Despite having a complicated past, it seems that JP Morgan’s love for Bitcoin is growing every day thanks to its potential as an investment and store of value. In a recent report, the American bank shared with its investors an analysis of Bitcoin’s current situation and possible future scenarios regarding prices and fundamental value. The bank explained that under the current conditions, Bitcoin has a good chance of increasing its price. JP Morgan Believes Bitcoin Could be an Alternative to Gold JP Morgan believes that investors could switch from gold to bitcoin as a way to diversify their portfolio and having another uncorrelated storage of value. This is especially important for those who don’t want to depend exclusively on gold when it comes to diversify their risk

Topics:

Felix Mollen considers the following as important: AA News, Bitcoin (BTC) Price, Bitcoin Adoption, Bitcoin Bull Run, Bitcoin Long-Term Prediction, jp morgan

This could be interesting, too:

Chayanika Deka writes SEC Closes Investigation Into Gemini, Winklevoss Seeks Reimbursement

Wayne Jones writes CZ Criticizes Safe Wallet’s Post-Mortem on Bybit Hack

Mandy Williams writes Bitcoin ETFs Record Over .6B in Outflows in the Past 2 Weeks

Wayne Jones writes This Trending AI Token Hits New ATH After Binance Listing

Despite having a complicated past, it seems that JP Morgan’s love for Bitcoin is growing every day thanks to its potential as an investment and store of value.

In a recent report, the American bank shared with its investors an analysis of Bitcoin’s current situation and possible future scenarios regarding prices and fundamental value. The bank explained that under the current conditions, Bitcoin has a good chance of increasing its price.

JP Morgan Believes Bitcoin Could be an Alternative to Gold

JP Morgan believes that investors could switch from gold to bitcoin as a way to diversify their portfolio and having another uncorrelated storage of value. This is especially important for those who don’t want to depend exclusively on gold when it comes to diversify their risk exposure:

“Even a modest crowding out of gold as an ‘alternative’ currency over the longer term would imply doubling or tripling of the bitcoin price.

The report also adds that adoption is key to increasing Bitcoin’s perceived utility, and therefore, its price. They explain that it is necessary to observe a more significant number of “economic agents” accepting cryptocurrencies as a means of payment in order to talk about a historical price appreciation scenario.

This is not far from reality. In fact, bitcoin is increasing acceptance by large economic agents (which seems to prove JP Morgan’s thesis). The recent rise in prices from $10,500 to the current $13,110 began after the payment processor Square announced a $50 million investment in Bitcoin.

PayPal’s announcement to support the purchase and sale of cryptocurrency -BTC, ETH, BCH, and LTC for now- also further catalyzed the crypto markets’ bullish sentiment.

A Generational Thing

JP Morgan also assures that Bitcoin’s acceptance within the global financial culture goes through a cultural or generational context. As boomers leave the market and millennials take a more prominent position, Bitcoin and other digital tokens become more relevant in the investment world.

“The potential long-term upside for bitcoin is considerable as it competes more intensely with gold as an ‘alternative’ currency we believe, given that Millenials would become over time a more important component of investors’ universe.”

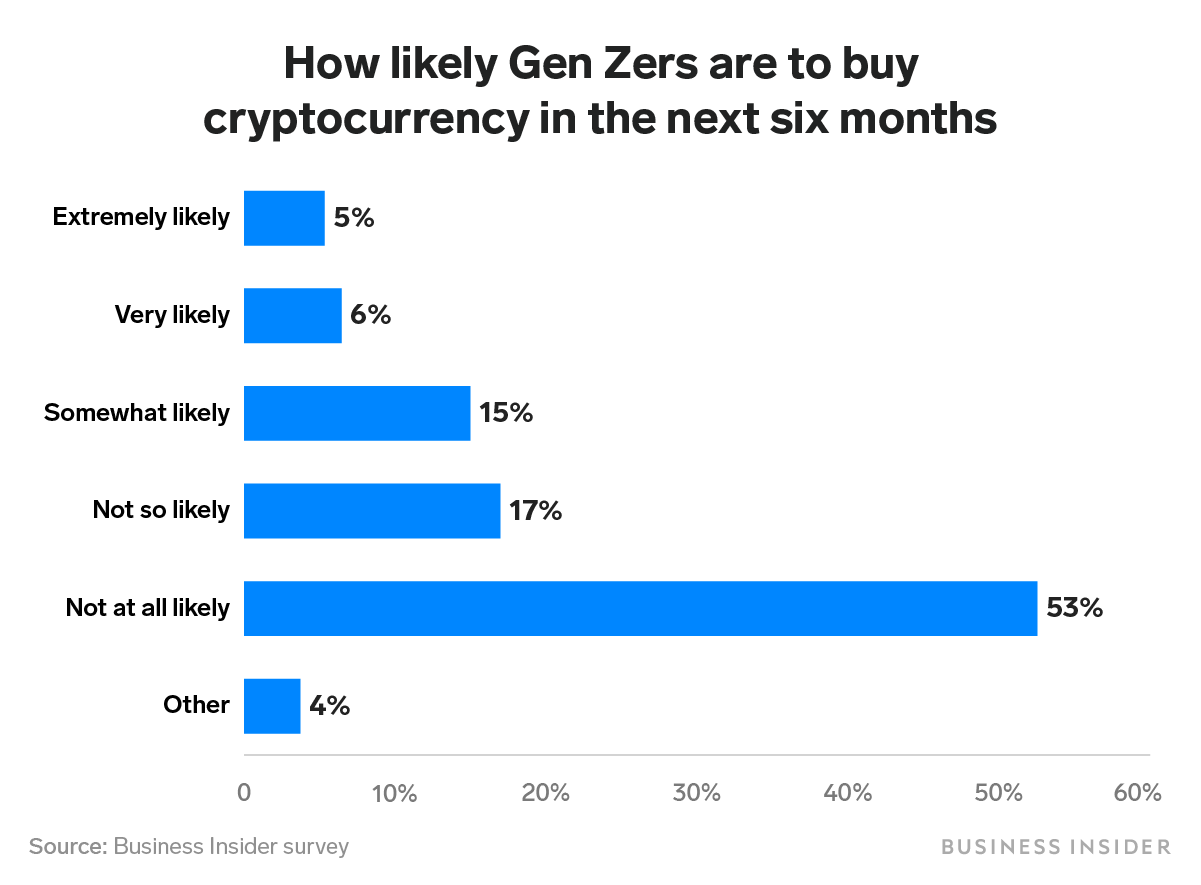

However, this assertion must be taken with a pinch of salt since studies reveal that Gen Z -the Millenials’ offspring- are not as enthusiastic about the use of crypto, opting for alternatives involving the digitalization of fiat money.

JP Morgan’s statements show the bank’s ability to adapt to new market trends, which is also characteristic of PayPal. Just two years ago, the bank’s CEO said Bitcoin was “worse than tulip bulbs” while PayPal’s CEO referred to Bitcoin in the same way:

“Bitcoin is the greatest scam in history. It’s a colossal pump-and-dump scheme, the likes of which the world has never seen.

Bitcoin is having a good time, with many models anticipating potential upward behavior over the next few months. The most controversial and discussed one, the stock-to-flow model, predicts that Bitcoin could reach $1 million by around 2026.

Crypto EcoBlog

Crypto EcoBlog