The bitcoin price dropped by 31% since October 26, in just over a month. Yet, Blockchain Capital partner Spencer Bogart sees strengthening fundamentals pushing BTC up in the medium-term. The cryptocurrency market showed signs of stagnation throughout November following China’s crackdown on small exchanges and the sell-off of bitcoin on spot exchanges like Huobi and Binance.Bitcoin is nearing a critical juncture as its recent sell-off shows few signs of slowing. Blockchain Capital's Spencer Bogart sees Bitcoin prices going higher https://t.co/EKGtumm5x9 pic.twitter.com/gUZUIG3KFn— Bloomberg TV (@BloombergTV) December 2, 2019Why Prominent Investors are Confident in Medium to Long-Term Bitcoin Price TrendAs said by Adaptive Fund partner Willy Woo, short-term price movements in the bitcoin

Topics:

Joseph Young considers the following as important: Cryptocurrency News

This could be interesting, too:

Temitope Olatunji writes X Empire Unveils ‘Chill Phase’ Update: Community to Benefit from Expanded Tokenomics

Bhushan Akolkar writes Cardano Investors Continue to Be Hopeful despite 11% ADA Price Drop

Bena Ilyas writes Stablecoin Transactions Constitute 43% of Sub-Saharan Africa’s Volume

Chimamanda U. Martha writes Crypto Exchange ADEX Teams Up with Unizen to Enhance Trading Experience for Users

The bitcoin price dropped by 31% since October 26, in just over a month. Yet, Blockchain Capital partner Spencer Bogart sees strengthening fundamentals pushing BTC up in the medium-term.

The cryptocurrency market showed signs of stagnation throughout November following China’s crackdown on small exchanges and the sell-off of bitcoin on spot exchanges like Huobi and Binance.

Bitcoin is nearing a critical juncture as its recent sell-off shows few signs of slowing. Blockchain Capital's Spencer Bogart sees Bitcoin prices going higher https://t.co/EKGtumm5x9 pic.twitter.com/gUZUIG3KFn

— Bloomberg TV (@BloombergTV) December 2, 2019

Why Prominent Investors are Confident in Medium to Long-Term Bitcoin Price Trend

As said by Adaptive Fund partner Willy Woo, short-term price movements in the bitcoin market are often led by margin trading platforms like BitMEX.

Consecutive liquidations of either short or long contracts tend to fuel minor rallies or corrections, causing intense volatility. As such, short-term price trends of bitcoin are difficult to predict and are almost always conditional.

BTC market in a nutshell:

Long term price is determined by investor activity and adoption curve. The domain of on-chain fundamentals.

Short term price is determined by a random walk of pivots in the direction of liquidating the most traders on BitMEX.

— Willy Woo (@woonomic) November 23, 2019

But, the medium to long-term trend of bitcoin can be identified with fundamental data and indicators.

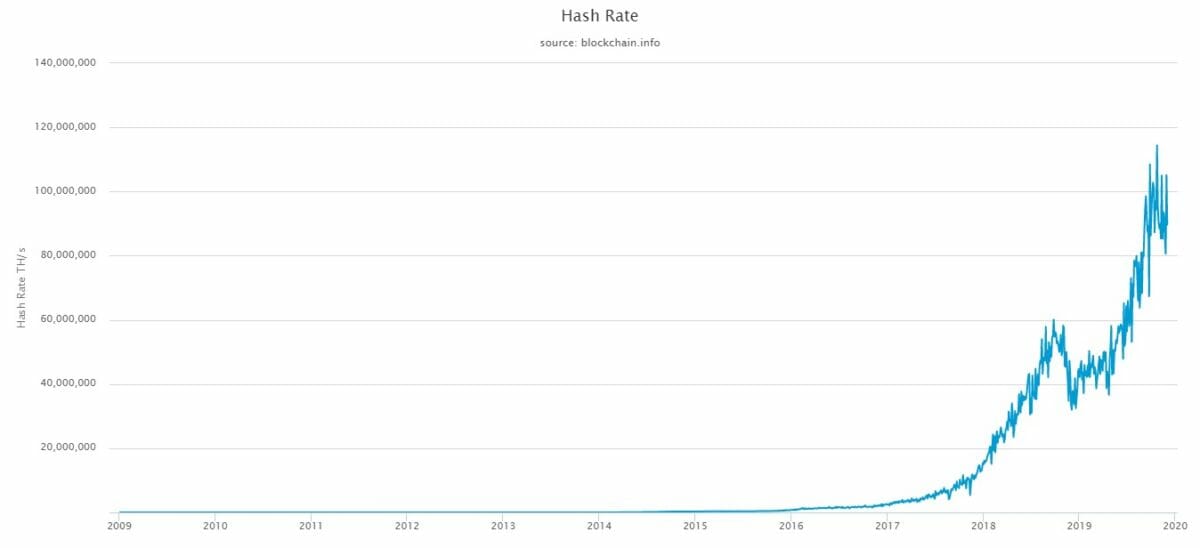

When evaluating cryptocurrencies, analysts explore three major areas: transaction volume, developer activity, and hash rate.

Growth in all three areas indicate that that the user activity of a cryptocurrency is rising as developers and miners continue to strengthen network security.

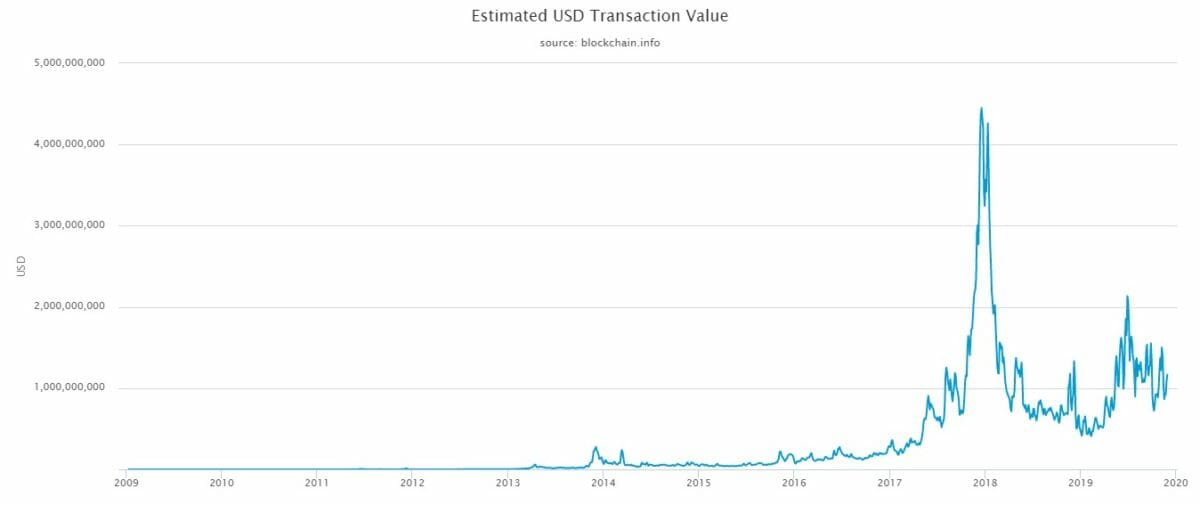

According to Blockchain.com, total daily BTC transaction volume denominated by the U.S. dollar has increased from around $315 million in January 2017 to over $1 billion in December 2019.

Hash rate, which represents the total amount of computing power securing the Bitcoin network, rose from 0.3 exahash to over 100 exahash in the same period.

Based on the fundamentals, Bogart said during an interview with Bloomberg that the bitcoin price will move higher over the next several years.

He said:

I don’t think that bitcoin’s future is anyway dependent on what China does. So I think it is helpful to zoom out, get away from some of the near-term headlines because I think in general, any kind of short-term trading strategy around bitcoin is the wrong one.

I think the question people need to be asking is, is bitcoin going to be more successful in the next five years than today? I think if we look at all the underlying trends here, they are all very constructive. Bitcoin’s gone from being a joke just a few years ago to processing $1 to $3 billion worth of transactions daily.

How About 2019?

The bitcoin price is struggling to recover beyond key resistance levels in the mid-$7,000 region as the year’s end approaches.

The lack of momentum in the short-term price trend of BTC may leave it vulnerable to declining sentiment heading into 2020.

As seen in 2018, when negative sentiment is carried over from the fourth quarter to the first quarter of the subsequent year, a bear trend gets extended.

Whether bitcoin is currently in a bear market is arguable, given its two-fold increase from January 2019.

This article was edited by Samburaj Das.