The Singaporean multinational banking and financial services corporation DBS Bank has compiled a report on cryptocurrencies and the recent developments in the sector. The paper noted that central banks are both “troubled and intrigued” by the growing role of digital assets in today’s world, especially following the COVID-19 pandemic.DBS Bank: Cryptocurrencies Are GrowingHeadquartered in Marina Bay, DBS Bank is among the largest banks in the region. In its recent paper on cryptocurrencies, DBS said that while they were once perceived by central banks as entirely speculative assets with little-to-no real-life utilization, they have outgrown that mantra and have “captured the investor zeitgeist.”The COVID-19 pandemic and the actions taken by central banks have only highlighted their merits

Topics:

Jordan Lyanchev considers the following as important: AA News, Banks, singapore

This could be interesting, too:

Chayanika Deka writes SEC Closes Investigation Into Gemini, Winklevoss Seeks Reimbursement

Emily John writes Singapore Metro Store Adopts Stablecoins for Smooth Payments

Wayne Jones writes CZ Criticizes Safe Wallet’s Post-Mortem on Bybit Hack

Mandy Williams writes Bitcoin ETFs Record Over .6B in Outflows in the Past 2 Weeks

The Singaporean multinational banking and financial services corporation DBS Bank has compiled a report on cryptocurrencies and the recent developments in the sector. The paper noted that central banks are both “troubled and intrigued” by the growing role of digital assets in today’s world, especially following the COVID-19 pandemic.

DBS Bank: Cryptocurrencies Are Growing

Headquartered in Marina Bay, DBS Bank is among the largest banks in the region. In its recent paper on cryptocurrencies, DBS said that while they were once perceived by central banks as entirely speculative assets with little-to-no real-life utilization, they have outgrown that mantra and have “captured the investor zeitgeist.”

The COVID-19 pandemic and the actions taken by central banks have only highlighted their merits and accelerated the developments in the field, the paper added.

“Ever since central banks around the world embarked on an unprecedented expansion of their balance sheets to combat the COVID-19 pandemic-related economic headwinds, interest in cryptocurrencies, along with gold, has resurged.”

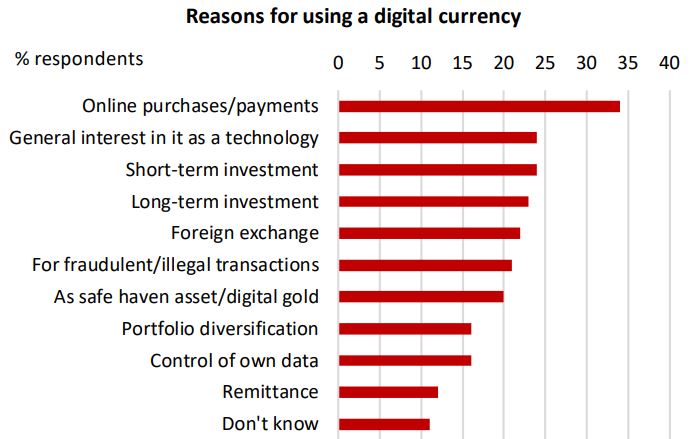

Although the paper outlined that Bitcoin’s maximum cap of 21 million makes it an enticing investment instrument or a store of value, it also brought up a poll indicating compelling results.

Nearly 35% of participants have responded that they employ BTC and other digital assets for online payments and purchases. At the same time, less than 25% of all answers go to “general interest in it as a technology, short-term investment, and long-term investment.”

Asia Leads The Way

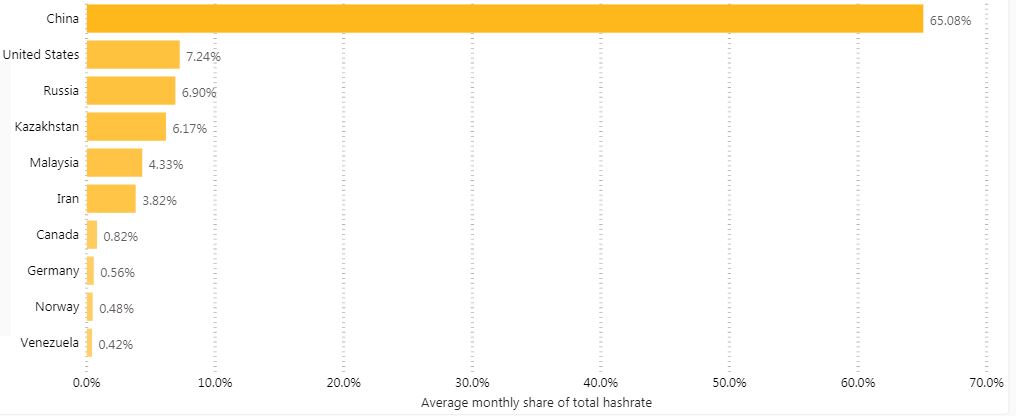

The document also asserted that Asian countries are most fond of cryptocurrencies and digital payments. According to the Bitcoin Mining Map tool tracking BTC Mining, China is the leader, with a significant difference from the country that follows – the USA.

DBS’s report also said that Singapore is the “global hub for initial coin offerings (ICOs)” with the US and Switzerland. Last year, the Parliament of Singapore passed the Payment Services Act to bring cryptocurrency operations under the supervision of the Monetary Authority of Singapore (MAS).

On the other hand, Hong Kong is the home of numerous cryptocurrency exchanges. The country’s Securities and Futures Commission (SFC) introduced new legislation in 2018, bringing digital assets funds managers and distributors under its regulation.

“Measured by traffic, liquidity and trading volume, half of the world’s top ten cryptocurrency exchanges are in Asia.” – the paper added.

Additionally, the world’s largest continent is also a leader in digital payments, as China “comprises almost half of the worldwide transaction value.”