The tenth-largest cryptocurrency by market cap, Tezos (XTZ), has the most assets locked in staking with over .8 billion. The popular blockchain protocol has been especially attractive to investors lately and has surpassed the former leader of staking – EOS.XTZ Locked In StakingPer data from the monitoring website, Staking Rewards, Tezos became the leading in terms of assets locked in staking over the past month. As of April 24th, the total amount equaled to .81 billion. Interestingly, as the total market cap of Tezos is approximately .95B, it would mean that nearly 93% of all XTZ in circulation is locked.Tezos/EOS/ALGO/ATOM/DASH Staking. Source: StakingRewards.comEOS now has about .6 billion, in the second place, which is 64% of its total market capitalization (.5B at the time of

Topics:

Jordan Lyanchev considers the following as important: AA News, EOSBTC, eosusd, Proof of Stake (PoS), Tezos, Tezos (XTZ) Price, TRXBTC, TRXUSD, XTZBTC, XTZUSD

This could be interesting, too:

Chayanika Deka writes Yuga Labs Secures Major Win as SEC Closes Investigation Without Charges

Andrew Throuvalas writes Bitcoin Soars Back To ,000 After BlackRock CEO Says “Buy The Dip”

Chayanika Deka writes XRP, SOL, and ADA Inclusion in US Crypto Reserve Pushes Traders on Edge

Chayanika Deka writes Why Arthur Hayes Is Bullish on Bitcoin Under Trump’s Economic Strategy

The tenth-largest cryptocurrency by market cap, Tezos (XTZ), has the most assets locked in staking with over $1.8 billion. The popular blockchain protocol has been especially attractive to investors lately and has surpassed the former leader of staking – EOS.

XTZ Locked In Staking

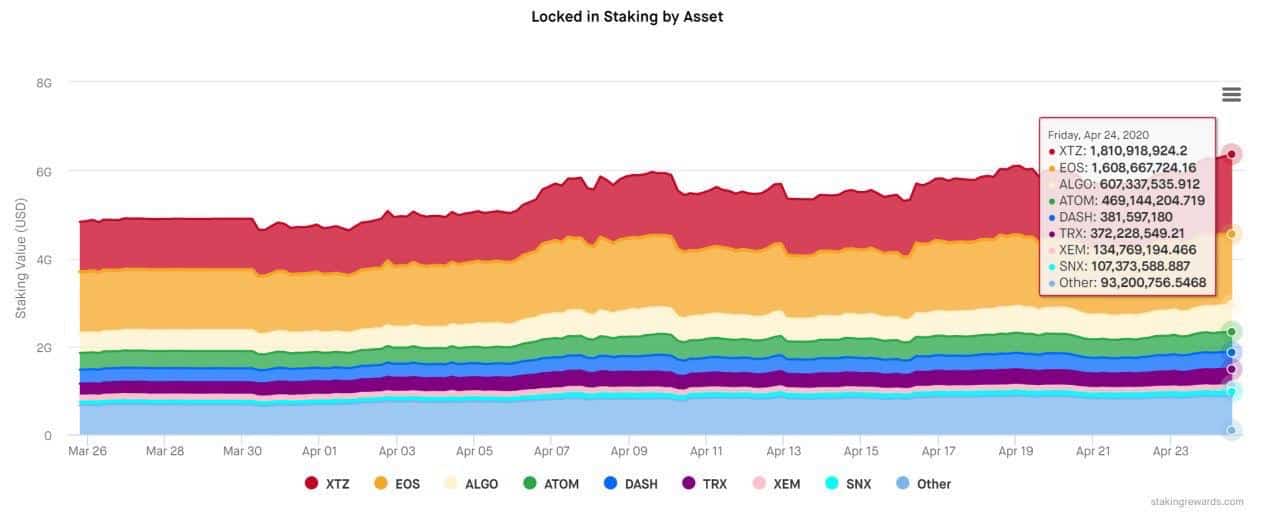

Per data from the monitoring website, Staking Rewards, Tezos became the leading in terms of assets locked in staking over the past month. As of April 24th, the total amount equaled to $1.81 billion. Interestingly, as the total market cap of Tezos is approximately $1.95B, it would mean that nearly 93% of all XTZ in circulation is locked.

EOS now has about $1.6 billion, in the second place, which is 64% of its total market capitalization ($2.5B at the time of this writing). Algorand (ALGO), Cosmos (ATOM), Dash (DASH), and Tron (TRX) are next on this list.

Tezos became accessible for staking over the past several months, as the coin surpassed the $1 price mark. To attribute for its growth on the matter, some of the most widely used cryptocurrency exchanges started offering XTZ staking. Those included Kraken, Coinbase, and Binance, which even announced a zero-fee Tezos staking in-exchange mechanism.

Tezos staking requires investors to “lock” a certain amount of coins, which are based on the Proof-of-Stake consensus algorithm or many of its varieties. The holders who “stake” their assets usually get the right to vote and to participate in the governance of the network. As they are not using the staked amount, they receive rewards for it, which could make it somewhat profitable.

As the data from above proves, cryptocurrency investors are quite fond of the process. Therefore, one can now employ even some digital wallets to stake a particular set of coins.

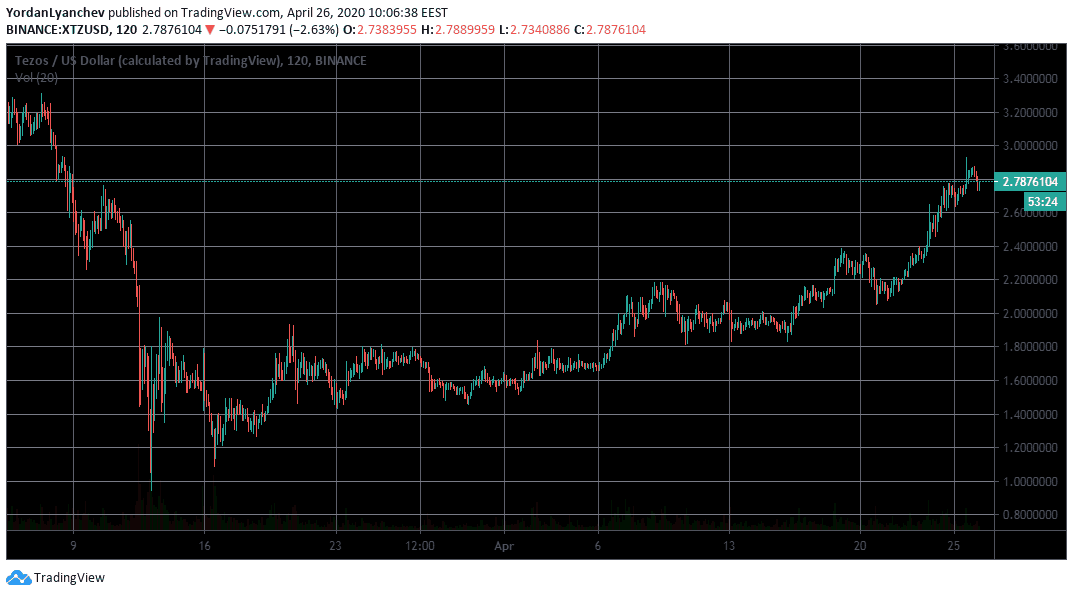

Tezos Price Actions

The price developments of XTZ have been similarly impressive lately, which made it even more attractive for staking. Ever since it briefly dipped below $1 during the massive sell-offs in mid-March, Tezos has been on a role. It’s currently trading at $2.77, which represents a 195% surge in just six weeks, outperforming Bitcoin.

From a technical standpoint, XTZ managed to shatter the previous resistance levels on its way up. The next one is at $3, followed by $3.3. Contrary, if the price of the asset starts retracing, the first key support line lies at $2.38, and the next one is $2.07.