Just a couple of days ago, Bitcoin plunged to ,000, losing ,500 of its USD value in less than an hour. This marked a severe drop of around 14% and had quite a lot of people worried about whether the bullish trend of 2019 has reversed. A closer look at the state of the network, however, as well as the long-term movement of the price reveals that everything might be just fine.Bitcoin Transactions At All-Time HighWith the latest developments in Bitcoin’s price, the community started to wonder if the bullish trend of this year has reversed. While the drop was significant, especially given the fact that it came after the launch of Bakkt and its underwhelming performance, a closer look at certain network metrics reveals that everything with the cryptocurrency is actually fine.First things

Topics:

George Georgiev considers the following as important:

This could be interesting, too:

Emmanuel (Parlons Bitcoin) writes Un code moral pour l’âge d’or, la règle Bitcoin

Bitcoin Schweiz News writes April-Boom an den Märkten: Warum Aktien und Bitcoin jetzt durchstarten

Bitcoin Schweiz News writes VanEck registriert ersten BNB-ETF in den USA – Nächster Meilenstein für Krypto-ETFs?

Fintechnews Switzerland writes Revolut Hits Milestone of One Million Users in Switzerland

Bitcoin Schweiz News writes US-Rezession als Bitcoin-Turbo? BlackRock überrascht mit kühner Prognose

Just a couple of days ago, Bitcoin plunged to $8,000, losing $1,500 of its USD value in less than an hour. This marked a severe drop of around 14% and had quite a lot of people worried about whether the bullish trend of 2019 has reversed. A closer look at the state of the network, however, as well as the long-term movement of the price reveals that everything might be just fine.

Bitcoin Transactions At All-Time High

With the latest developments in Bitcoin’s price, the community started to wonder if the bullish trend of this year has reversed. While the drop was significant, especially given the fact that it came after the launch of Bakkt and its underwhelming performance, a closer look at certain network metrics reveals that everything with the cryptocurrency is actually fine.

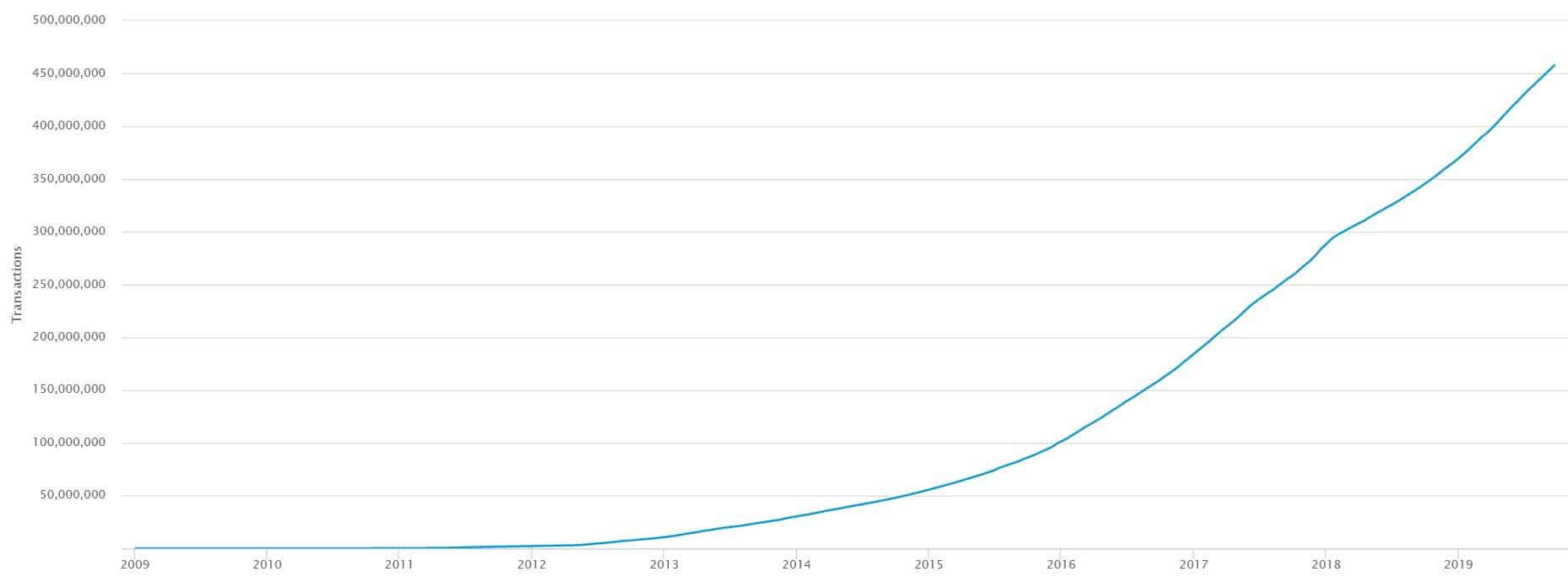

First things first, the 365 daily moving average of the number of on-chain transactions has been increasing progressively throughout the years and has reached an all-time high at the time of this writing.

Another thing to consider is Bitcoin’s inflation rate. Perhaps one of the best things about it is that it’s preprogrammed because of the cryptocurrency’s protocol. Looking at the chart, it tells us that the inflation rate has been decreasing progressively over the year.

As seen on the chart, it stays at around 3.7%, which is exactly as intended. Following the 2020 Bitcoin Halving, the inflation rate will drop to 1.8%.

The hash rate has also been increased substantially and despite the short-term drop which happened around the time of the price crash, it is again back on track and it’s more than 90 quintillion hashes per second. This demonstrates the network’s security.

Is Bitcoin’s Price Really An Issue?

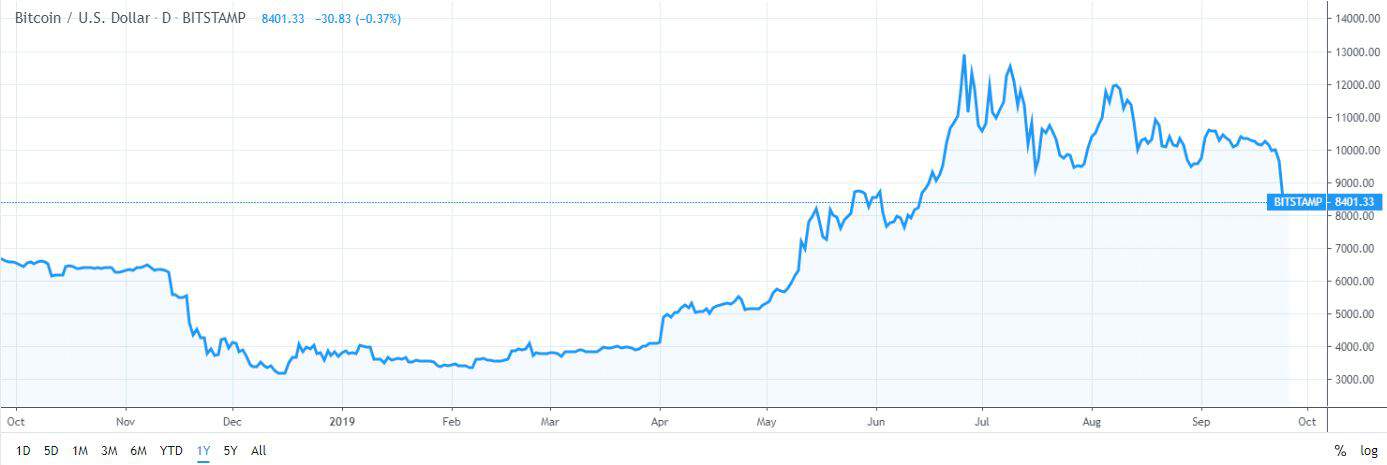

So, back to the main point – Bitcoin’s price. It’s true that the past months was rather turbulent and that we saw Bitcoin dropping from $14,000 to its current point at around $8,400.

However, looking at the bigger picture reveals that Bitcoin is still substantially up in the past year.

It started the year trading at around $3,700, which means that, so far, it marked an increase upwards of around 130%.

In other words, while it’s definitely important to account for short-term fluctuations, regardless of their direction, it’s also paramount to keep the bigger picture in mind. Bitcoin’s network looks better than ever and there have been major developments going on. Hence, fundamentals are in place and with the Bitcoin Halving being a few months away, it’s interesting to see where the price will take from here. Adding to the above, even banks are starting to receive crypto.