived to build its deep background and expertise in financial markets, make key breakthroughs and successfully set itself apart from its competitors.

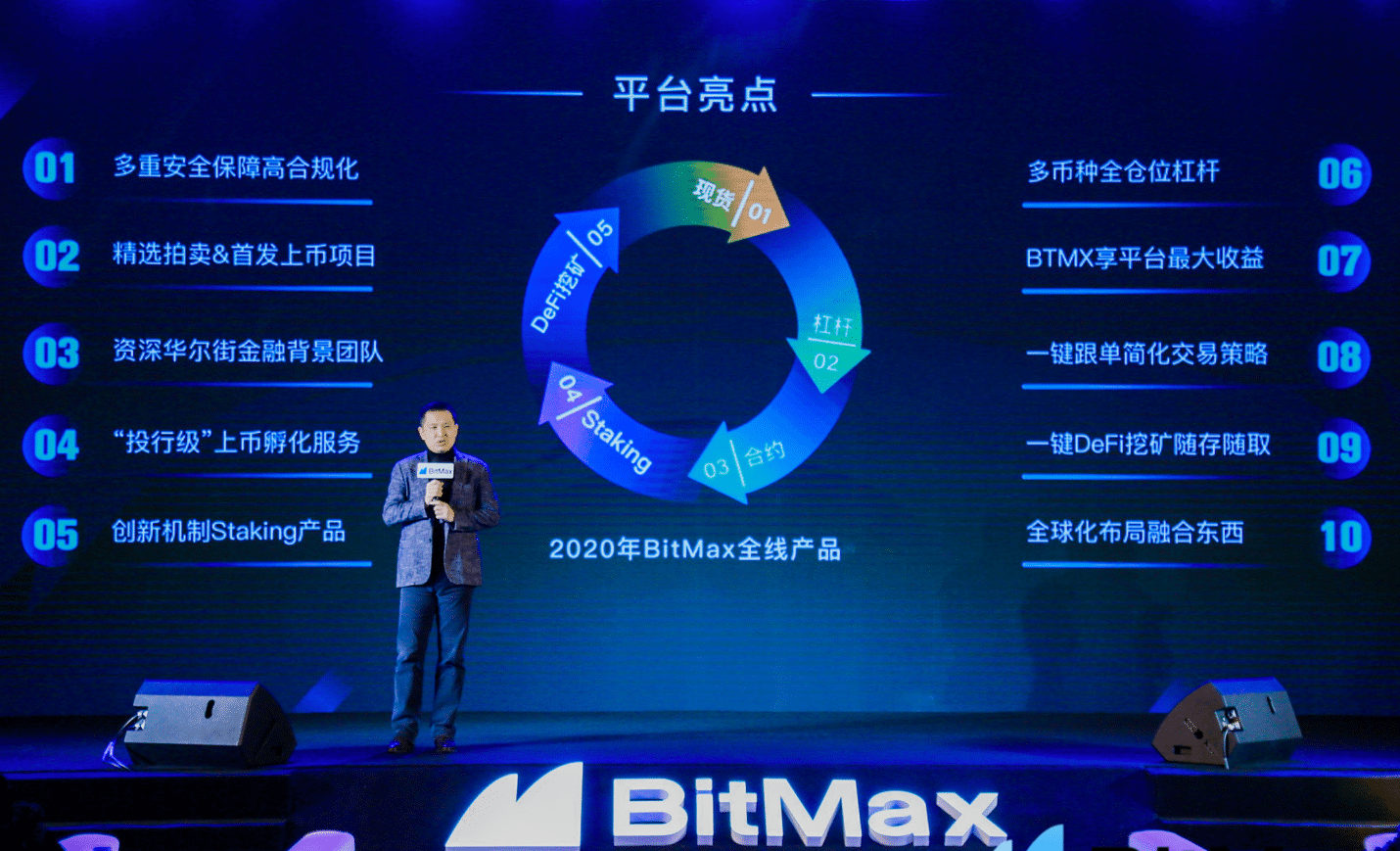

BitMax, an industry-leading digital asset trading platform built by Wall Street quant trading veterans, hosted “The Pursuit of Excellence, Breakthrough, and Win-Win” at Renaissance Beijing Wangfujing Hotel in celebration of the company’s two-year anniversary. The event brought together over 200 blockchain investors, traders, users, and enthusiasts from across the globe. Dr. Cao Jing, Founder and CEO of BitMax, delivered a speech at the opening ceremony, showcasing his great confidence in the future of BitMax and the fast-evolving digital asset ecosystem.

2020 has been a remarkable year for BitMax. The platform has successfully launched services for institutional clients, staking, and DeFi mining products. The launch of “Community Captain Program” has invigorated many users from over 100 top crypto communities, aiming to accelerate the platform’s global expansion and further support the BitMax ecosystem. In the past year alone, BitMax has conducted over 20 primary listings, of which 7 auction projects consumed 20 million BTMX.

Photo: BitMax.io

Founded in 2018, BitMax now has four global operational centers servicing well-diversified users across 196 countries. The comprehensive product suite includes trading across spot, margin, and futures markets, wallet services for over 100 cryptocurrencies, and innovative staking support for top blockchain projects. In 2020, the total number of BitMax.io users has increased by 300%. The platform currently supports five different languages and three fiat-enabled deposit services via partnerships with third-party vendors.

Followed by Dr. Cao’s opening speech, Xu Zhihong, Partner of BitUniverse, joined the conversation with the theme of 2020 Review and 2021 Outlook for Digital Asset Investments. “The rise of bitcoin this year is a long-suppressed release,” said Dr. Cao. “The adoption of bitcoin in various countries and the asset allocation from different asset management institutions are accelerating the expansion of bitcoin into the traditional financial market.”

Photo: BitMax.io

Dr. Cao commented that centralized and decentralized exchanges would complement each other. He stated, “overall, the development of cryptocurrency exchanges relies on market size growth. Even if bitcoin rises to $27,000, total cryptocurrency’s market value is still just a drop in the bucket compared with that of traditional stocks, commodity futures, and foreign exchange. The full-scale competition needs to wait until the market value of bitcoin reaches to at least 5% of the gold market.”

Dr. Cao further pointed out that while the development of regulatory oversight on cryptocurrency has been ongoing within each jurisdiction, large institutions have started to venture into the market. BitMax hopes to facilitate seamless onboarding for those institutions who are new to the digital asset ecosystem and ultimately look to expand the size of the market. In 2021, BitMax will continue to capture the best of market trends, optimize its product lines, improve user experience with functional enhancements across the platform.

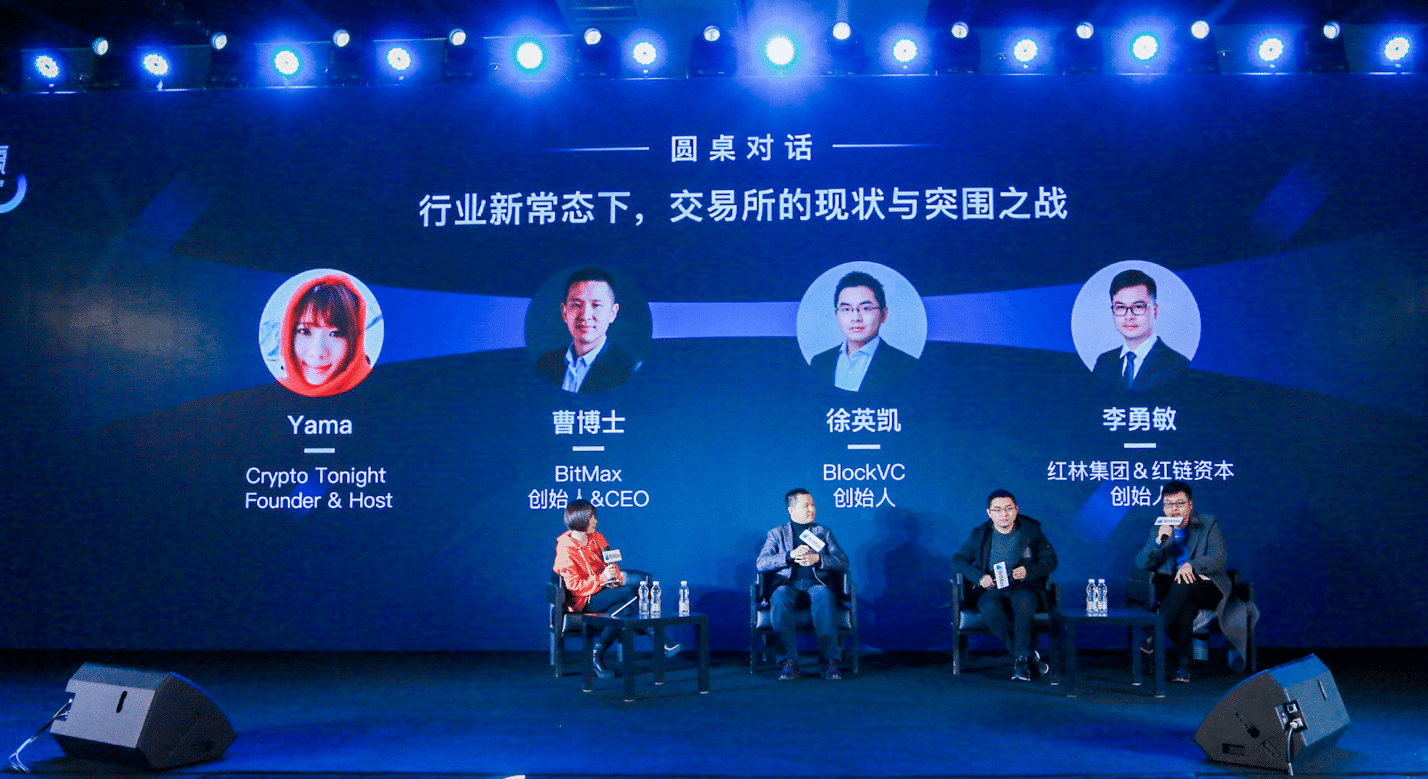

Photo: BitMax.io

Then, the panel discussion on “Current Development and Challenges under New Industry Norm in Digital Asset Trading” was joined by Yama, Founder of Crypto Tonight, Xu Yingkai, Founder of BlockVC, and Li Yongmin, Founder of Honglian Capital. Dr. Cao started the panel discussion with his detailed analysis on the current development of the digital asset market vs. traditional financial markets, such as some level of correlation between bitcoin price movement vs. commodities, such as gold, and overall US equity markets. Also, there has been a significant impact from regulatory and policy development within major regions. Dr. Cao summarized those being the healthy signs of global acceptance of bitcoin as part of mainstream financial products for trading and investment consideration, especially with the recent rise in market value.

Follow-up to Dr. Cao’s comments, Xu Yingkai shared his view on the core differences between the Chinese and US crypto markets. “One difference is from investment infrastructure perspective. The US market is more mature in terms of its regulatory framework development, trust custody products, and OTC trading, providing users with a great range of products and trading options for bitcoin. Secondly, the difference derives from the recognition and acceptance of digital assets. In the past, the majority of bitcoin ownership has concentrated within handful of Asian-based investors and whalers. However, this year’s change in the economic environment has also affected people’s view on digital assets and their purposes for trading or investment. Third difference lies with the expectation of future development, especially when it comes down to revolutionary aspects of owning digital assets vs. traditional assets.”

Photo: BitMax.io

Li Yongmin, Founder of Honglian Capital, pointed out the complementary relationship between centralized finance (“CeFi”) and decentralized finance (“DeFi”). He mentioned that the growth in DeFi project incubation has expanded the listing source of decentralized exchanges and further brought traffic to centralized platforms. Moreover, DeFi is currently benchmarking the fixed-income financial products in the market, which can attract more attention of institutional players to enter the market.

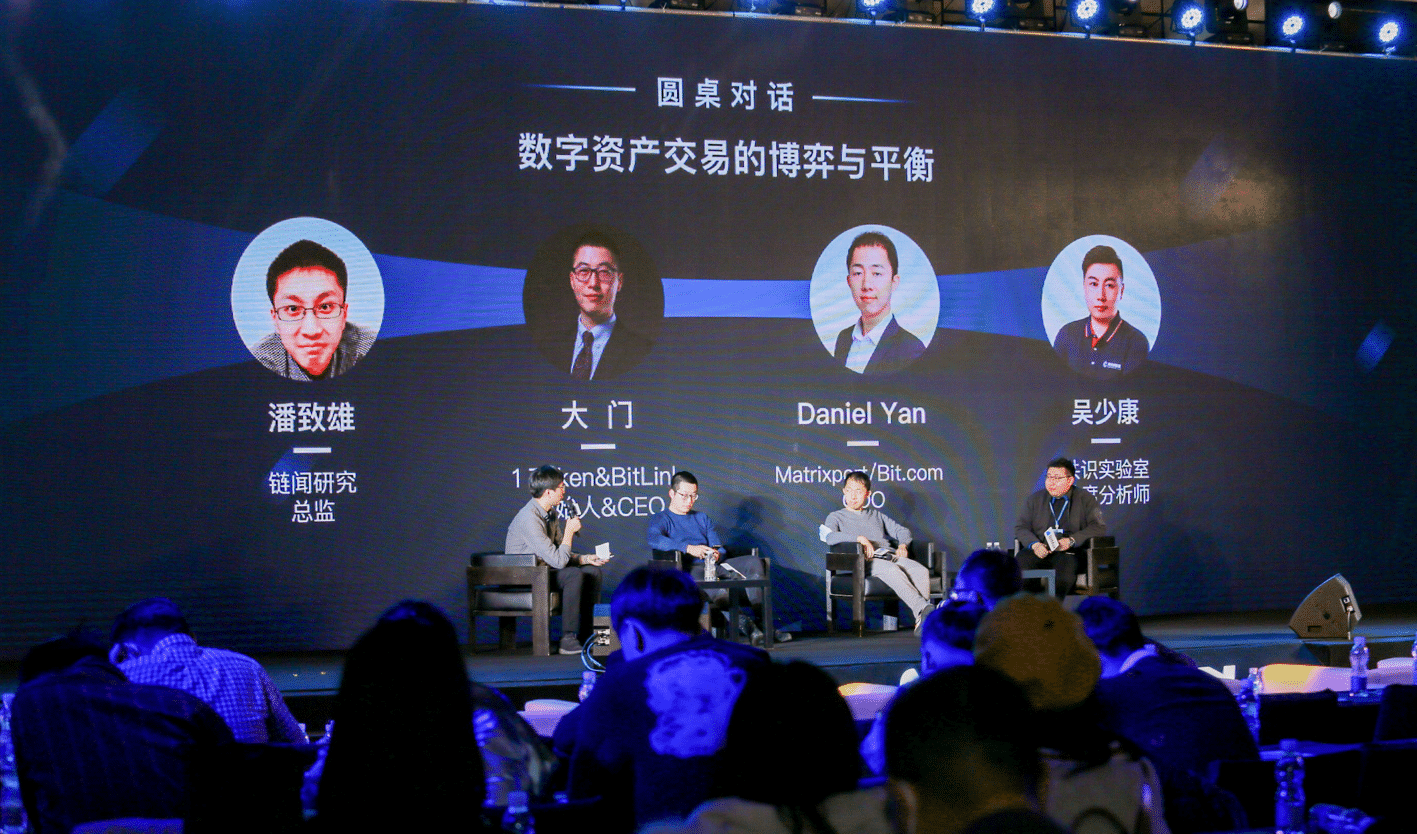

During the round table discussion on “Risks and Rewards of Digital Asset Trading,” Pan Zhixiong, Research Director of Chain News, Damon, Founder of TokenInsight, Daniel Yan, COO of Matrixport, Harry, CEO of CyberX, Wu Shaokang, Chief Analyst of Consensus Lab jointly expressed their respective views based on their experience in the space.

Photo: BitMax.io

“It is inevitable for trading platform to get upgrade, especial when every financial institutions must have a comprehensive systematic and risk management,” Damon, Founder of 1 Token & BitLink, said. “After the institutionalization of the market, many will have problems at the infrastructure level, say delay and downtime. Therefore, financial institutions need to prepare in advance to upgrade their trading and asset management systems.”

In terms of market structure, in particular with rapid market movement, all financial institutional must spend a lot of energy on building out its technical infrastructure, which is also why the BitMax team focuses on constantly improving its trading platform, its products and services in response to ever-changing market place.

Daniel Yan, COO of Matrixport, shared his views from the user demographic perspective. “There are two development trends that worth our attention. First, the number of broker-dealer-type users is increasing, and many institutions now plays the role of broker to serve customers. Many are engaged in derivatives and futures trading as hedging strategies to reduce the investment risk, vs. expression of their view on market directions.” Secondly, he pointed out a large number of institutions from Europe and the US have entered the market. These institutions started to build long positions as early as 6 months ago in support of new market demand. All those latest developments were hard to imagine just two years back.

Wu Shaokang, Chief Analyst of Consensus Lab, outlined the similarities and differences between options and futures. “Trading depth is the soul of capital markets. All exchanges have been vigorously developing their futures trading capabilities since 2019, and as a result, the trading depth has increased rapidly, providing better liquidity in the market. However, in some major exchanges, the liquidity for options trading is still scarce and the spread is wide, as there are very few orders from buy-side and sell-side.” However, he did highlight the gradual entry of professional institutions is a promising sign for long-term growth in options trading market development.

Photo: BitMax.io

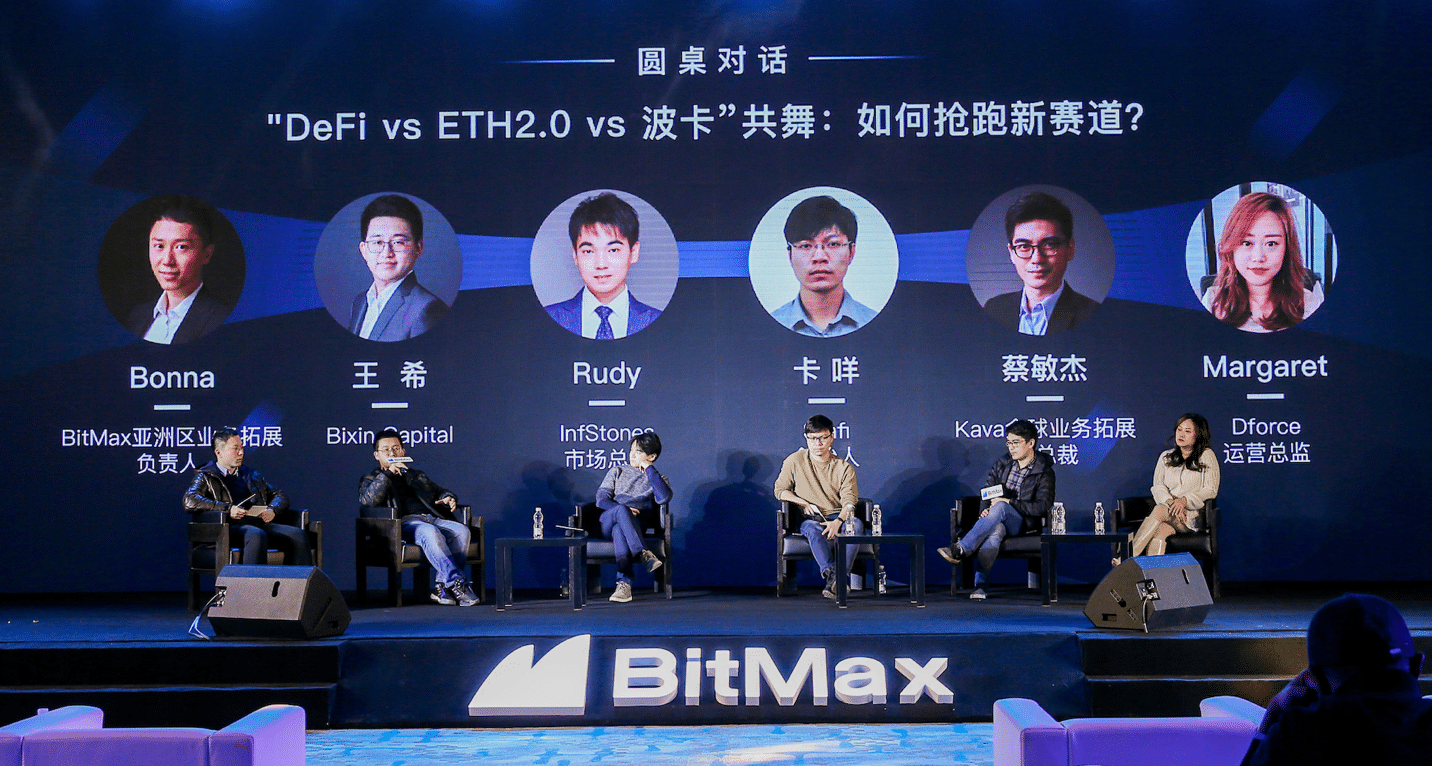

In the second roundtable discussion, Bonna Zhu, Head of Business Development of Asia, alongside WangXi, Partner of Bixin Capital, Rudy Lu, Marketing Director of InfStones, Ka Mie, Founder of Stafi, Cai Minjie, Vice President of Global Business Development of Kava discussed the topic of “DeFi vs ETH 2.0 vs Polkadot”.

“DeFi and CeFi have their respective advantages and shortcomings,” said Cai Minjie. “The advantage of DeFi is that anyone can use it without further requirements of custody, audit, and authority, which is certainly much more convenient than CeFi. However, centralized platforms provide a better user experience and low barrier of entry from usage perspective. Kava hopes to integrate its products with the features of centralized platforms and allow customers to navigate from CeFi to DeFi without leaving the platform. The DeFi mode is still the direction of future growth.

Photo: BitMax.io

Margaret, Operation Director of dForce viewed DeFi still in a very early stage of development. “High-quality on-chain assets are very scarce right now. With the gradual maturity of the DeFi ecosystem, the compatibility and scalability between DeFi protocols are improving. dForce will seek to innovate in different types of protocol next year and hope to bring to market more innovative product designs, including the DeFi governance and landing mode which can better encourage user participation in the ecosystem buildout for future return. Margaret also noted that DeFi projects must have more high-quality on-chain assets as the foundation in order to achieve increasing market growth like quantum leap.

Rudy Lu, Marketing Director of InfStones regarded staking as one type of DeFi products. However, the market size had been too small and people just started to realize that. The essence of Ethereum 2.0 bunding is to return the token to the project to earn risk-free interest rate. In his opinion, there will be a new set of DeFi implementations built upon the concept of staking in the future, including derivatives and aggregators. There will be all kinds of superimposed products to drive overall DeFi market growth.

Ka Mie, Founder of Stafi, explained the balance between DeFi and CeFi. “In the future, regardless of decentralization, some customers still need high-end, convenient, and cheap services. In this case, there will still be a significant level of competition between CeFi and DeFi. So, it is a good strategy for centralized platforms to provide DeFi solutions to meet different user requirements. If we don’t embrace innovation, we will be likely falling behind the pack and on the losing end. Startups should consider more options and innovation at both DeFi and CeFi levels,” said Ka Mie.

Photo: BitMax.io

In terms of future opportunities, WangXi, Partner of Bixin Capital, is more optimistic about micro innovation DeFi projects such as crypto art. In his view, crypto art is the first aesthetic revolution led by engineers, which is also first collaboration between art and technology and subsequently may increase the market size in the future. “There might be more audience if you conduct activities accompanied with some crypto art exhibitions.”

2020 is the year of digital assets. With the broad-based market adoption and the large-scale entry of institutional players, users and trading volume has continued rising high. With intensified competition in digitial asset industry, exchanges and trading platforms will need to think beyond just simple client acquisition and retention but more dynamic strategic plays in trading innovation, user experience enhancement and proper regulatory framework development to survive and thrive in the longer run.

In the past year, BitMax has strived to build on its deep background and expertise in financial markets, make key breakthroughs and successfully set itself apart from other similar competitors. With current encouraging market development and further global adoption, BitMax is very well positioned to continue its accelerated growth and lead future industry innovation in the upcoming year.

Photo: BitMax.io

Please check out latest news, expert comments and industry insights from Coinspeaker's contributors.