According to a popular Decentralized Finance (DeFi) monitoring resource, the value that’s already locked in the space totals over billion. Interestingly enough, almost 60% of the market is currently overtaken by the Maker project. The majority of the money is also locked in lending solutions.Value Locked In DeFi Upwards Of BillionAccording to DeFiPulse, the value that is currently locked into DeFi-based solutions exceeds billion. This goes on to show how far the space has come in just a year.For comparison, this time last year, the money which was invested in DeFi-based solutions was about 6 million. In other words, this is a surge of more than 260%.DeFi Value Growth. Source: DeFipulse.comIt’s also important to note that the predominant market leader in the field remains Maker.

Topics:

George Georgiev considers the following as important: AA News, defi

This could be interesting, too:

Bitcoin Schweiz News writes Manuel Stagars: Eine neue Dokumentation über das Crypto Valley in Entwicklung

Bitcoin Schweiz News writes Tokenisierung live erleben: Von der Regulierung zur Praxis am 10. April in Zug

Bitcoin Schweiz News writes Ethereum Foundation fördert DeFiScan: Ein Meilenstein für Transparenz im DeFi-Sektor

Bitcoin Schweiz News writes Are US Gold Reserves Soon to Be Crypto Tokens? The Blockchain Revolution for National Gold

According to a popular Decentralized Finance (DeFi) monitoring resource, the value that’s already locked in the space totals over $1 billion. Interestingly enough, almost 60% of the market is currently overtaken by the Maker project. The majority of the money is also locked in lending solutions.

Value Locked In DeFi Upwards Of $1 Billion

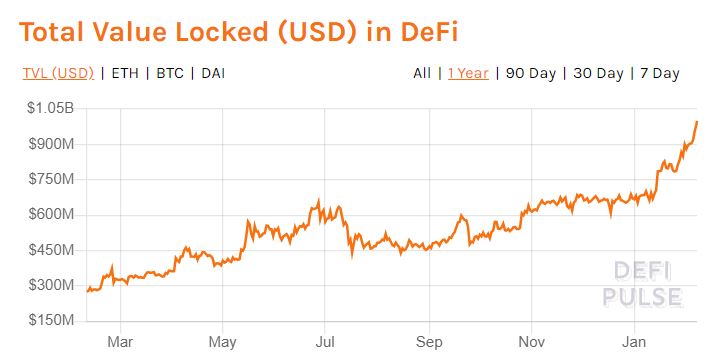

According to DeFiPulse, the value that is currently locked into DeFi-based solutions exceeds $1 billion. This goes on to show how far the space has come in just a year.

For comparison, this time last year, the money which was invested in DeFi-based solutions was about $276 million. In other words, this is a surge of more than 260%.

It’s also important to note that the predominant market leader in the field remains Maker. The value locked in its projects is upwards of $597 million or roughly 60% of the entire market.

People are putting most of their money in lending solutions. However, derivatives and payments are also creeping up.

DeFi Is Catching Up To Speed

Decentralized Finance is an exciting concept that became particularly popular in 2019. It attempts to establish a new monetary system that’s built on public blockchains.

The main idea is that this system won’t have a single point of failure because it’s decentralized. At the same time, this will also guarantee that it’s censorship-resistant and that people won’t be denied access based on wealth, ethnicity, location, and so forth.

There are different manifestations of DeFi and a lot of applications already created in the fields of payments, stablecoins, infrastructural projects, know-your-customer, credit and lending, insurance, custody, and others of the kind.

Maker is one of the most successful projects in the field. The team behind it created the DAI stablecoin, which is decentralized, and it’s still stable. This solves a lot of the issues that centralized stablecoins currently face. For instance, it’s governed by its community, and a single company like Tether does not control it, for example.