The San Francisco-based venture capital firm, Andra Capital, is planning to issue its own Silicon Valley Coin (SVC) via a Security Token Offering (STO). The project comes after a collaboration with the Tezos Foundation, and it will be built on the latter’s blockchain. Following this announcement, XTZ notes a daily increase of almost 9% against the dollar.Andra Capital Partners With Tezos To Issue SVC TokenAs reported earlier today, the California VC company will work with the Tezos Foundation to ultimately launch the Silicon Valley Coin. To do so, Andra Capital will utilize TokenSoft’s issuance platform.The firm’s open-ended technology fund, commonly referred to as the “Fund,” will mainly use the SVC to invest in late-stage, private tech companies. Furthermore, the new token will also

Topics:

Jordan Lyanchev considers the following as important: AA News, Tezos, Tezos (XTZ) Price

This could be interesting, too:

Chayanika Deka writes Yuga Labs Secures Major Win as SEC Closes Investigation Without Charges

Andrew Throuvalas writes Bitcoin Soars Back To ,000 After BlackRock CEO Says “Buy The Dip”

Chayanika Deka writes XRP, SOL, and ADA Inclusion in US Crypto Reserve Pushes Traders on Edge

Chayanika Deka writes Why Arthur Hayes Is Bullish on Bitcoin Under Trump’s Economic Strategy

The San Francisco-based venture capital firm, Andra Capital, is planning to issue its own Silicon Valley Coin (SVC) via a Security Token Offering (STO). The project comes after a collaboration with the Tezos Foundation, and it will be built on the latter’s blockchain. Following this announcement, XTZ notes a daily increase of almost 9% against the dollar.

Andra Capital Partners With Tezos To Issue SVC Token

As reported earlier today, the California VC company will work with the Tezos Foundation to ultimately launch the Silicon Valley Coin. To do so, Andra Capital will utilize TokenSoft’s issuance platform.

The firm’s open-ended technology fund, commonly referred to as the “Fund,” will mainly use the SVC to invest in late-stage, private tech companies. Furthermore, the new token will also provide the investment opportunity for “qualified purchasers in the U.S. and permitted investors around the globe.” Additionally, investors will be able to take delivery of the blockchain-based SVC.

According to Sam Raman, Head of Strategic Partnerships at Andra Capital, his company is employing the best of both worlds with TokenSoft and the Tezos Foundation:

“The TokenSoft platform provides the technology for qualified retail investors to participate in desirable, late-stage, pre-IPO technology venture companies, and we have partnered with the best-in-class providers including the Tezos Foundation for its expertise in digital securities for the Silicon Valley Coin offering.”

Alison Mangiero, the President of TQ Tezos, also spoke about the collaboration and the forthcoming product. She said that they are “thrilled to see venture capital firms embrace digital securities, which allow them to easily and compliantly offer global investors access to a historically exclusive asset class.”

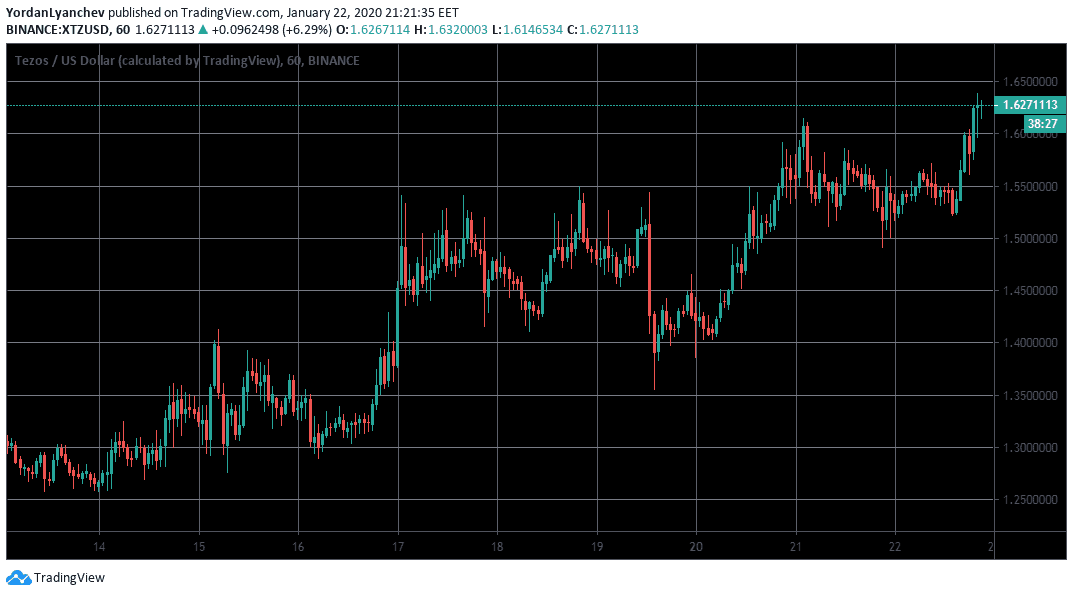

Tezos Price Reaction

The native cryptocurrency of Tezos is on the rise today. XTZ traded at around $1.50 yesterday but has surged to the current price of $1.63, which is an increase of almost 9%. Naturally, its total market capitalization also grows to $1.127 B and is currently occupying the 13th place among the top 100 coins ranked by the same factor.

When compared to the largest cryptocurrency, XTZ also displays an impressive 8% gain over the last 24 hours. Just over a week ago, XTZ/BTC went down to 1480 SAT. However, since then, Tezos has been continuously ascending and is currently trading at1888 SAT. This represents a 27% move upwards since the 15th of January.