Bakkt’s Bitcoin futures trading platform appears to be gaining steam, seeing its highest trading volume day yesterday. After a slow start, the number of contracts traded on the 9th of October was 224. Interestingly enough, this happened on the same day that Bitcoin’s price surged to ,600, marking a three-week high.Bitcoin Price Surges to ,600After a few weeks of declines and sideways trading, Bitcoin finally saw a notable move, surging to ,600 in a matter of hours. The price climbed to a three-week high as volume numbers rose across the board.BTC/USD. Source: TradingViewAs CryptoPotato reported today, the bullish divergence, combined with a breakout of the descending wedge three days ago, was not disappointing for Bitcoin’s price. It will be interesting to see whether Bitcoin manages

Topics:

Jordan Lyanchev considers the following as important: AA News

This could be interesting, too:

Chayanika Deka writes Yuga Labs Secures Major Win as SEC Closes Investigation Without Charges

Andrew Throuvalas writes Bitcoin Soars Back To ,000 After BlackRock CEO Says “Buy The Dip”

Chayanika Deka writes XRP, SOL, and ADA Inclusion in US Crypto Reserve Pushes Traders on Edge

Chayanika Deka writes Why Arthur Hayes Is Bullish on Bitcoin Under Trump’s Economic Strategy

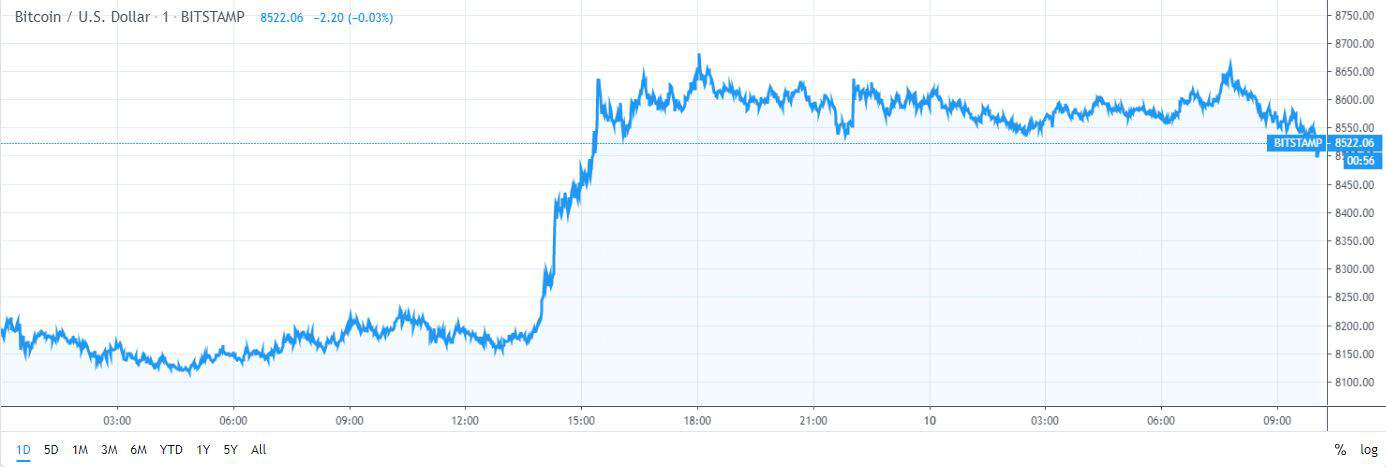

Bakkt’s Bitcoin futures trading platform appears to be gaining steam, seeing its highest trading volume day yesterday. After a slow start, the number of contracts traded on the 9th of October was 224. Interestingly enough, this happened on the same day that Bitcoin’s price surged to $8,600, marking a three-week high.

Bitcoin Price Surges to $8,600

After a few weeks of declines and sideways trading, Bitcoin finally saw a notable move, surging to $8,600 in a matter of hours. The price climbed to a three-week high as volume numbers rose across the board.

As CryptoPotato reported today, the bullish divergence, combined with a breakout of the descending wedge three days ago, was not disappointing for Bitcoin’s price. It will be interesting to see whether Bitcoin manages to push beyond the upcoming resistance at the 200-day moving average line.

It’s also worth noting that Bitcoin’s dominance rate has been declining throughout the past three weeks, and some of the altcoins have managed to capitalize on that. Ether (ETH), Ripple (XRP), and Binance Coin (BNB) all made notable gains against the USD and against Bitcoin as well. It appears that the trend during the second half of 2019 of altcoins failing to take advantage of the opportunities presented by the declining price of Bitcoin might be reversing.

Bakkt Trading Volume Also Surges

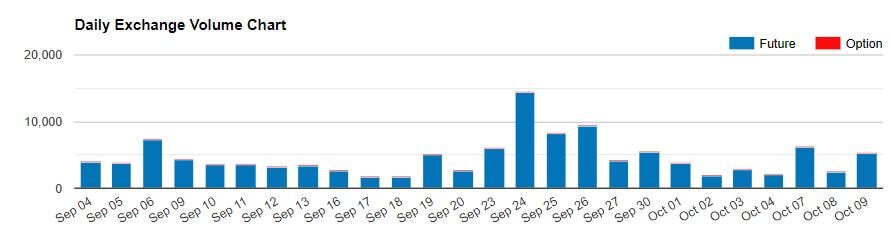

Despite kicking off with negligible volume, Bakkt saw a surge in the volume of its monthly Bitcoin futures contracts.

According to the Bakkt Volume Bot, yesterday the platform saw a total of 224 traded contracts, which is an all-time high. Given that each contract represents 1 bitcoin, the total cash equivalent is $1.9 million.

Daily summary of Wednesday’s Bakkt Bitcoin Monthly Futures:

? Traded contracts: 224 (+796%) (New ATH ?)

? Day before: 25

? New all time high: 224Follow @BakktBot for realtime updates. pic.twitter.com/gd7nu1GndG

— Bakkt Volume Bot (@BakktBot) October 10, 2019

Bakkt Still Has a Long Way to Go

Despite Bakkt’s notable volume increase, the number of traded contracts is far behind that of the Chicago Mercantile Exchange. CME also saw a significant volume increase yesterday, with the number of traded contracts more than doubling from 2,500 to 5,200.

However, there are a few key differences between these two platforms’ contracts. One CME Bitcoin futures contract represents 5 bitcoins, rather than Bakkt’s 1. Thus, the difference between the platforms’ respective volumes is even more substantial.

On the other hand, Bakkt provides physical delivery. When a contract expires, each investor receives an actual Bitcoin rather than its cash equivalent as with CME and other futures contracts. This is believed to have a greater impact on the liquidity of the market.