Though some insurance plans on Nexus Mutual can be relatively costly to take out, with charges of up to 60% of the protected amount per year, others are far more reasonable at as low as 2.6% per year.Decentralized finance, or DeFi, has long been hailed as the future of the cryptocurrency space, thanks to the increasingly diverse range of protocols and tools that empower cryptocurrency holders.But though the DeFi industry has only really been witnessing explosive growth over the last three years, it is already remarkably well developed, and there is now a DeFi alternative available for most centralized services. Here, we take a look at some of the ways DeFi services offer additional value to crypto users.Decentralized DerivativesCryptocurrencies are widely regarded as incredibly

Topics:

<title> considers the following as important:

This could be interesting, too:

Emmanuel (Parlons Bitcoin) writes Un code moral pour l’âge d’or, la règle Bitcoin

Bitcoin Schweiz News writes April-Boom an den Märkten: Warum Aktien und Bitcoin jetzt durchstarten

Bitcoin Schweiz News writes VanEck registriert ersten BNB-ETF in den USA – Nächster Meilenstein für Krypto-ETFs?

Fintechnews Switzerland writes Revolut Hits Milestone of One Million Users in Switzerland

Bitcoin Schweiz News writes US-Rezession als Bitcoin-Turbo? BlackRock überrascht mit kühner Prognose

Though some insurance plans on Nexus Mutual can be relatively costly to take out, with charges of up to 60% of the protected amount per year, others are far more reasonable at as low as 2.6% per year.

Decentralized finance, or DeFi, has long been hailed as the future of the cryptocurrency space, thanks to the increasingly diverse range of protocols and tools that empower cryptocurrency holders.

But though the DeFi industry has only really been witnessing explosive growth over the last three years, it is already remarkably well developed, and there is now a DeFi alternative available for most centralized services.

Here, we take a look at some of the ways DeFi services offer additional value to crypto users.

Decentralized Derivatives

Cryptocurrencies are widely regarded as incredibly speculative assets that savvy investors and traders can use to turn a potentially fantastic profit if they have a keen eye for trends and the correct risk appetite.

But until only recently, the vast majority of cryptocurrency trading has taken place on centralized exchange platforms, which though typically simple to use, come with myriad tradeoffs – such as privacy concerns, downtime risks, and regional restrictions.

But this is beginning to change, with the advent of DeFi trading platforms that can now rival even the most capable centralized exchanges. While this is plain to see with platforms like PancakeSwap, which offers a wide array of trading tools and features that centralized platforms lack, it is perhaps best demonstrated by the recent development of decentralized derivatives trading platforms.

Chief among these is Premia, one of the first protocols to successfully offer decentralized options trading. The platform stands out from centralized derivatives trading platforms in that it not only supports options for assets that are not found anywhere else, but also provides the option to create custom options contract which can be traded on the decentralized Premia marketplace.

“What’s cooking with Premia Meta Vaults and the Premia Options AMM?”

The Premia AMM will be the first DeFi Options AMM to provide Black Scholes prices that responds dynamically to supply/demand.

???MEGA THREAD ???

— Premia – Options Platform (@PremiaFinance) April 9, 2021

With DeFi trading platforms now approaching the same or similar functionality to centralized ones, and decentralized derivatives becoming more capable, and easier to use, it may not be long until they are the primary choice for most cryptocurrency traders.

Insurance Is Now Available

Hacks are one of the primary concerns many individuals have when interacting with DeFi protocols – particularly those that require users to lock up their funds to earn some sort of yield or benefit, such as a yield farm, liquidity pool, or open lending platform.

In the past, users would need to weigh up the individual benefits of each platform with the risk of potentially losing their funds – largely by relying on third-party security audits and estimating the odds of an attack. But this is an imperfect solution. Unlike when dealing with real-world financial products, most DeFi protocols generally lack any sort of insurance mechanism.

That is, until now.

The last year has seen the development of a range of DeFi insurance products, which can be used to protect against a variety of potential attacks, exploits, or failures that can result in loss of funds.

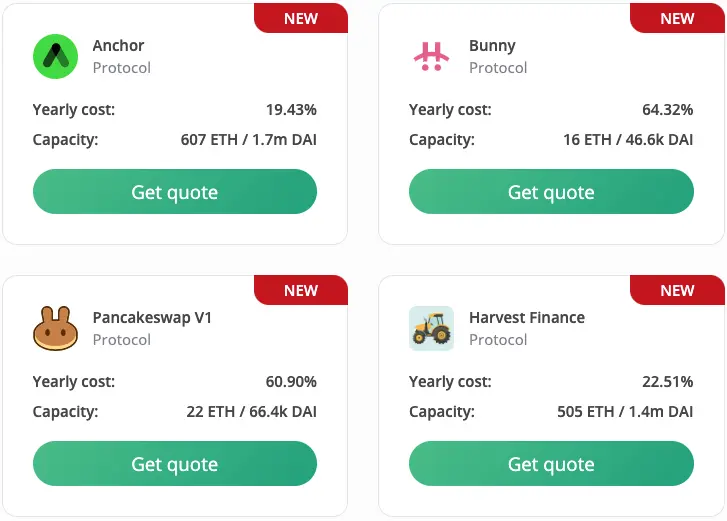

These platforms include Nexus Mutual, which offers crowd-funded insurance policies against smart contract failures, exchange hacks, and exploits for many of the most popular decentralized and centralized crypto platforms – including Binance, PancakeSwap, Uniswap, and more.

Photo: Nexus Mutual

Though some insurance plans on Nexus Mutual can be relatively costly to take out, with charges of up to 60% of the protected amount per year, others are far more reasonable at as low as 2.6% per year.

While DeFi insurance platforms typically operate as a standalone service, they are becoming increasingly integrated with popular DeFi products. But it will likely be some time before insured DeFi becomes the norm.

Having obtained a diploma in Intercultural Communication, Julia continued her studies taking a Master’s degree in Economics and Management. Becoming captured by innovative technologies, Julia turned passionate about exploring emerging techs believing in their ability to transform all spheres of our life.

Crypto EcoBlog

Crypto EcoBlog