XRP/USD – XRP Falls Short At 20-day MA Key Support Levels: %excerpt%.6, %excerpt%.556, %excerpt%.5.Key Resistance Levels: %excerpt%.7, %excerpt%.72, %excerpt%.781. XRP has been trading inside a falling price channel since the start of June. However, the cryptocurrency bounced from the lower boundary of this price channel at the end of the month and hit %excerpt%.7 at the start of July. Unfortunately, XRP has been unable to close a daily candle above %excerpt%.7 in July. Alongside the resistance provided by the upper boundary of the price channel, the 20-day MA is further bolstering the resistance there. Additionally, it looks like the cryptocurrency is starting to form a short-term ascending triangle pattern with the roof of the triangle around %excerpt%.72 (200-day MA). XRP/USD Daily Chart. Source: TradingView.XRP-USD Short Term

Topics:

Yaz Sheikh considers the following as important: Ripple (XRP) Price, XRP Analysis, xrpbtc, xrpusd

This could be interesting, too:

Jordan Lyanchev writes Ripple’s (XRP) Surge to Triggers Over Million in Short Liquidations

Jordan Lyanchev writes Trump Confirms Work on Strategic Crypto Reserve: XRP, ADA, SOL Included

Dimitar Dzhondzhorov writes Is a Major Ripple v. SEC Lawsuit Development Expected This Week? Here’s Why

Mandy Williams writes Ripple Releases Institutional DeFi Roadmap for XRP Ledger in 2025

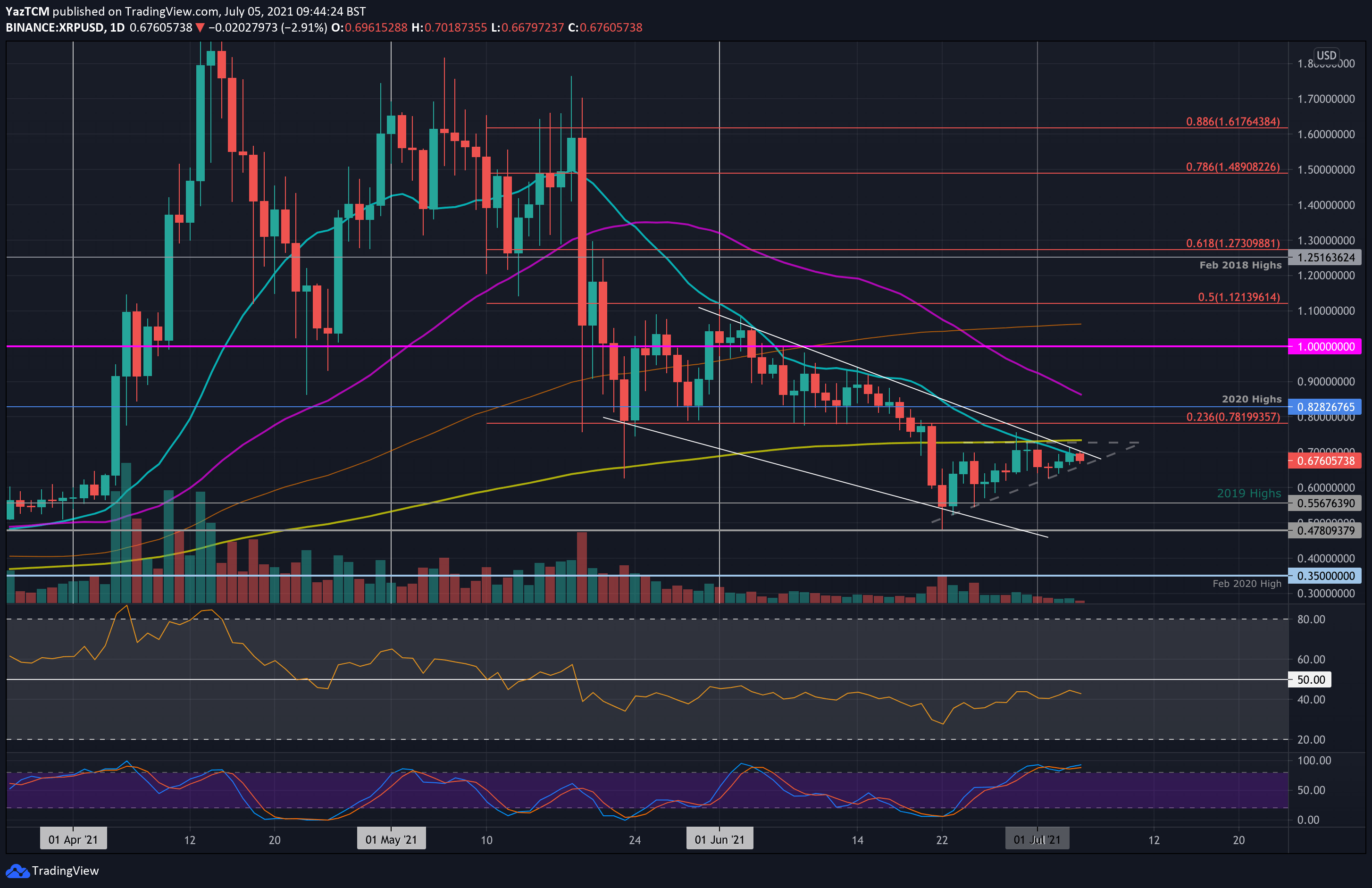

XRP/USD – XRP Falls Short At 20-day MA

Key Support Levels: $0.6, $0.556, $0.5.

Key Resistance Levels: $0.7, $0.72, $0.781.

XRP has been trading inside a falling price channel since the start of June. However, the cryptocurrency bounced from the lower boundary of this price channel at the end of the month and hit $0.7 at the start of July.

Unfortunately, XRP has been unable to close a daily candle above $0.7 in July. Alongside the resistance provided by the upper boundary of the price channel, the 20-day MA is further bolstering the resistance there.

Additionally, it looks like the cryptocurrency is starting to form a short-term ascending triangle pattern with the roof of the triangle around $0.72 (200-day MA).

XRP-USD Short Term Price Prediction

Looking ahead, if the sellers fall beneath the support of the triangle, the first support lies at $0.6. This is followed by $0.556 (2019 highs), $0.5, and $0.478 (price channel lower boundary).

On the other side, the first resistance lies at $0.7 (20-day MA). This is followed by $0.72 (200-day MA), $0.781 (bearish .236 Fib), and $0.8282 (2020 high).

The RSI is near the midline but still sits beneath it, indicating the bears are still in control. The bulls have not maintained any momentum since mid-May, and the RSI has remained bearish ever since.

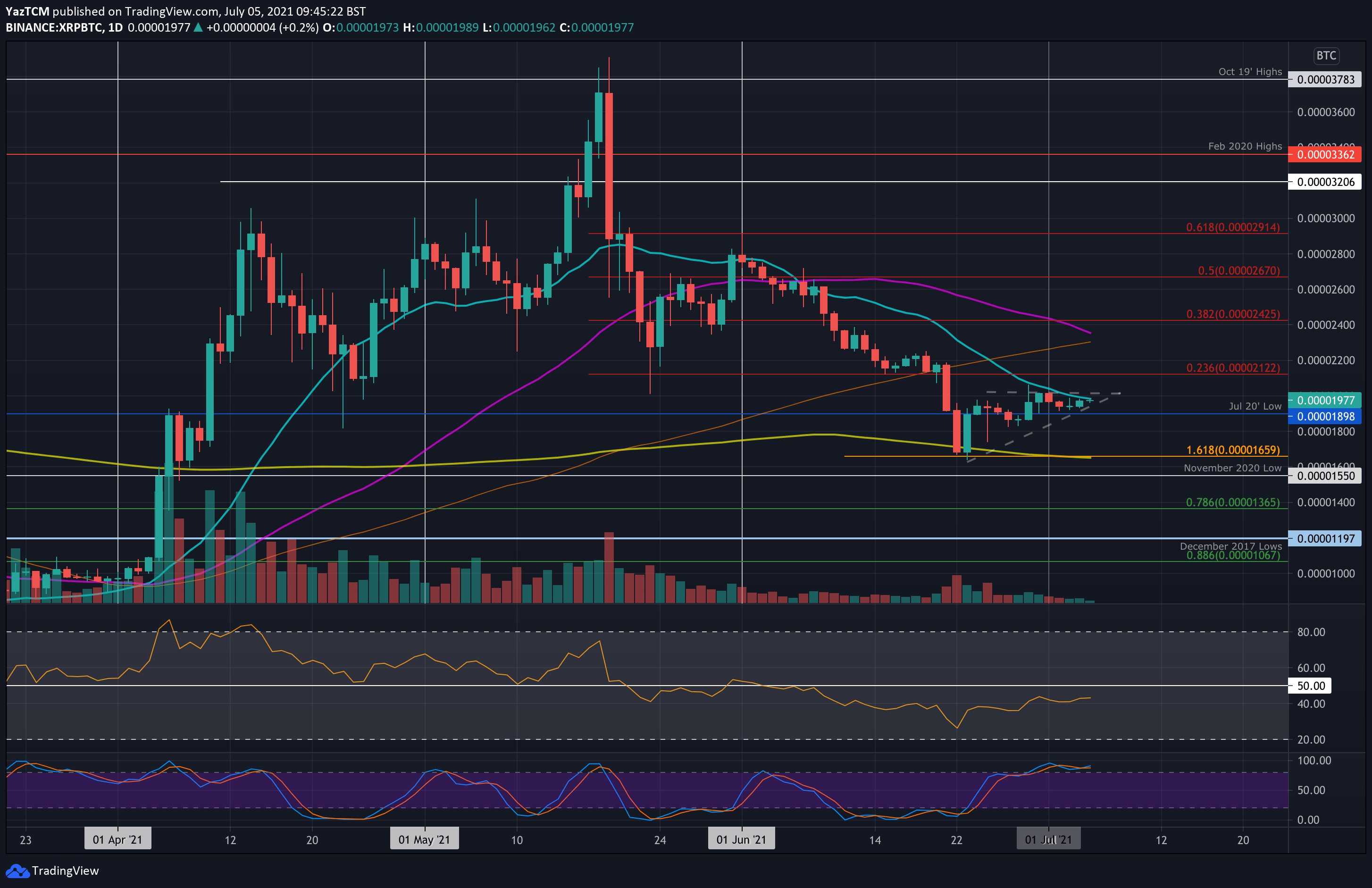

XRP/BTC – Bulls Continue To Battle At 2000 SAT

Key Support Levels: 1900 SAT, 1800 SAT, 1660 SAT.

Key Resistance Levels: 2000 SAT, 2120 SAT, 2250 SAT.

The battle for 2000 SAT continues for the bulls. XRP rebounded from 1660 SAT at the end of June and pushed into the 20-day MA at 2000 SAT by the start of July.

Unfortunately, it has struggled to gain any ground above the 20-day MA and has failed to break 2000 SAT so far. It also trades inside an ascending triangle pattern of its own with the roof formed at 2000 SAT.

XRP-BTC Short Term Price Prediction

Looking ahead, the first support to the downside lies at 1900 SAT (Jul 2020 low). This is followed by 1800 SAT, 1660 SAT (downside 1.618 Fib Extension & 200-day MA), and 1550 SAT (November 2020 lows).

On the other side, the first resistance lies at 2000 SAT (20-day MA). This is followed by 2120 SAT (bearish .236 Fib), 2250 SAT (100-day MA), and 2425 SAT (bearish .382 Fib & 50-day MA).

The RSI also remains beneath the midline, indicating weak bullish momentum within the market.