ICE’s Bitcoin futures trading platform, Bakkt, launched a few days ago. This was one of the most anticipated events of 2019 as it was supposed to clear the way for institutional money to enter the market. However, looking at the first week of trading, we can see that the volume on the platform has been nothing but disappointing. This is especially the case compared to CME Group’s Bitcoin futures contracts, whose recent volume numbers dwarfed those of Bakkt.Minimal VolumeAccording to Bakkt’s official website, during the first week of trading, the platform saw a total of 165 contracts purchased. The monthly futures contract contains 1 Bitcoin, meaning that the cash equivalent of that volume is roughly around .5 million based on Bitcoin’s average price throughout the week. This is

Topics:

George Georgiev considers the following as important:

This could be interesting, too:

Emmanuel (Parlons Bitcoin) writes Un code moral pour l’âge d’or, la règle Bitcoin

Bitcoin Schweiz News writes April-Boom an den Märkten: Warum Aktien und Bitcoin jetzt durchstarten

Bitcoin Schweiz News writes VanEck registriert ersten BNB-ETF in den USA – Nächster Meilenstein für Krypto-ETFs?

Fintechnews Switzerland writes Revolut Hits Milestone of One Million Users in Switzerland

Bitcoin Schweiz News writes US-Rezession als Bitcoin-Turbo? BlackRock überrascht mit kühner Prognose

ICE’s Bitcoin futures trading platform, Bakkt, launched a few days ago. This was one of the most anticipated events of 2019 as it was supposed to clear the way for institutional money to enter the market. However, looking at the first week of trading, we can see that the volume on the platform has been nothing but disappointing. This is especially the case compared to CME Group’s Bitcoin futures contracts, whose recent volume numbers dwarfed those of Bakkt.

Minimal Volume

According to Bakkt’s official website, during the first week of trading, the platform saw a total of 165 contracts purchased. The monthly futures contract contains 1 Bitcoin, meaning that the cash equivalent of that volume is roughly around $1.5 million based on Bitcoin’s average price throughout the week.

This is definitely disappointing, especially when one considers the hype that was created before the launch and the fact that many people thought that Bakkt would essentially open up the market to institutional cash flow.

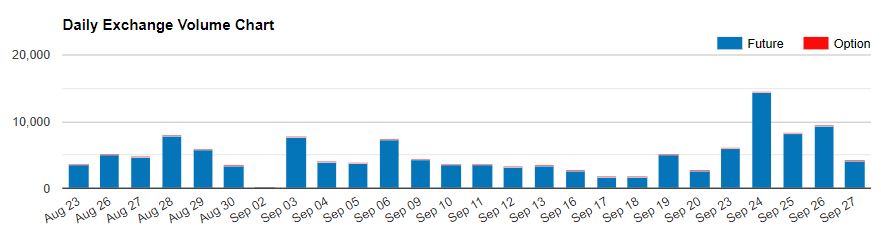

Unfortunately, this doesn’t seem to have been the case. At the same time, CME Group’s Bitcoin futures contracts continue to dwarf those of Bakkt in terms of volume. On September 27th alone, there were 4,099 contracts, each containing 5 Bitcoins, which is substantially more than Bakkt’s volume. This number was even higher on September 24, when upwards of 14,300 contracts were purchased.

What this goes to show is that it’s perhaps unwise to hype upcoming events and put faith in something whose actual market implications are unknown.

A Silver Lining?

Despite Bakkt’s disappointing first week, the platform is definitely a step in the right direction. While it may not have gotten the initial traction it was expected to get, Bakkt’s warehousing solution is regulated by the New York State Department of Financial Services (NYDFS), making it a qualified custodian.

In addition, Bakkt’s Bitcoin futures contract guarantees physical delivery. In other words, upon the expiration date, an investor will receive an actual Bitcoin rather than its cash equivalent. Purportedly, this guarantees liquidity that is much higher compared to futures contracts that don’t offer physical settlement. Despite the short-term disappointment, Bakkt is certainly a step in the right direction in the longer term.