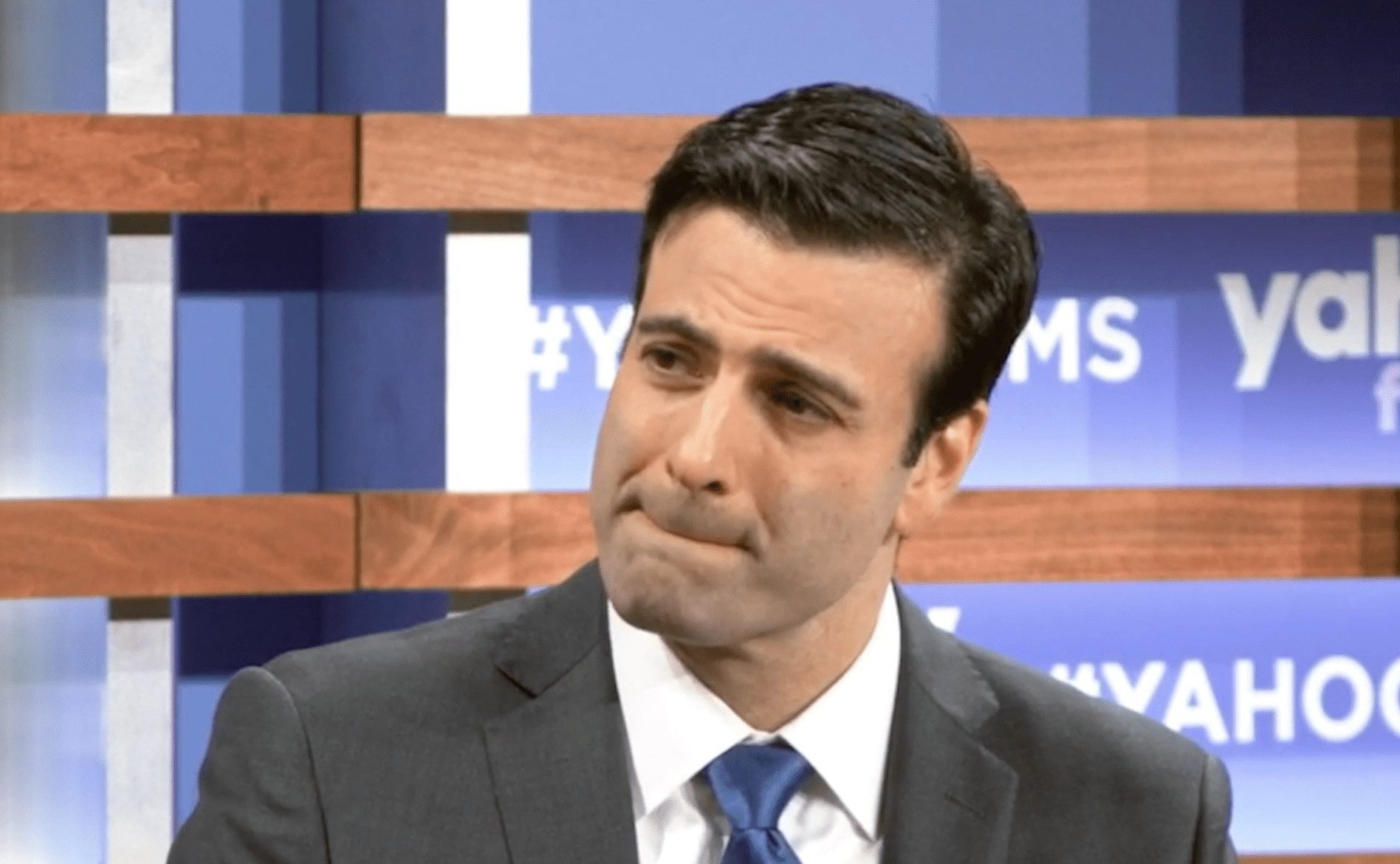

The US Commodity Futures Trading Commission (CFTC) published a new set of regulations for derivatives assets, including cryptocurrencies. The agency is developing comprehensive rules for digital assets to promote innovation in the field.CFTC’s New Legislation For CryptocurrenciesThe CFTC is the US’s derivatives regulator. According to the chairman, Heath P. Tarbert, derivatives, including futures, swaps, and options, “provide critical risk management and price discovery tools that can promote long-term stability and growth in the real economy.” Consequently, he believes that it’s his agency’s duty to introduce comprehensive regulations on all involved asset groups.Heath Tarbert CFTC Chairman. Source: YahooEstablished to operate as an independent agency in 1974, the CFTC grew in time to

Topics:

Jordan Lyanchev considers the following as important: AA News, CFTC, Regulations, United States

This could be interesting, too:

Chayanika Deka writes Yuga Labs Secures Major Win as SEC Closes Investigation Without Charges

Andrew Throuvalas writes Bitcoin Soars Back To ,000 After BlackRock CEO Says “Buy The Dip”

Chayanika Deka writes XRP, SOL, and ADA Inclusion in US Crypto Reserve Pushes Traders on Edge

Chayanika Deka writes Why Arthur Hayes Is Bullish on Bitcoin Under Trump’s Economic Strategy

The US Commodity Futures Trading Commission (CFTC) published a new set of regulations for derivatives assets, including cryptocurrencies. The agency is developing comprehensive rules for digital assets to promote innovation in the field.

CFTC’s New Legislation For Cryptocurrencies

The CFTC is the US’s derivatives regulator. According to the chairman, Heath P. Tarbert, derivatives, including futures, swaps, and options, “provide critical risk management and price discovery tools that can promote long-term stability and growth in the real economy.” Consequently, he believes that it’s his agency’s duty to introduce comprehensive regulations on all involved asset groups.

Established to operate as an independent agency in 1974, the CFTC grew in time to include energy and metals commodities such as crude oil, heating oil, gasoline, copper, gold, and silver.

In its strategic plan published earlier this week for 2020-2024, the agency outlined that it will oversee DCMs for financial products such as interest rates, stock indexes, foreign currency, and cryptocurrencies.

More specifically, the Commission said that it had granted DCM licenses for exchanges specializing in futures and options trading for digital assets. Those two platforms are the ErisX and LedgerX – both received such permits last year.

For the upcoming period from 2020 to 2024, the agency admitted that market regulations for the cryptocurrency field need to be intact with the current trends. As such, the CTFC noted developing “a holistic framework to promote responsible innovation in digital assets.”

CFTC Chairman On Crypto And Blockchain

Tarbert has been rather positive on the cryptocurrency and blockchain industries in the past while planning to establish more precise regulation at the same time.

In late 2019, he urged the US to become more receptive to technological innovations and to lead in blockchain and digital asset adoption. He said that cryptocurrencies could “have a fundamental transformational change to the global financial system.”

He doubled-down on his bullish views on blockchain in another interview later, saying that “I think whoever ends up leading in this technology will end up writing the rules of the road for the rest of the world. My emphasis is on making sure the United States is a leader.”

In January this year, Tarbert asserted that the CFTC is currently working to “legitimize and add liquidity to these (cryptocurrency) markets.”