Its unique features give ZeroSwap an edge over the incumbents and boost its attractiveness to users.The Decentralised Finance (DeFi) space is growing at an astonishing pace with investors keen to make the most out of this frenzy. The Blockchain developers’ community has played a significant role by providing the necessary tools to accelerate DeFi growth. Decentralised Exchanges (DEX) have been central to this movement by facilitating simple, efficient, and cheap means for participating in the space.Through DEXes, users are able to provide and access liquidity, invest in token offerings and trade various digital assets. Unfortunately, due to the limitations of the existing DEXes, users are not able to conduct all of these operations on a single platform. Rather, they are forced to juggle

Topics:

<title> considers the following as important:

This could be interesting, too:

Emmanuel (Parlons Bitcoin) writes Un code moral pour l’âge d’or, la règle Bitcoin

Bitcoin Schweiz News writes April-Boom an den Märkten: Warum Aktien und Bitcoin jetzt durchstarten

Bitcoin Schweiz News writes VanEck registriert ersten BNB-ETF in den USA – Nächster Meilenstein für Krypto-ETFs?

Fintechnews Switzerland writes Revolut Hits Milestone of One Million Users in Switzerland

Bitcoin Schweiz News writes US-Rezession als Bitcoin-Turbo? BlackRock überrascht mit kühner Prognose

Its unique features give ZeroSwap an edge over the incumbents and boost its attractiveness to users.

The Decentralised Finance (DeFi) space is growing at an astonishing pace with investors keen to make the most out of this frenzy. The Blockchain developers’ community has played a significant role by providing the necessary tools to accelerate DeFi growth. Decentralised Exchanges (DEX) have been central to this movement by facilitating simple, efficient, and cheap means for participating in the space.

Through DEXes, users are able to provide and access liquidity, invest in token offerings and trade various digital assets. Unfortunately, due to the limitations of the existing DEXes, users are not able to conduct all of these operations on a single platform. Rather, they are forced to juggle between different DEXes to access their preferred service and cryptocurrencies. ZeroSwap intends to put an end to this hassle by providing all these solutions on a single platform.

What is ZeroSwap?

ZeroSwap is a multi-chain protocol for liquidity mining, market making, DeFi Token Offering, and DEX Aggregation. The decentralised platform provides all of these services at zero cost to the users that is enabled by transaction fee mining.

ZeroSwap’s mission is to empower the DeFi ecosystem by creating more robust technology to help others within the space to become efficient, faster and simpler. To achieve this goal, the ZeroSwap team is building their platform on both Ethereum and Binance Smart Chain with development on other protocols set to follow soon. Upon completion, users will be able to make both on-chain and cross-chain trades without paying any fees. Instead, the platform will reward its users with the native ZEE tokens for every transaction and providing liquidity to existing DEXes. To ensure the self-sustainability of these feeless trades, a percentage of the tokens will be burnt for each instance.

ZeroSwap Valuation Analysis

ZeroSwap is a promising project with unique attributes that differentiate it from other decentralised platforms. The analysis of these attributes coupled with peer and DEX ecosystem reviews helps paint a clear picture of the project’s huge potential and shows why it is a highly valued project.

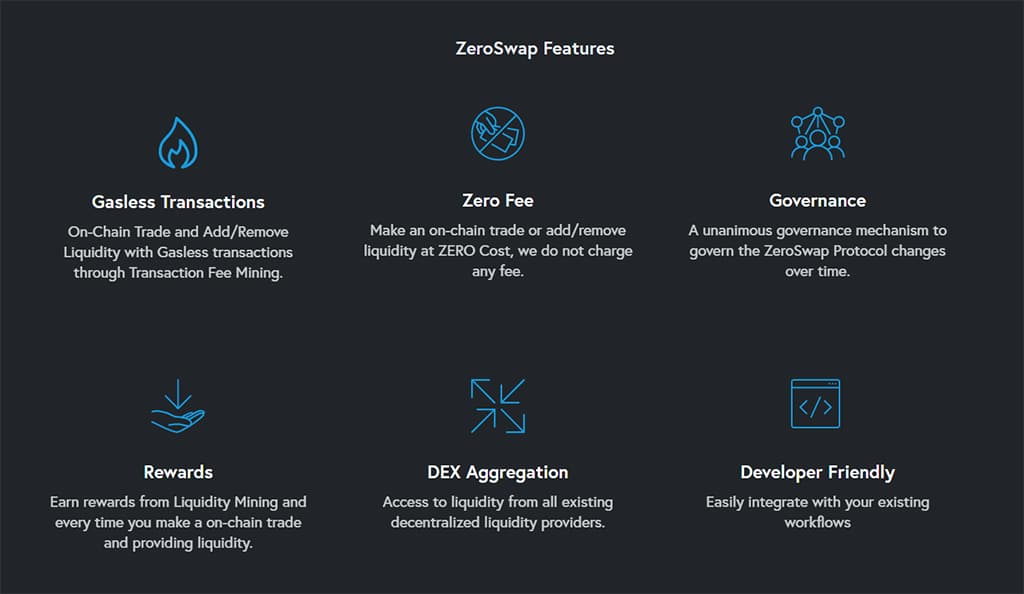

Photo: Zeroswap

ZeroSwap Core features

ZeroSwap is no ordinary DEX but rather a versatile one-stop shop for all DeFi operations. It is a one of its kind platform that grants users access to a wide range of blockchain-based financial products and services from various networks. This is enabled by the following features:

- Gasless Transactions — All on-chain trades and addition/removal of liquidity will be processed via gas-less transactions, this will happen through transaction fee mining.

- Zero-Fee — Addition/removal of liquidity and trading on protocol would be at ZERO Cost.

- Rewards — Users will earn rewards from Liquidity Mining and every time they make an on-chain trade and provide liquidity.

- DEX Aggregation — the platform aggregates liquidity from all the existing protocols to facilitate the best rates.

- Governance — A unanimous governance mechanism to govern the ZeroSwap Protocol changes over time.

- Developer Friendly — ZeroSwap SDK, is easy to build and integrate with existing workflows.

ZeroSwap Utilities

ZeroSwap’s core features support its multiple functionalities and grant users access to a wide range of services. These are available through this set of utilities:

- Liquidity mining – Users can earn rewards by pooling in liquidity to DEX via ZeroSwap

- DeFi Token Offering – A unique platform to kickstart DeFi Token Launch with ZERO cost

- Market Making Suite – ZeroSwap SDK – Ubiquitous Market Making Suite for DeFi, Empowering on-chain trading truly

- Multi Chain – ZeroSwap will be a Multi-Chain protocol, starting with Ethereum and Binance Smart Chain

Peer Analysis

DEXes are gradually stamping their authority in the crypto ecosystem as their uptake grows with time. As a result, the popularity of entities such as Uniswap, Sushiswap, and Paraswap has risen remarkably over the past few years. ZeroSwap’s entry into the scene couldn’t have come at a better time as users are flocking to these platforms that serve as gateways to the DeFi space. The platform will greatly appeal to such users as it offers over and above what is currently provided by its peers.

For instance, ZeroSwap’s multi-chain functionality will help users leverage earning opportunities available on different blockchains through a single platform. Existing DEXs are built on a specific protocol with users able to interact with only the products and services based on such a network. This unique feature boosts ZeroSwap’s superiority as users can do more as compared to platforms such as Uniswap.

DeFi Ecosystem Review

ZeroSwap entry into the DEX space is perfectly timed with DeFi growing at an explosive rate as more people are entering into the sector. Monthly DEX volume peaked at $12 billion in Aug. 2020, thanks to the ever-increasing demand for DeFi products. The total value locked in DeFi is currently over $10.81 billion according to DefiPulse. This translates to more than 200% Year on Year growth to date and rising. By the end of 2020, this figure could potentially eclipse the 300% growth recorded in 2019.

DEXes have performed remarkably well in comparison to their centralised counterparts. DEXes processed a total volume of $4 billion in 2020 with a year to date returns of 241% for DEX tokens as compared to 44% for CEX tokens. In Aug. 2020 DEXes surpassed CEX daily volume for the first time with UniSwap’s $426 million eclipsing Coinbase $348 million. This trend looks set to continue with UniSwap’s $15.3 billion monthly volume in September surpassing $13.6 billion processed by Coinbase.

These figures are indicators of the surging demand for DeFi as the sector is slowly becoming an ideal alternative to the mainstream financial market. More importantly, the statistics show how DEXes are maturing and positioned to take over the market.

With the sector bearing such positive propositions, the stage is set for ZeroSwap to succeed. Its unique features give ZeroSwap an edge over the incumbents and boost its attractiveness to users. This effective combination positions ZeroSwap to take over the DEX space making it a very attractive investment for 2020.

Having obtained a diploma in Intercultural Communication, Julia continued her studies taking a Master’s degree in Economics and Management. Becoming captured by innovative technologies, Julia turned passionate about exploring emerging techs believing in their ability to transform all spheres of our life.