The leading global accounting firm – KPMG International – claimed in one of its recent reports that the cryptocurrency market has displayed growing maturity in the past several months. This comes despite the ongoing military conflict between Russia and Ukraine and the record inflation that spreads in some countries. It is also worth noting that most digital assets trade far below their all-time high levels from 2021, but that has not stopped investments in the space. Prominent entities like Trade Republic, Fireblocks, and FTX have allocated billions of dollars to support start-ups part of the ecosystem. The Gruesome Reality The COVID-19 health disaster, the rising inflation, the military conflict between Russia and Ukraine, and the energy crisis, among others, are all

Topics:

Dimitar Dzhondzhorov considers the following as important: AA News, Coronavirus (COVID-19), russia, Ukraine

This could be interesting, too:

Chayanika Deka writes Yuga Labs Secures Major Win as SEC Closes Investigation Without Charges

Andrew Throuvalas writes Bitcoin Soars Back To ,000 After BlackRock CEO Says “Buy The Dip”

Chayanika Deka writes XRP, SOL, and ADA Inclusion in US Crypto Reserve Pushes Traders on Edge

Chayanika Deka writes Why Arthur Hayes Is Bullish on Bitcoin Under Trump’s Economic Strategy

The leading global accounting firm – KPMG International – claimed in one of its recent reports that the cryptocurrency market has displayed growing maturity in the past several months. This comes despite the ongoing military conflict between Russia and Ukraine and the record inflation that spreads in some countries.

It is also worth noting that most digital assets trade far below their all-time high levels from 2021, but that has not stopped investments in the space. Prominent entities like Trade Republic, Fireblocks, and FTX have allocated billions of dollars to support start-ups part of the ecosystem.

The Gruesome Reality

The COVID-19 health disaster, the rising inflation, the military conflict between Russia and Ukraine, and the energy crisis, among others, are all factors that have directly or indirectly affected a significant part of the globe.

Apart from taking millions of lives, the coronavirus pandemic seriously affected the global financial system. The stay-at-home rules, plus the controversial mass printing of fiat currency which some central banks did, were prerequisites for a future monetary crisis simply because the increased amount of money in circulation did not respond to the crippled production.

As a result, the inflation rate has reached peak levels for decades, with Turkey, the UK, the USA, and others being such examples.

The energy crisis, which started affecting some regions in 2021, intensified in the past several months due to the Russia-Ukraine military conflict and is another component that pushes the economy down.

The world’s largest country by landmass halted some of its gas deliveries to multiple nations that imposed sanctions on it beforehand. With the approaching winter season in Europe, the uncertainty rises as some states risk being left without enough energy supplies during the coldest months.

Unsurprisingly, the negative trends have taken their toll on nearly all financial markets, including the crypto sector. Today’s global cryptocurrency market capitalization stands at around $1 trillion, while in November last year, it exceeded $3 trillion. Bitcoin, for one, currently sits about 70% lower than its ATH less than a year ago.

In Spite of This, the Crypto Market Matures

Contrary to that evident decline, KPMG International believes the digital asset market continues to mature. The consultancy firm said numerous investors focused on the industry during the first half of the year because of the uncertainty in traditional finance and distributed billions of dollars.

The German online broker – Trade Republic – raised $1.1 billion to support organizations in the digital asset niche. The crypto custodian Fireblocks secured a $550 million fundraiser and tapped a valuation of $8 billion. Sam Bankman-Fried’s spearheaded exchange – FTX – closed a $400 million Series E venture capital round and is currently worth over $32 billion.

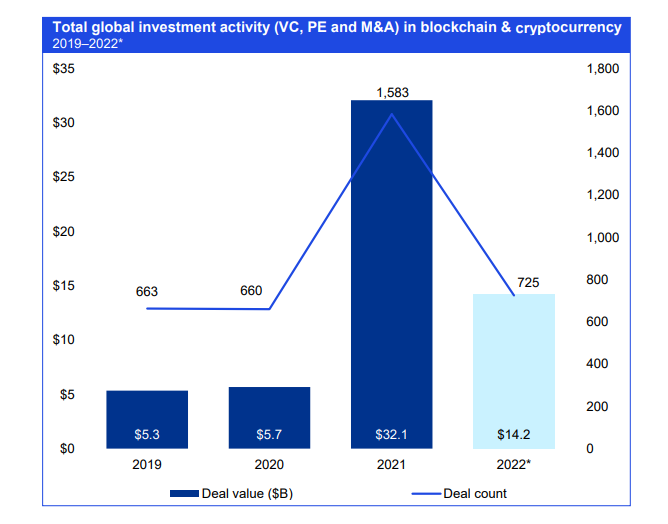

In total, investments in the crypto space since the start of 2022 equal $14.2 billion. This is significantly less than the $32.1 billion in 2021 but more than 2019 and 2020 put together.

It is worth noting, though, that the interest in the crypto industry was not that impressive in 2019 and 2020. Speaking of the record investments in 2021, those could be explained by the bull run when bitcoin and many of the altcoins reached their all-time highs.

In addition, giant institutions like Tesla bought billions of dollars worth of BTC, while prominent companies like Expedia, PayPal, Rakuten, and Etsy started accepting payments in crypto.

The hype peaked in September 2021 when El Salvador became the first country to embrace bitcoin as a legal tender inside its borders.

KPMG’s Crypto Efforts

The entity started interacting with the cryptocurrency industry in 2020. Back then, it introduced a project called KPMG Chain Fusion, which helps traditional financial companies provide well-managed digital asset services.

In February this year, the Canadian subsidiary of KPMG made its first cryptocurrency investments by adding Bitcoin (BTC) and Ether (ETH) to its corporate treasury.

A few months later, it hired Ian Taylor to lead the company’s British crypto team and guide its Web3 endeavors. Being also an Executive Director of CryptoUK, he has a rich experience in the field.