Oil exports plummeted, the rial halved in value, these are some of the results of the sanction imposed by the U.S. government on Iran. Iran is now suffering from economic recession and hyperinflation, and the COVID-19 certainly didn’t help the situation. But amid the crisis, there is one silver lining – the wider adoption of cryptocurrency.To combat hyperinflation, Iran has announced its plan to redenominate its fiat currency the rial and create a new fiat called the toman, which will remove four place values of the rial. Besides the creation of new currency, both the government and the public look to cryptocurrency, especially at Bitcoin.Bitcoin – the Digital Gold in IranIn the past few years, cryptocurrency has become one of the go-to solutions for countries ravaged by the economic

Topics:

Guest considers the following as important: Sponsored

This could be interesting, too:

Guest User writes The Power of Smart Contracts in the World of DeFi

Guest User writes Explore a Universe of Opportunities in Digital Asset Trading at KoinBay

Guest User writes Strategies for Success: Effective Strategies for Affiliate Marketing Beginners and Benefits for XERAPRO Users

Guest User writes The Benefits of WEWE Global’s Referral Marketing in the Crypto World

Oil exports plummeted, the rial halved in value, these are some of the results of the sanction imposed by the U.S. government on Iran. Iran is now suffering from economic recession and hyperinflation, and the COVID-19 certainly didn’t help the situation. But amid the crisis, there is one silver lining – the wider adoption of cryptocurrency.

To combat hyperinflation, Iran has announced its plan to redenominate its fiat currency the rial and create a new fiat called the toman, which will remove four place values of the rial. Besides the creation of new currency, both the government and the public look to cryptocurrency, especially at Bitcoin.

Bitcoin – the Digital Gold in Iran

In the past few years, cryptocurrency has become one of the go-to solutions for countries ravaged by the economic crisis, as it serves as a store of value as well as a de facto form of cash in international transactions. Venezuela, who launched a new cryptocurrency the petro in 2018, will allow shops and enterprises to settle payment via Bitcoin in June.

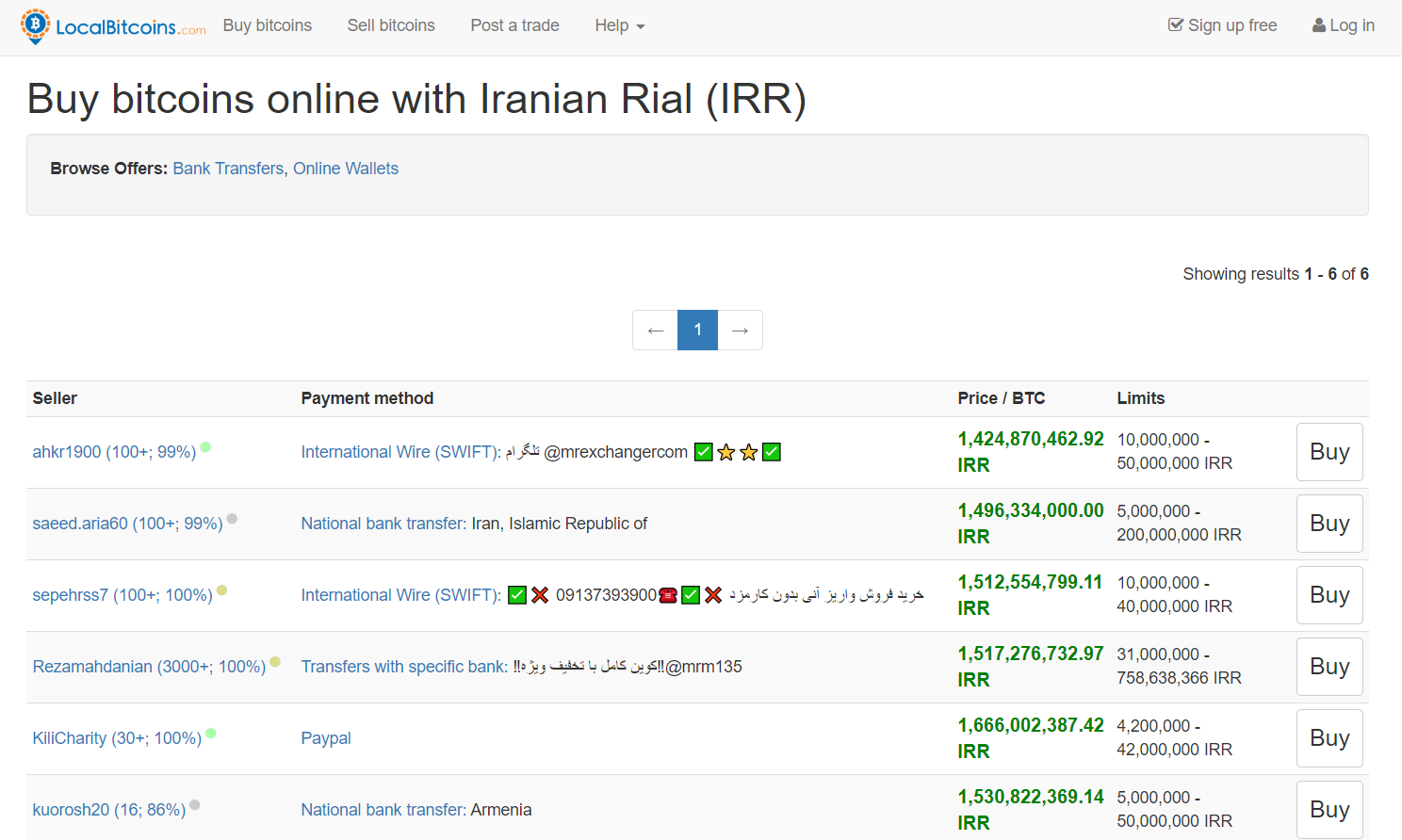

For Iran, the demand for Bitcoin only increases over time. At an official level, Iranian general Saeed Muhammad has suggested using cryptocurrencies to bypass the US sanctions; Iran’s central bank also cooperates with local blockchain solutions provider Areatak to develop a national blockchain project called Borna. There seems to be a bitcoin craze as local people flocked to exchange their fiat into bitcoin. In local peer-to-peer exchange, Bitcoin sold for between 300% and 400% of the global average price since 2020 is clear evidence of the substantial demand among Iranians.

By January 2020, Iran has issued 1,000 licenses for cryptocurrency mining. According to Amir Hossein Saeedi Nai, a member of the Information and Communications Technology (ICT) Guild Organization’s blockchain commission, the fully functioned mining industry could bring $8.5 billion into the local economy.

To accelerate its pace in cryptocurrency adoption, Iran recently granted a bitcoin mining license to Turkish mining firm iMiner. With the license, iMiner can not only operate 6,000 mining machines in Semnan city but also provides crypto custody and trading services to Iranians.

Nai also stated that the ICT Guild Organization is committed to creating a better environment for Iran’s cryptocurrency mining conditions and that the local mining activity is expected to see significant improvement once the electricity rate goes down and the cooperation between miners and power plants become more frequent.

“Mining, holding and trading of cryptocurrencies, especially BTC and ETH, is widely adopted in Iran. I’m sure in next months we will see more investment by the public, especially the middle class, in cryptocurrencies like BTC,” said Babak Behboudi, the CEO of blockchain innovation firm Synchronium. Bitcoin is gaining unprecedented popularity in Iran, and maybe it could replace fiat in some ways. We can expect more capital flowing from Iran to the crypto market in the foreseeable future, thus driving up the price of Bitcoin.

Bexplus to Offer Leveraged Futures Trading in Iran

“Bitcoin is borderless and immune to inflation. Iran’s adoption of Bitcoin will be a significant step in combating hyperinflation,” remarked by Knash Nikolsson, the marketing director of Bexplus, a bitcoin-based futures trading platform, “Bexplus hope to support Iranian traders during the pandemic. We welcome Iranian traders with open arms and will provide every user with the most attentive service.”

Established in 2017 and headquartered in Hong Kong, Bexplus provides 100x leverage futures trading on BTC, ETH, LTC, EOS, XRP and etc. Unlike Bitcoin spot trading, traders can take advantage of any price swing and make a profit in futures trading. Even at times of great volatility, traders can generate profits with the help of Bexplus. And its Stop Loss & Take Profit options could help them lower the risks and lock in profits.

Bexplus – Recommended Leverage Trading Platform

- No KYC requirement, registration with E-mail verification within a few minutes

- Demo account with 10 BTC for traders to get familiar with leverage trading

- 100% bonus for every deposit and 10% off of transaction fee

- Intuitive and full-featured App on Apple App Store and Google Play

- Affiliate program with up to 50% commission reward

- 24/7 customer support

Crypto EcoBlog

Crypto EcoBlog