Named after the fermented Korean dish, Kimchi is a fork of the wildly popular SushiSwap protocol that was forked from Uniswap late last week. Launched on Tuesday, September 1, Kimchi has already accrued almost 0,000 in liquidity in less than 24 hours, according to its dashboard.In the first few hours after its launch, the protocol offered APYs upward of 120,000% on the KIMCHI/TEND pool, and more than 70,000% on the other KIMCHI pools. Even though these numbers have since decreased, they are still particularly considerable.Kimchi Finance Dashboard. Source: Kimchi FinanceA Clone of a Clone of a Clone?Kimchi is the latest crypto clone to join the DeFi food party. It offers a similar platform to SushiSwap, which has taken liquidity from Uniswap to offer greater rewards, which include a

Topics:

Martin Young considers the following as important: AA News, defi

This could be interesting, too:

Bitcoin Schweiz News writes Manuel Stagars: Eine neue Dokumentation über das Crypto Valley in Entwicklung

Bitcoin Schweiz News writes Tokenisierung live erleben: Von der Regulierung zur Praxis am 10. April in Zug

Bitcoin Schweiz News writes Ethereum Foundation fördert DeFiScan: Ein Meilenstein für Transparenz im DeFi-Sektor

Bitcoin Schweiz News writes Are US Gold Reserves Soon to Be Crypto Tokens? The Blockchain Revolution for National Gold

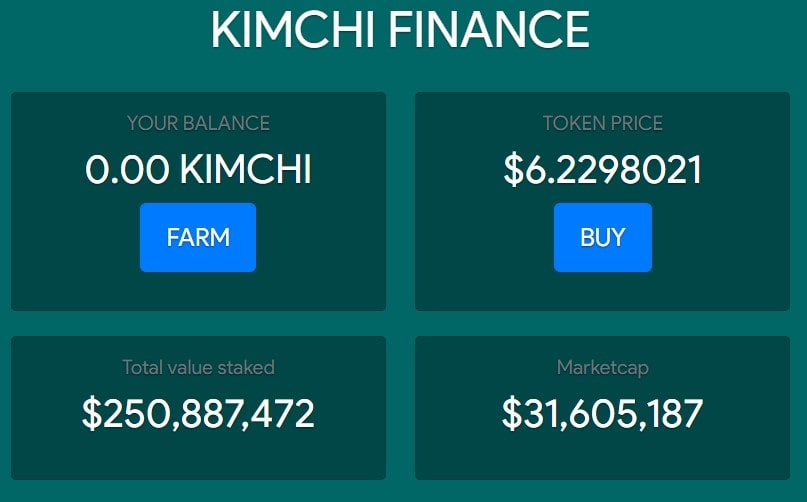

Named after the fermented Korean dish, Kimchi is a fork of the wildly popular SushiSwap protocol that was forked from Uniswap late last week. Launched on Tuesday, September 1, Kimchi has already accrued almost $250,000 in liquidity in less than 24 hours, according to its dashboard.

In the first few hours after its launch, the protocol offered APYs upward of 120,000% on the KIMCHI/TEND pool, and more than 70,000% on the other KIMCHI pools. Even though these numbers have since decreased, they are still particularly considerable.

A Clone of a Clone of a Clone?

Kimchi is the latest crypto clone to join the DeFi food party. It offers a similar platform to SushiSwap, which has taken liquidity from Uniswap to offer greater rewards, which include a governance token.

Initial findings indicate that Kimchi is actually a copy of Yuno Finance, which itself copied Sushi to offer better returns on Uniswap liquidity pool tokens. Yuno quipped that the cloners of the clone were posting fake TVL numbers;

“When kimchi copied our code, they didn’t even read through what is underneath. (And you didn’t remove our GA tags). Their actual TVL is around 5-8M. You guys are probably farming fake numbers anyways,”

KIMCHI allows yield farmers to deposit ETH, SUSHI, TEND, USDT, or Uniswap LP assets in the hope that they’ll earn ridiculously high interest for generating liquidity for the platform.

There’s a Catch

Developer Roman Semenov has delved a little deeper into the Kimchi sauce, revealing what could be the beginnings of a scam.

Looks like @kimchi_finance contract has a method that mines free tokens directly to developer’s address. Smells like a scam to me. Contract address: https://t.co/d5xxbTZQFl, current dev wallet: https://t.co/Qqvp9qAUqo pic.twitter.com/BPWP46mFWy

— Roman Semenov ?️ ? (@semenov_roman_) September 1, 2020

Kimchi replied, adding that they have benchmarked the Sushi’ timelock’ function and time-locked into ‘infinite loop,’ suggesting that there is no control over the protocol.

Meanwhile, BitMEX CEO Arthur Hayes, who has been shilling new DeFi food protocols for the past couple of weeks, was quick to add his approval for the new clone.

You know I love me some Korean food. KIMCHI is lit. It’s a stable of the CHAD diet. Get on my level. – he tweeted.

According to CoinGecko, which recently listed the latest DeFi token, Kimchi was trading hands for $6.20, which gives it an estimated market capitalization of $27 million.

At the time of writing, Sushi was trading down 30% from its peak earlier this week at around $7.20, according to the analytics dashboard. TVL was reported at $1.2 billion, which still represents over 67% of leeched liquidity from Uniswap.